- United States

- /

- Specialty Stores

- /

- NasdaqGS:PETS

Some PetMed Express, Inc. (NASDAQ:PETS) Shareholders Look For Exit As Shares Take 28% Pounding

PetMed Express, Inc. (NASDAQ:PETS) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

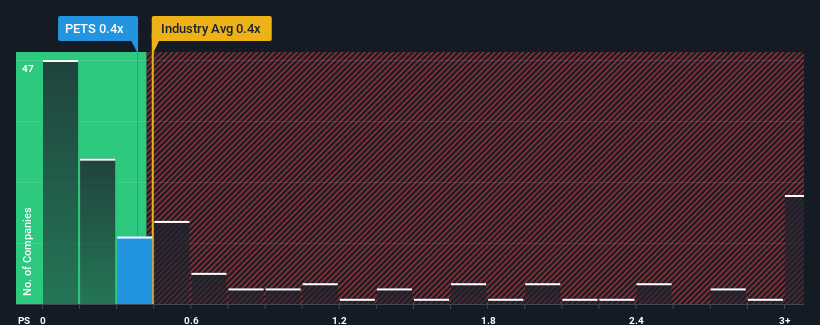

Even after such a large drop in price, there still wouldn't be many who think PetMed Express' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when it essentially matches the median P/S in the United States' Specialty Retail industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for PetMed Express

How Has PetMed Express Performed Recently?

While the industry has experienced revenue growth lately, PetMed Express' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think PetMed Express' future stacks up against the industry? In that case, our free report is a great place to start.How Is PetMed Express' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like PetMed Express' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 4.1% decrease to the company's top line. As a result, revenue from three years ago have also fallen 8.8% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 4.2% during the coming year according to the two analysts following the company. That's not great when the rest of the industry is expected to grow by 4.3%.

With this in consideration, we think it doesn't make sense that PetMed Express' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

PetMed Express' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

While PetMed Express' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Plus, you should also learn about these 2 warning signs we've spotted with PetMed Express (including 1 which is potentially serious).

If you're unsure about the strength of PetMed Express' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PETS

Flawless balance sheet low.