- United States

- /

- Specialty Stores

- /

- NasdaqGS:PRTS

Can You Imagine How Elated CarParts.com's (NASDAQ:PRTS) Shareholders Feel About Its 805% Share Price Gain?

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. But when you hold the right stock for the right time period, the rewards can be truly huge. One such superstar is CarParts.com, Inc. (NASDAQ:PRTS), which saw its share price soar 805% in three years. It's also up 58% in about a month.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for CarParts.com

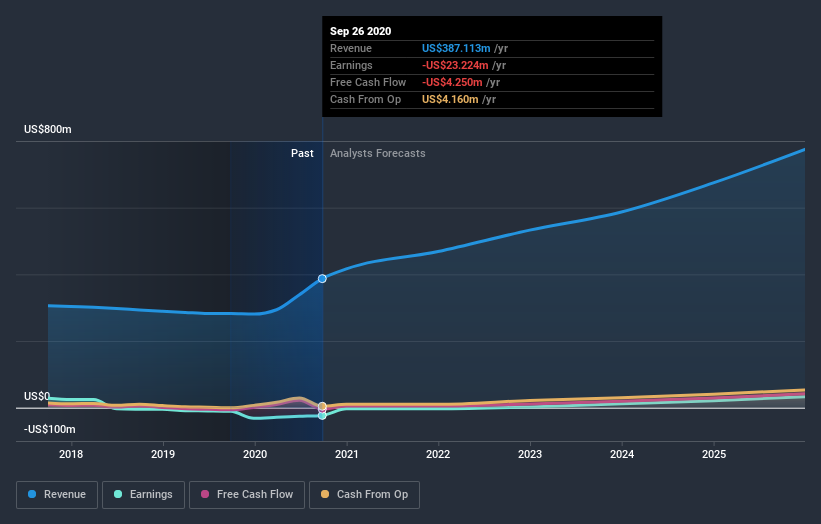

Because CarParts.com made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

CarParts.com's revenue trended up 4.0% each year over three years. Considering the company is losing money, we think that rate of revenue growth is uninspiring. So we're surprised that the share price has soared by 108% each year over that time. A win is a win, even if the revenue growth doesn't really explain it, in our view). The company will need to continue to execute on its business strategy to justify this rise.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on CarParts.com

A Different Perspective

We're pleased to report that CarParts.com shareholders have received a total shareholder return of 607% over one year. That gain is better than the annual TSR over five years, which is 47%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand CarParts.com better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for CarParts.com you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade CarParts.com, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PRTS

CarParts.com

Operates as an online retailer of aftermarket auto parts and accessories in the United States and the Philippines.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success