- United States

- /

- Food

- /

- NasdaqGS:LMNR

US Growth Companies With High Insider Ownership For August 2024

Reviewed by Simply Wall St

As U.S. stocks continue to experience significant volatility, with major indices like the Dow Jones and Nasdaq Composite sharply lower due to economic concerns, investors are increasingly looking for stable opportunities in a turbulent market. One key indicator of potential stability and growth is high insider ownership, which often signals confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 24.7% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39% |

| Duolingo (NasdaqGS:DUOL) | 15% | 47.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's review some notable picks from our screened stocks.

Limoneira (NasdaqGS:LMNR)

Simply Wall St Growth Rating: ★★★★☆☆

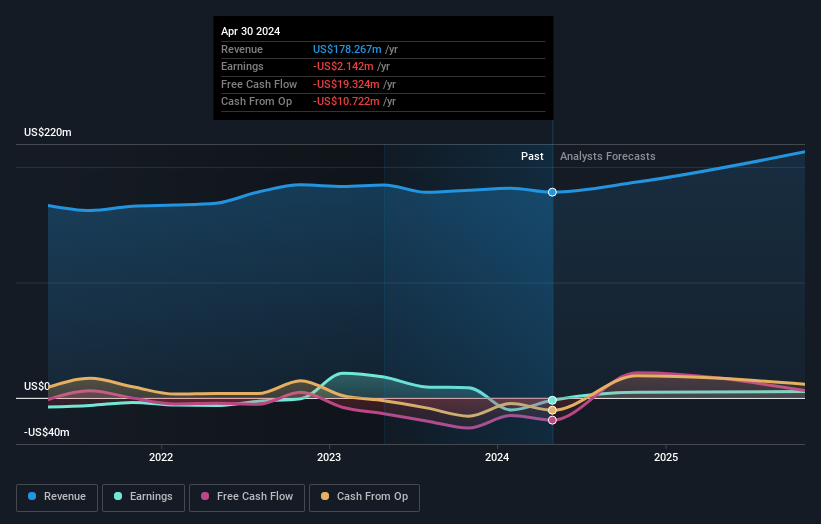

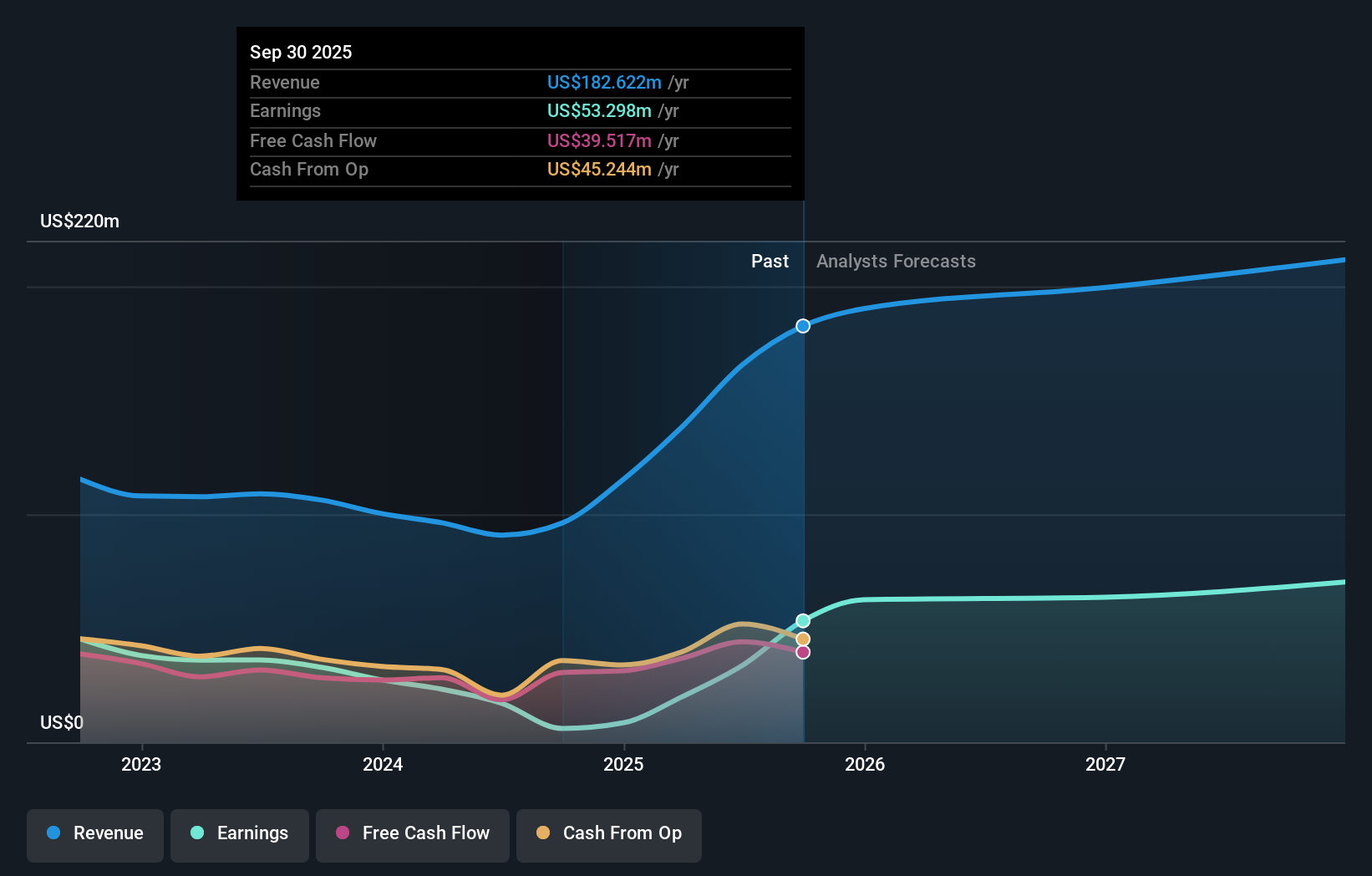

Overview: Limoneira Company operates as an agribusiness and real estate development company in the United States and internationally, with a market cap of $379.13 million.

Operations: The company's revenue segments include $120.50 million from Fresh Lemons, $50.10 million from Lemon Packing, $27.43 million from Other Agribusiness, and $5.79 million from Avocados.

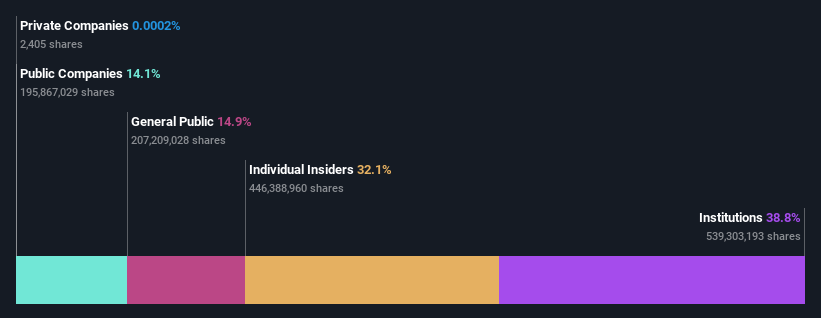

Insider Ownership: 13.7%

Revenue Growth Forecast: 12.3% p.a.

Limoneira, trading 40.1% below its estimated fair value, is forecast to become profitable within three years with earnings expected to grow 107.26% annually. Despite slower revenue growth at 12.3% per year compared to the market's 8.5%, recent developments include a $0.075 quarterly dividend and significant progress in its real estate ventures, notably the Harvest at Limoneira project which has expanded by 550 units approved by Santa Paula City Council in April 2024.

- Navigate through the intricacies of Limoneira with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Limoneira implies its share price may be too high.

PDD Holdings (NasdaqGS:PDD)

Simply Wall St Growth Rating: ★★★★★★

Overview: PDD Holdings Inc., a multinational commerce group with a market cap of approximately $176.94 billion, owns and operates a portfolio of businesses.

Operations: The company generates revenue primarily from its Internet Software & Services segment, which amounts to CN¥296.81 billion.

Insider Ownership: 32.1%

Revenue Growth Forecast: 20.6% p.a.

PDD Holdings, trading at 71.5% below its estimated fair value, has seen substantial earnings growth of 115.8% over the past year and is forecast to continue growing earnings by 21.65% annually, outpacing the US market's expected growth. Recent Q1 results show significant revenue and net income increases to CNY 86.81 billion and CNY 27.99 billion respectively, reflecting robust performance despite past shareholder dilution concerns.

- Unlock comprehensive insights into our analysis of PDD Holdings stock in this growth report.

- Our valuation report unveils the possibility PDD Holdings' shares may be trading at a discount.

Peoples Financial Services (NasdaqGS:PFIS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Peoples Financial Services Corp., with a market cap of $320.82 million, operates as the bank holding company for Peoples Security Bank and Trust Company, offering a range of commercial and retail banking services.

Operations: Peoples Security Bank and Trust Company generates $90.82 million from its commercial and retail banking services.

Insider Ownership: 11.5%

Revenue Growth Forecast: 39.2% p.a.

Peoples Financial Services Corp. has seen substantial insider buying in the past three months, indicating strong internal confidence. Despite recent challenges such as increased charge-offs and a decline in net income to US$3.28 million for Q2 2024, the company is poised for significant growth with earnings expected to rise by 100.4% annually over the next three years. Additionally, its revenue is forecasted to grow at an impressive 39.2% per year, outpacing market averages.

- Get an in-depth perspective on Peoples Financial Services' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Peoples Financial Services is trading behind its estimated value.

Next Steps

- Unlock our comprehensive list of 185 Fast Growing US Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LMNR

Limoneira

Operates as an agribusiness and real estate development company in the United States and internationally.

Reasonable growth potential and slightly overvalued.