- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

With PDD Holdings Inc. (NASDAQ:PDD) It Looks Like You'll Get What You Pay For

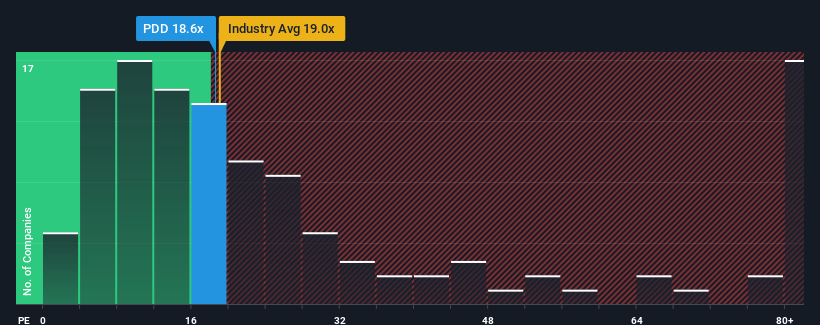

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 14x, you may consider PDD Holdings Inc. (NASDAQ:PDD) as a stock to potentially avoid with its 18.6x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for PDD Holdings as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for PDD Holdings

How Is PDD Holdings' Growth Trending?

In order to justify its P/E ratio, PDD Holdings would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 302%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 14% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 11% per year growth forecast for the broader market.

In light of this, it's understandable that PDD Holdings' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of PDD Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - PDD Holdings has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group, owns and operates a portfolio of businesses.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives