- United States

- /

- Specialty Stores

- /

- NasdaqGS:PETS

Some Confidence Is Lacking In PetMed Express, Inc. (NASDAQ:PETS) As Shares Slide 26%

To the annoyance of some shareholders, PetMed Express, Inc. (NASDAQ:PETS) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

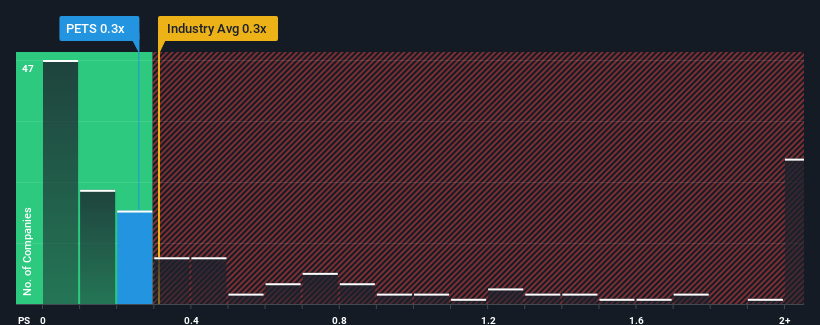

Although its price has dipped substantially, there still wouldn't be many who think PetMed Express' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when it essentially matches the median P/S in the United States' Specialty Retail industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for PetMed Express

What Does PetMed Express' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, PetMed Express' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on PetMed Express will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like PetMed Express' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 7.8% as estimated by the two analysts watching the company. That's not great when the rest of the industry is expected to grow by 4.6%.

With this in consideration, we think it doesn't make sense that PetMed Express' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On PetMed Express' P/S

With its share price dropping off a cliff, the P/S for PetMed Express looks to be in line with the rest of the Specialty Retail industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While PetMed Express' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Having said that, be aware PetMed Express is showing 3 warning signs in our investment analysis, and 1 of those is concerning.

If these risks are making you reconsider your opinion on PetMed Express, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PETS

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives