- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

The Bull Case For PDD Holdings (PDD) Could Change Following Analyst Upgrades and Temu’s Global Expansion Push

Reviewed by Sasha Jovanovic

- PDD Holdings has recently attracted heightened investor attention, driven by strong analyst upgrades, positive earnings momentum, and renewed momentum for its Temu platform's international expansion, including the resumption of direct shipments to the US.

- This wave of optimism highlights the company's perceived undervaluation and the potential for its aggressive overseas growth strategy to catalyze further business transformation.

- We'll explore how analyst optimism around Temu's expanding global footprint could strengthen PDD Holdings' broader investment narrative and growth story.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PDD Holdings Investment Narrative Recap

The big-picture thesis for PDD Holdings centers on its ability to rapidly scale both at home and overseas by driving ecosystem investment and consumer adoption through its Temu platform. The recent news underscores renewed analyst optimism and market momentum as direct shipments to the US resume, bolstering the narrative around global expansion; however, this does not materially change the most immediate catalyst, Temu’s ability to reach breakeven, and the ongoing risk remains the impact of sustained heavy investment on near-term profitability.

The announcement of Temu resuming direct shipments to US consumers stands out, as it has triggered fresh analyst upgrades and heightened investor interest. This is relevant to the key catalyst: the success of PDD's international growth strategy and whether continued logistics investment can translate into sustainable revenue diversification, higher sales volumes, and ultimately improved margins over time.

Yet, on the other hand, for investors it’s important to recognize the heightened risk that extended profit margin pressure could ...

Read the full narrative on PDD Holdings (it's free!)

PDD Holdings' outlook anticipates CN¥555.7 billion in revenue and CN¥147.1 billion in earnings by 2028. This scenario assumes a 10.7% annual revenue growth rate and a CN¥49.2 billion earnings increase from today's CN¥97.9 billion.

Uncover how PDD Holdings' forecasts yield a $143.36 fair value, a 7% upside to its current price.

Exploring Other Perspectives

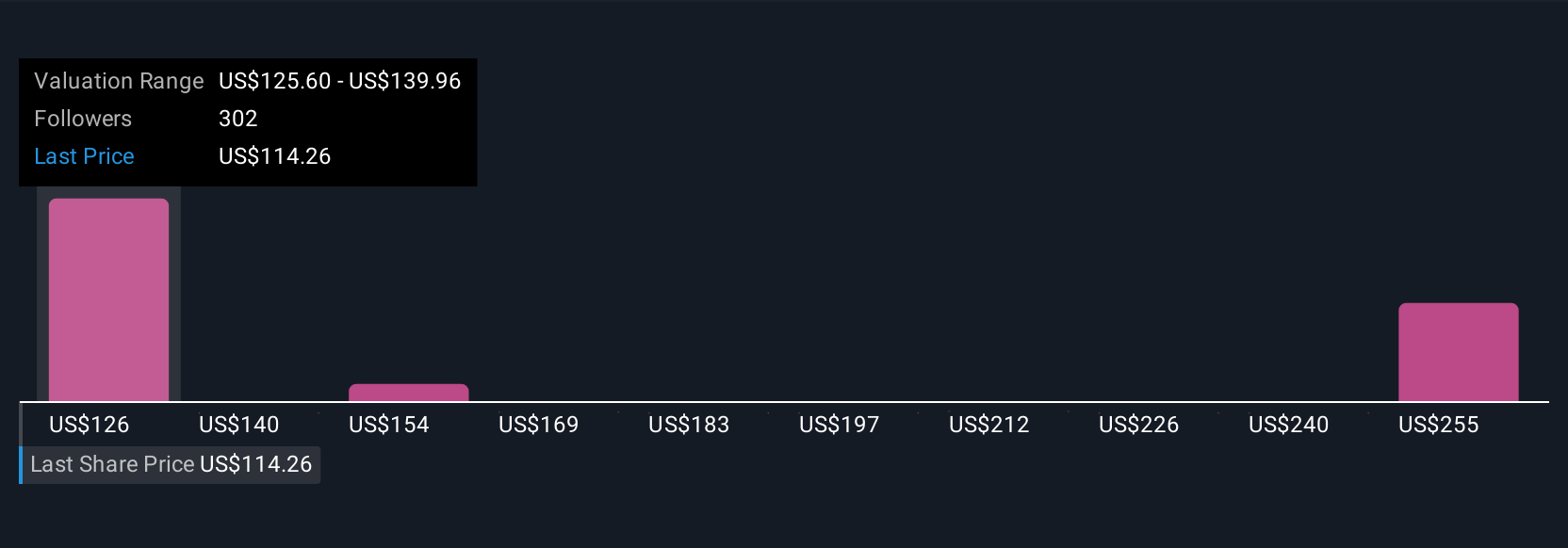

Fair value estimates from 22 Simply Wall St Community members range between US$143.36 and US$362.65. With so much variation and ongoing heavy investment impacting earnings, you may want to consider these contrasting outlooks before deciding for yourself.

Explore 22 other fair value estimates on PDD Holdings - why the stock might be worth just $143.36!

Build Your Own PDD Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDD Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PDD Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDD Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives