- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

A Fresh Look at RealReal (REAL) Valuation After Management Raises 2025 Revenue Outlook

Reviewed by Kshitija Bhandaru

Investors are closely watching RealReal (REAL) after management responded to concerns about slowing revenue growth and tightening cash reserves by increasing 2025 revenue guidance this week. This move has put a spotlight on the company's longer-term outlook.

See our latest analysis for RealReal.

RealReal’s latest guidance bump comes after a year marked by cautious optimism, with its share price now at $11.17 and the 1-year total shareholder return sitting modestly above 2%. While recent revenue concerns and cash challenges have made headlines, investor appetite appears steady rather than exuberant. Momentum is neither surging nor fading, leaving plenty to play for as management asserts a brighter outlook.

If RealReal’s shifting story has you scanning for other ideas, this could be your chance to discover fast growing stocks with high insider ownership.

With muted returns and a cautious growth outlook, the real question is whether RealReal’s latest optimism signals an undervalued opportunity for investors or if the market has already priced in all future upside potential.

Most Popular Narrative: 3% Overvalued

With RealReal’s fair value recalculated at $10.83 and shares closing at $11.17, the latest popular narrative sees the market slightly ahead of projected fundamentals, prompting attention to the headline catalysts fueling this sentiment.

Continuous investment in AI-driven automation (Athena and other initiatives) is delivering ongoing reductions in processing costs per unit and streamlining authentication. This enables scalable operational efficiencies that lower unit costs and support sustained margin expansion and improved EBITDA.

Curious what kind of financial leap could justify this ambitious valuation? The narrative’s forecast hinges on operational upgrades, a revamped earnings outlook, and a margin transformation investors might not see coming. Find out what’s driving this bold price target and how analyst expectations stack up behind the optimism.

Result: Fair Value of $10.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining commission rates and slow progress on AI-driven efficiencies could challenge RealReal’s optimistic trajectory and may test investor patience in the coming quarters.

Find out about the key risks to this RealReal narrative.

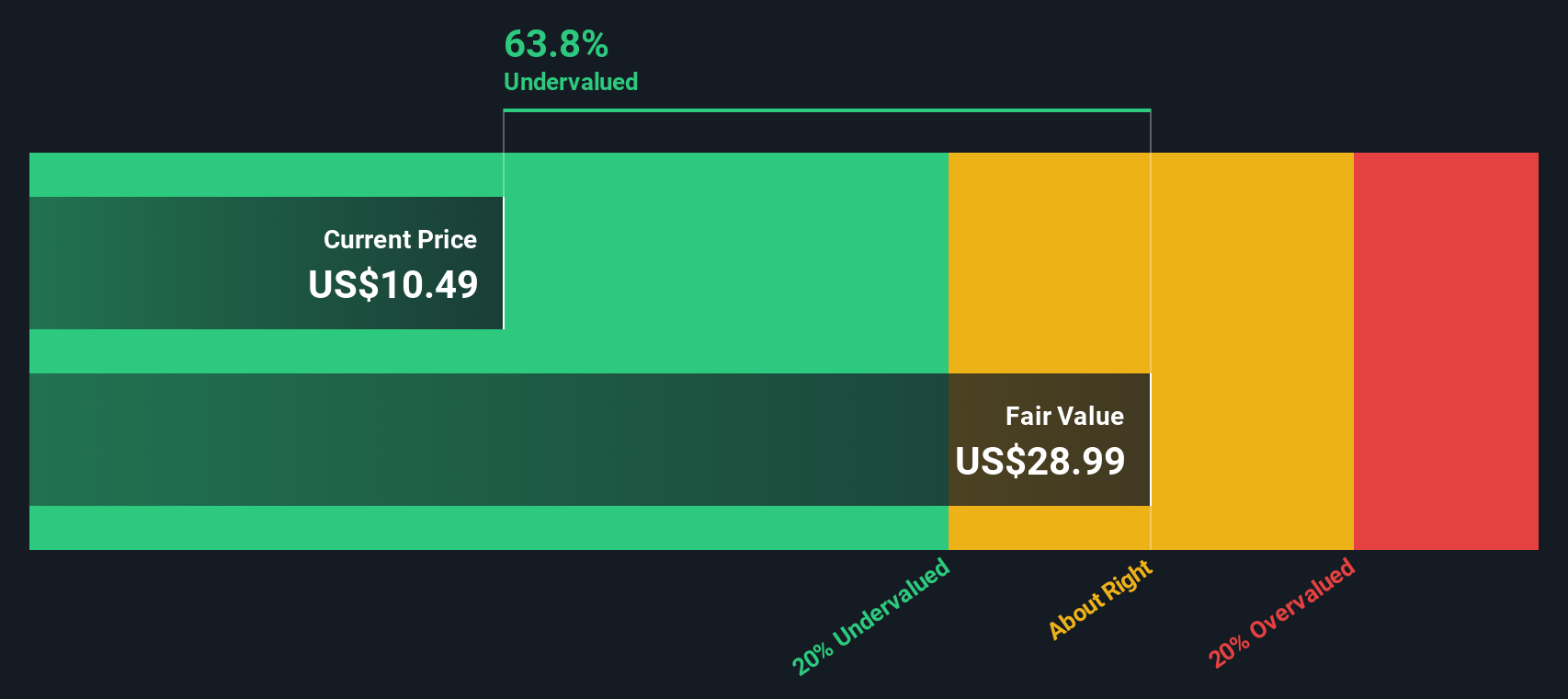

Another View: DCF Says Undervalued?

While analysts see RealReal as priced slightly above its fair value using future earnings and price targets, our SWS DCF model paints a more optimistic picture. DCF suggests RealReal is actually trading well below its estimated fair value, which may indicate significant upside that the market might be overlooking. Could this difference signal a hidden opportunity, or does it simply highlight diverging views on future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RealReal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RealReal Narrative

If this perspective isn’t quite convincing or you want to dive deeper into the numbers, you’re free to build your own view of RealReal in just minutes: Do it your way.

A great starting point for your RealReal research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stick to just one opportunity? Make sure you seize the best options by using the Simply Wall Street Screener. These handpicked ideas could put you ahead of the curve. Don’t let the next big winner pass you by!

- Tap into high-yield opportunities and strengthen your income stream by checking out these 19 dividend stocks with yields > 3% offering consistently strong yields above 3%.

- Pounce on emerging technology trends and get ahead of the curve with these 24 AI penny stocks poised to disrupt traditional industries.

- Fuel your portfolio’s growth and capitalize on innovation by exploring these 26 quantum computing stocks leading the charge in quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives