- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PTRN

High Insider Ownership Growth Companies To Watch In December 2025

Reviewed by Simply Wall St

As the U.S. stock market continues to show resilience, with major indexes like the Dow Jones and S&P 500 experiencing gains despite mixed economic signals such as a decline in private payrolls, investors are increasingly looking towards companies with solid growth potential and strong insider ownership. In this environment, stocks where insiders hold significant stakes can be particularly appealing, as they often indicate confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Here Group (HERE) | 36.1% | 38.8% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Here's a peek at a few of the choices from the screener.

EHang Holdings (EH)

Simply Wall St Growth Rating: ★★★★★☆

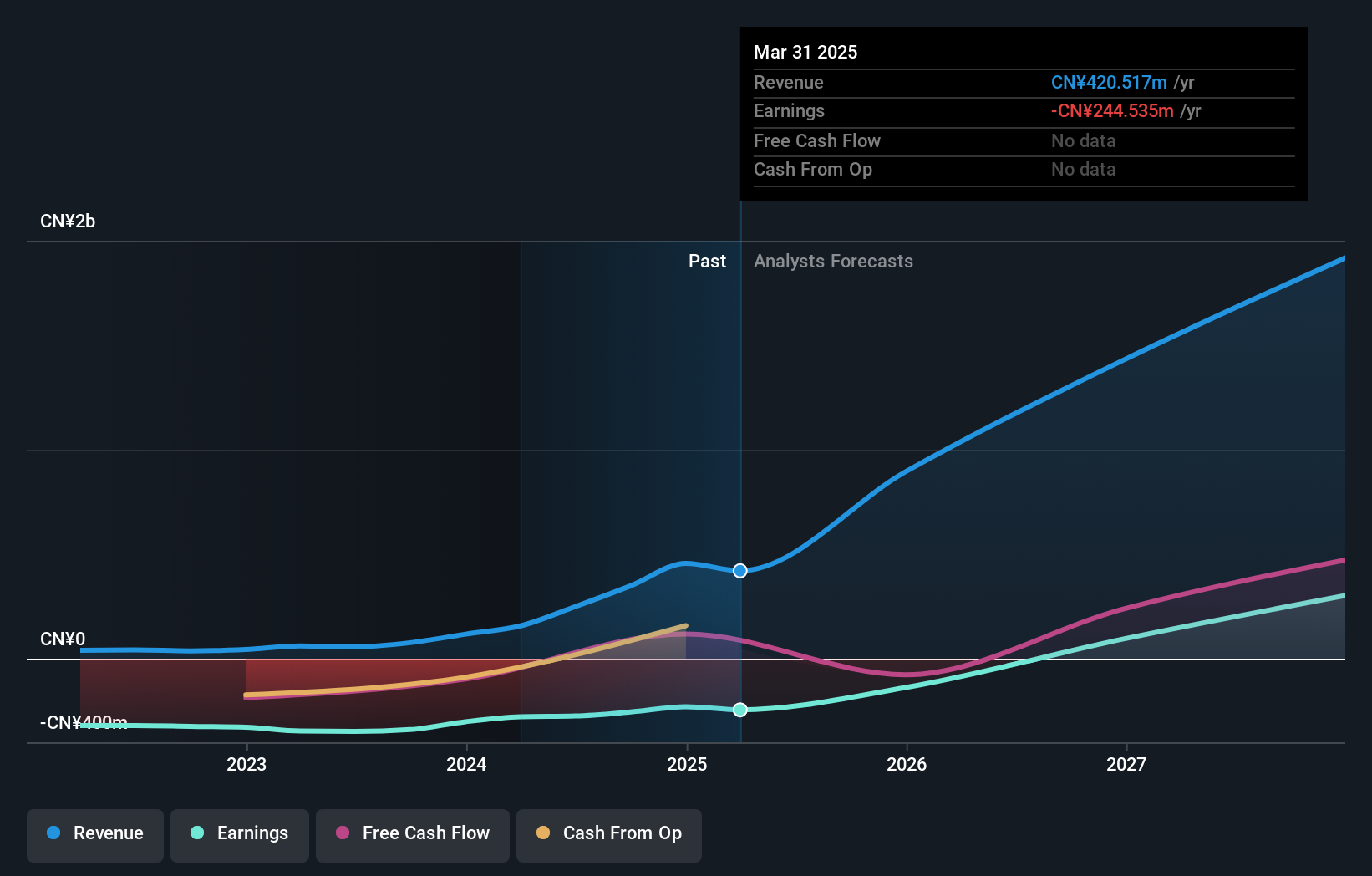

Overview: EHang Holdings Limited is an urban air mobility technology platform company operating across multiple regions including China, East Asia, West Asia, North America, South America, West Africa, and Europe with a market cap of $994.04 million.

Operations: The company generates its revenue from the Aerospace & Defense segment, amounting to CN¥430 million.

Insider Ownership: 27.8%

Revenue Growth Forecast: 39.5% p.a.

EHang Holdings is advancing in the Urban Air Mobility sector with strategic global partnerships, including a recent collaboration in Qatar and Thailand. Despite reporting a net loss of CNY 82.16 million for Q3 2025, EHang maintains revenue guidance of RMB 500 million for the year. The company anticipates substantial revenue growth, projected at 39.5% annually, and aims to achieve profitability within three years. EHang's innovative eVTOL technology positions it well for future expansion despite current financial challenges.

- Dive into the specifics of EHang Holdings here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of EHang Holdings shares in the market.

Clover Health Investments (CLOV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of $1.29 billion.

Operations: The company generates revenue primarily through its insurance segment, which accounts for $1.77 billion.

Insider Ownership: 21.4%

Revenue Growth Forecast: 17.4% p.a.

Clover Health Investments, facing a net loss of US$24.38 million in Q3 2025, has raised its full-year revenue guidance to US$1.85 billion - US$1.88 billion, indicating significant growth potential in the Medicare Advantage market. Despite current losses, Clover's AI-driven platform and innovative health plans position it for long-term expansion. The company's focus on operational efficiency and strategic board appointments further supports its growth trajectory amidst high insider ownership and market volatility.

- Take a closer look at Clover Health Investments' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Clover Health Investments is trading behind its estimated value.

Pattern Group (PTRN)

Simply Wall St Growth Rating: ★★★★☆☆

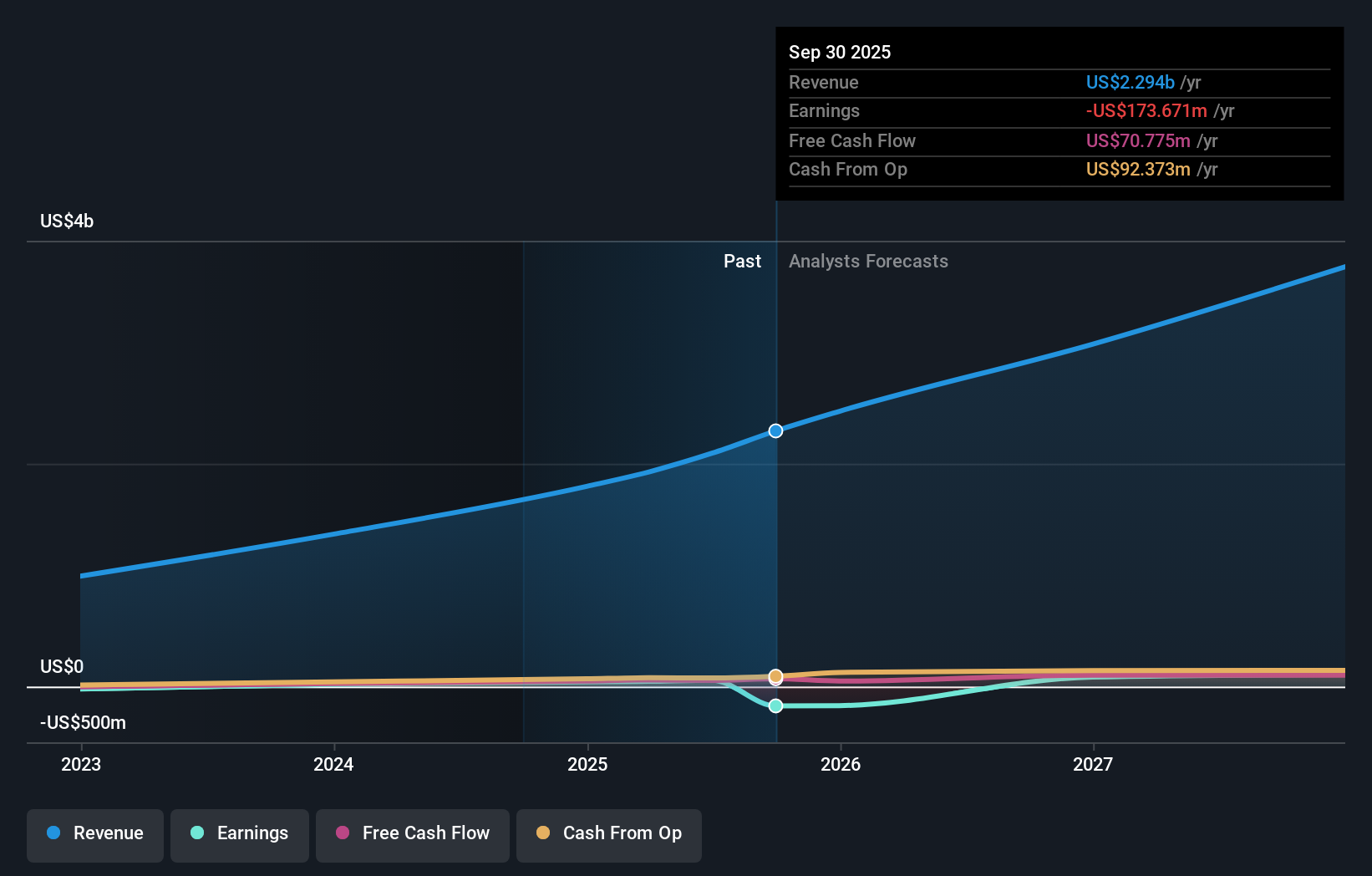

Overview: Pattern Group Inc. accelerates various brands on ecommerce marketplaces using proprietary technology and AI, with a market cap of $2.62 billion.

Operations: The company generates revenue of $2.29 billion from its online retailers segment.

Insider Ownership: 28.2%

Revenue Growth Forecast: 19.2% p.a.

Pattern Group, with substantial insider buying and no significant selling in the past three months, is poised for growth. Despite reporting a net loss of US$59.06 million in Q3 2025, its revenue surged to US$639.66 million from US$439.4 million year-over-year. The company's recent expansion into logistics services enhances its market position and operational capabilities, aligning with forecasts of becoming profitable within three years and trading below fair value estimates by analysts.

- Click here and access our complete growth analysis report to understand the dynamics of Pattern Group.

- The analysis detailed in our Pattern Group valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 196 more companies for you to explore.Click here to unveil our expertly curated list of 199 Fast Growing US Companies With High Insider Ownership.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTRN

Pattern Group

Pattern Group Inc. accelerates various brands on ecommerce marketplaces using proprietary technology and AI.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026