- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

Will Strong Q3 Earnings Shift PDD Holdings' (PDD) Growth Narrative?

Reviewed by Sasha Jovanovic

- PDD Holdings reported its third quarter 2025 results earlier this month, with sales reaching CNY108.28 billion and net income of CNY29.33 billion, both higher than the same period last year.

- An interesting development is that, despite lower net income for the nine-month period, the latest quarterly growth in earnings per share signals renewed operational momentum for the company.

- To assess how this recent surge in quarterly sales and profit influences PDD Holdings’ outlook, let's examine the implications for its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

PDD Holdings Investment Narrative Recap

To believe in PDD Holdings as a shareholder, you would need confidence that its persistent investments in supporting merchants and consumers, digital innovation, and global expansion will translate into sustainable market share and profit growth. The company’s stronger quarterly earnings are a positive sign for its ongoing ecosystem investment thesis, but the largest risk remains the uncertainty of returns on these investments and the potential for structurally lower margins if competitive pressures persist; this news does not materially shift those near-term risks or catalysts.

Of recent company announcements, the appointment of Ernst & Young as independent auditor stands out as most relevant to the latest earnings release, emphasizing the company’s attention to governance and transparency as it manages complex expansion and financial reporting obligations. In the context of heightened competition and ongoing investment, transparent financial oversight can play an important supporting role for investor confidence and future capital allocation decisions.

By contrast, investors should be aware that a prolonged lag between heavy investment and actual financial returns could...

Read the full narrative on PDD Holdings (it's free!)

PDD Holdings' narrative projects CN¥555.7 billion in revenue and CN¥147.1 billion in earnings by 2028. This requires 10.7% yearly revenue growth and a CN¥49.2 billion earnings increase from CN¥97.9 billion.

Uncover how PDD Holdings' forecasts yield a $146.91 fair value, a 27% upside to its current price.

Exploring Other Perspectives

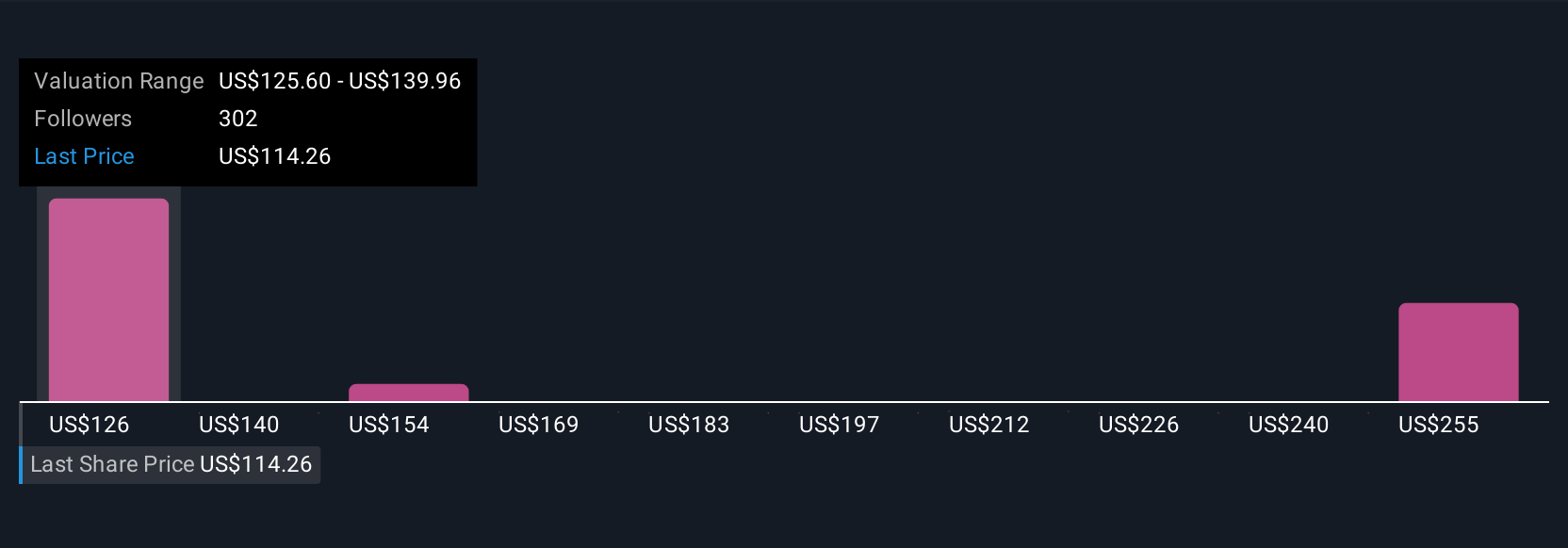

Eighteen fair value estimates from the Simply Wall St Community range from CN¥146.91 to CN¥343.05, illustrating widely varying market opinions. Persistent competitive intensity, highlighted in recent analyst narratives, may challenge the company's ability to turn heavy ecosystem investments into faster earnings growth; explore how others see it.

Explore 18 other fair value estimates on PDD Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own PDD Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDD Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free PDD Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDD Holdings' overall financial health at a glance.

No Opportunity In PDD Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.