- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

How Will Ross Stores’ (ROST) New CFO Shape Its Long-Term Financial Strategy?

Reviewed by Simply Wall St

- Ross Stores recently announced that Adam Orvos, the company's Chief Financial Officer, retired on September 30, 2025, with William Sheehan, an executive with more than 34 years of retail finance experience, appointed as his successor effective October 1, 2025.

- This transition brings a leader with deep institutional knowledge and retail finance expertise to the executive team at a critical point for the company.

- We'll examine how the leadership transition and earnings guidance update shape Ross Stores' investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ross Stores Investment Narrative Recap

Owning Ross Stores means believing in the ongoing appeal of value-focused retail and the company's ability to grow profitably through new store openings and merchandise sourcing efficiency, even as challenges like tariffs and rising costs persist. The recent CFO succession is unlikely to materially impact the most important near-term catalyst, continued resilience in consumer demand, but does not lessen the primary risk: ongoing margin pressure from higher tariffs and distribution expenses. Despite the executive change, short-term operating performance remains the core issue for investors to watch.

The company's revised full-year earnings guidance, with the upper end now slightly above Wall Street estimates, was a key announcement following earlier uncertainty tied to tariffs, and is directly relevant to the current market narrative. This guidance update provided some clarity and aligned expectations, but the broader influence of cost headwinds on future results continues to be a central focus for those tracking catalysts driving Ross’s outlook.

Yet investors need to be mindful, rising merchandise costs and supply chain pressures could have...

Read the full narrative on Ross Stores (it's free!)

Ross Stores' projections anticipate $25.0 billion in revenue and $2.4 billion in earnings by 2028. Achieving these targets requires 5.1% annual revenue growth and a $0.3 billion increase in earnings from the current $2.1 billion level.

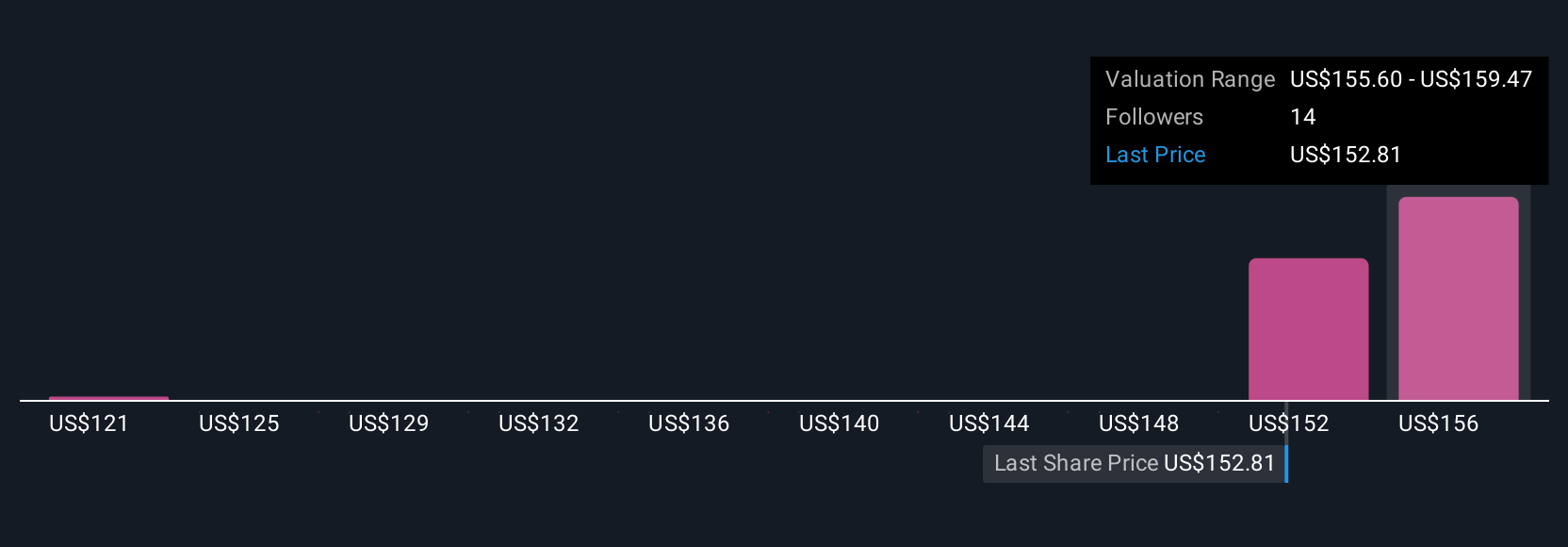

Uncover how Ross Stores' forecasts yield a $159.47 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members placed Ross Stores’ fair value between US$120.81 and US$159.47 per share. These viewpoints stand alongside concerns that tariff and distribution costs could limit margin recovery, highlighting important differences you should weigh as you form your own outlook.

Explore 4 other fair value estimates on Ross Stores - why the stock might be worth 18% less than the current price!

Build Your Own Ross Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ross Stores research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ross Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ross Stores' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives