- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

Pinduoduo's (NASDAQ:PDD) has Surprisingly Little Debt for a Profitable Growth Company

Along with renewable energy, sustainable food production is one of the most important business concepts of the 21st century.

Companies likePinduoduo Inc.(NASDAQ: PDD) attempt to innovate by bringing e-commerce to enhance farmers' operations. The company benefited from the COVID-19 pandemic as its network grew to 12 million farmers and hundreds of millions of active users.

Along with the latest earnings, we will examine its use of debt.

Q2 Earnings Results

- Non-GAAP EPS: US$0.44 (beat by US$0.65)

- GAAP EPS: US$0.27 (beat by US$0.61)

- Revenue: US$3.57b (miss by US$520m)

- Average monthly active users: +30% to 738.5m (consensus 759.2m)

- Active buyers: 849.9m (+24% y/y)

Check out our latest analysis for Pinduoduo

While the first-ever positive quarter propelled the stock almost 20% up instantly, it remains down over 30% since June 1st, as the regulatory crackdowns keep pressuring the entire sector.

Lei Chen, Chairman, and CEO stated that the company remains focused on agriculture and announced the "10 Billion Agriculture Initiative", an effort to support the digitalization and advance the sustainability of rural Chinese farms.

What Is Pinduoduo's Debt?

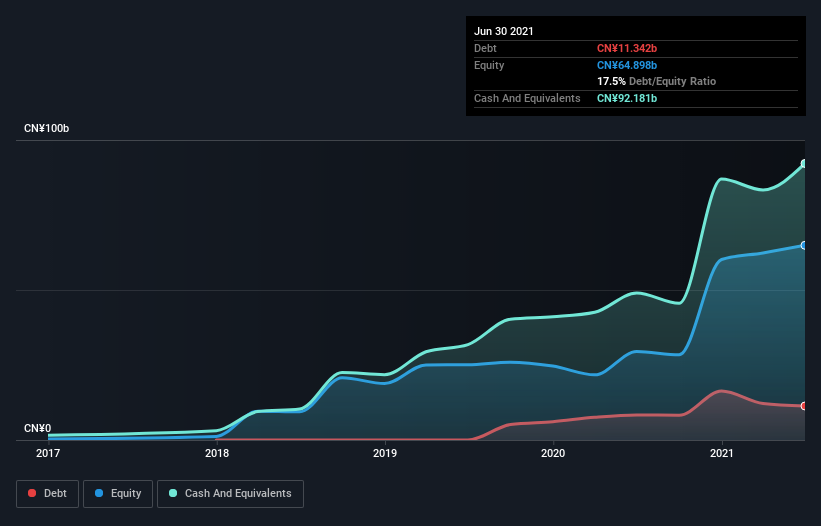

The image below, which you can click on for greater detail, shows that in June 2021, Pinduoduo had a debt of CN¥11.3b, up from CN¥8.33b in one year.

However, it does have CN¥92.2b in cash, offsetting this, leading to net cash of CN¥80.8b.

A Look At Pinduoduo's Liabilities

Examining the latest balance sheet data, we can see that Pinduoduo had liabilities of CN¥80.1b due within 12 months and liabilities of CN¥11.8b due beyond that. Offsetting these obligations, it had cash of CN¥92.2b as well as receivables valued at CN¥4.33b due within 12 months.

So it actually has CN¥4.67b more liquid assets than total liabilities.

Having regard to Pinduoduo's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the CN¥794.8b company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Pinduoduo boasts net cash, so it's fair to say it does not have a heavy debt load!

When analyzing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Pinduoduo's ability to maintain a healthy balance sheet from now on. So if you're focused on the future, you can check out this free report showing analyst profit forecasts.

Assessing the Risk of Pinduoduo

Although Pinduoduo had earnings before interest and tax (EBIT) loss recently, it just posted the first positive quarter results, which is a big thing, as positive cash flow has always been a point of criticism for hyper-growth companies. So taking that at face value and considering the net cash situation, we don't think that the stock is too risky in the near term.

There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Pinduoduo you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives