- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

Is PDD Stock Still Attractive After a 35.8% Surge in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with PDD Holdings stock? You are definitely not alone. The shares have seen some exciting moves lately, and plenty of investors are trying to make sense of what is driving the action. Over just the last week, PDD jumped 3.5%, and since the start of the year, it has powered ahead an impressive 35.8%. Even more convincingly, the stock is up 176.8% over three years, showing there is real long-term growth behind the name. These gains come as the company continues to expand its global e-commerce footprint and innovate with new digital retail offerings. This is a story that seems to resonate across both the market and recent headlines.

Despite all this growth, there is still a crucial question: is PDD Holdings actually undervalued, or are investors chasing momentum? Using a set of six primary valuation checks, PDD comes in with a value score of 5, meaning it is considered undervalued on five out of six key measures. That is not something you see every day, especially with this much upward movement in the share price.

In the next section, we will dig into exactly how these valuation approaches stack up and what investors should look for. After we break down the numbers, there is an even more insightful perspective on valuing PDD that you will not want to miss at the end of the article.

Why PDD Holdings is lagging behind its peers

Approach 1: PDD Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates the intrinsic value of a company by forecasting its future free cash flows and discounting them back to today's value. This method helps investors determine how much the business is truly worth based on its potential to generate cash over time, rather than focusing solely on current earnings or revenues.

For PDD Holdings, the most recent reported Free Cash Flow (FCF) stands at CN¥93.3 billion. Analysts estimate FCF growth will continue, projecting it to reach CN¥162.0 billion by the end of 2027. Projections for later years, extrapolated by Simply Wall St, suggest FCF could climb to over CN¥287.9 billion in 2035. These estimates describe a growth profile supported by the company's expanding global e-commerce platform.

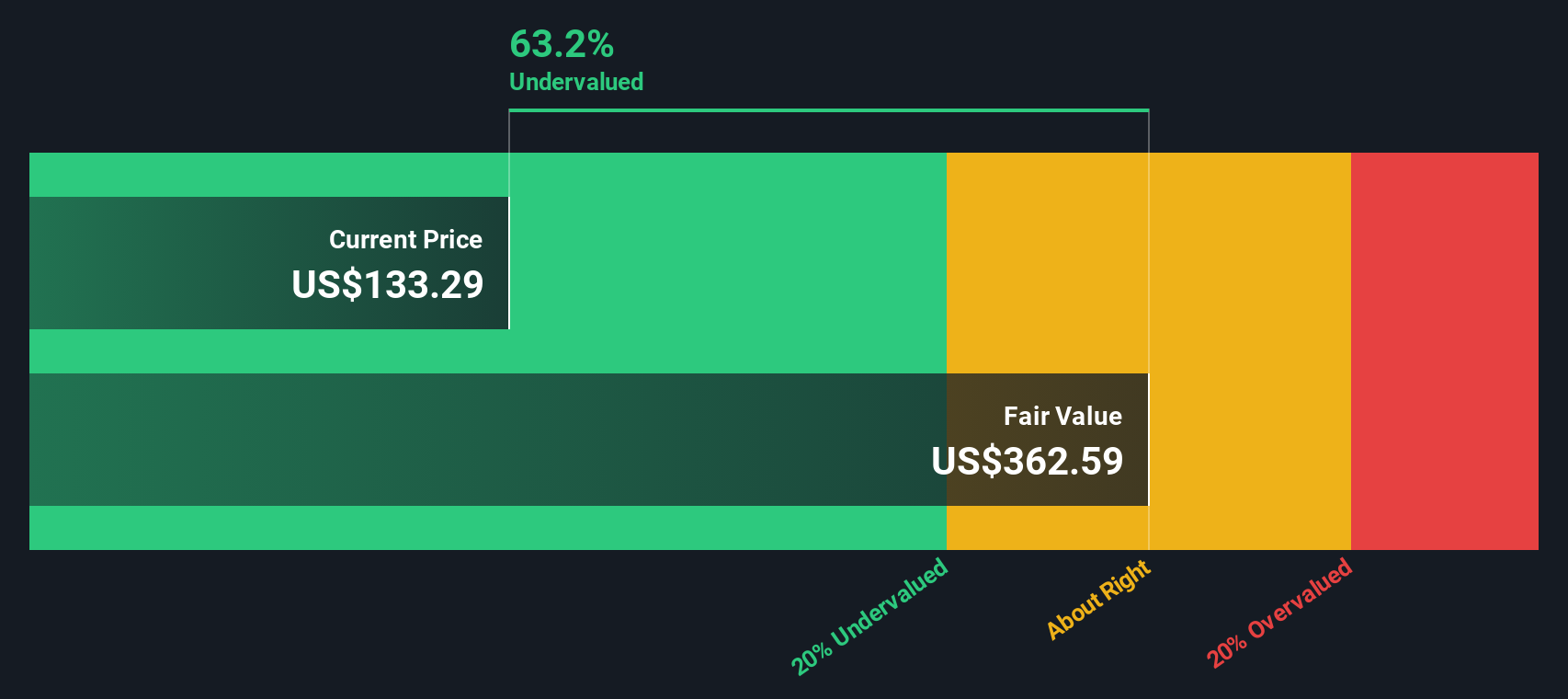

Based on these cash flow projections, the DCF model arrives at an intrinsic fair value of $362.79 per share. With the stock currently trading at a 63.7% discount to this estimate, PDD Holdings appears undervalued according to this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PDD Holdings is undervalued by 63.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PDD Holdings Price vs Earnings

The price-to-earnings (PE) ratio is often the go-to metric when valuing profitable companies like PDD Holdings, as it directly connects a company's market price to its bottom line earnings. This helps investors gauge how much the market is willing to pay for each dollar of profit. It is also a reliable way to compare the company to both industry peers and its own growth history.

What is considered a "normal" or "fair" PE ratio can depend significantly on how fast the company is expected to grow and what level of risk investors perceive. High-growth companies usually command higher PE ratios, since investors anticipate stronger future earnings. Likewise, companies facing more uncertainty or industry risks may trade at lower multiples.

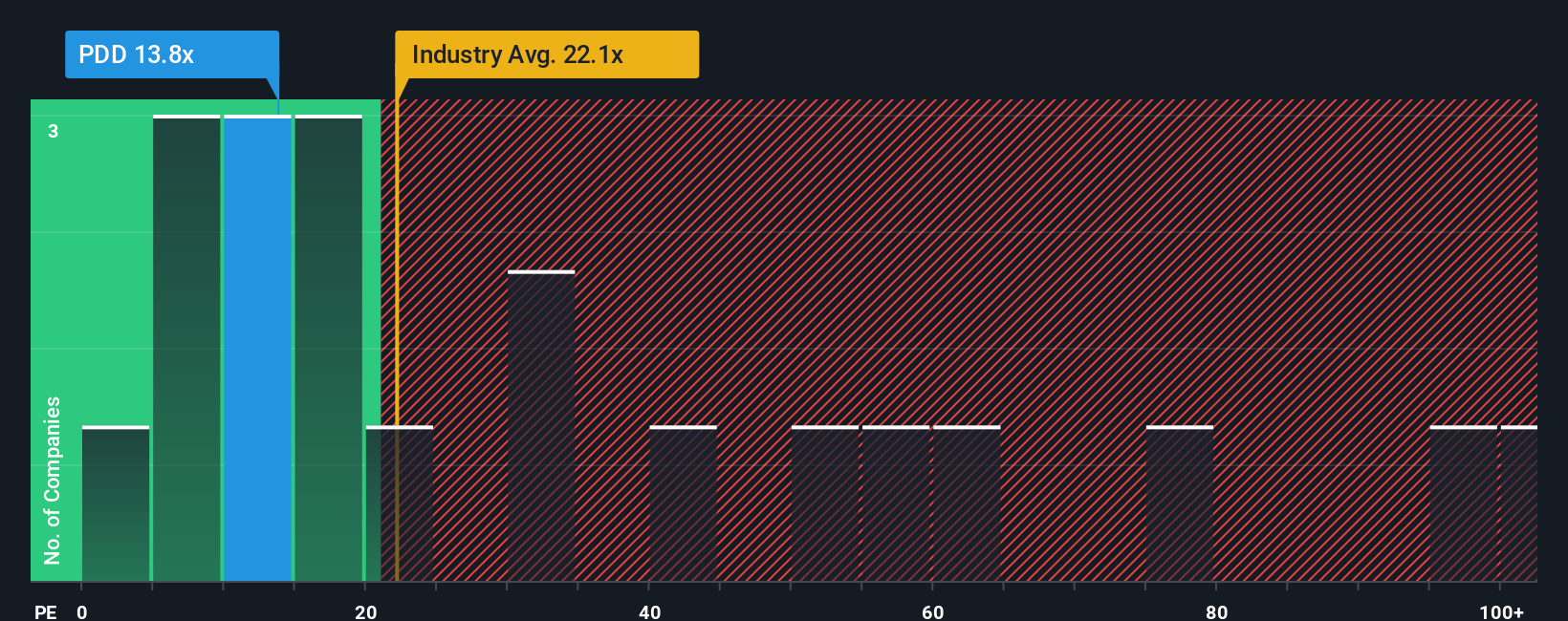

PDD Holdings currently trades at a PE ratio of 13.6x. This is noticeably below the Multiline Retail industry average of 21.7x and significantly under the peer average of 77.7x. To provide a more nuanced benchmark, Simply Wall St calculates a “Fair Ratio” of 28.4x for PDD Holdings. Unlike broad industry comparisons, this Fair Ratio takes into account PDD's unique growth prospects, profit margins, industry profile, and company-specific risks. This gives investors a tailored valuation benchmark that is more meaningful than averaging across very different businesses.

With PDD’s current PE of 13.6x well below its Fair Ratio of 28.4x, the stock appears undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PDD Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple and powerful way for investors like you to combine their perspective on a company’s future, such as what you believe about PDD’s growth, margins, and key trends, with real financial forecasts and an estimated fair value. Unlike traditional analyses that focus only on numbers, Narratives connect the story behind the company to those forecasts, so you can understand not just what the market is saying, but why you (or other investors) might see things differently.

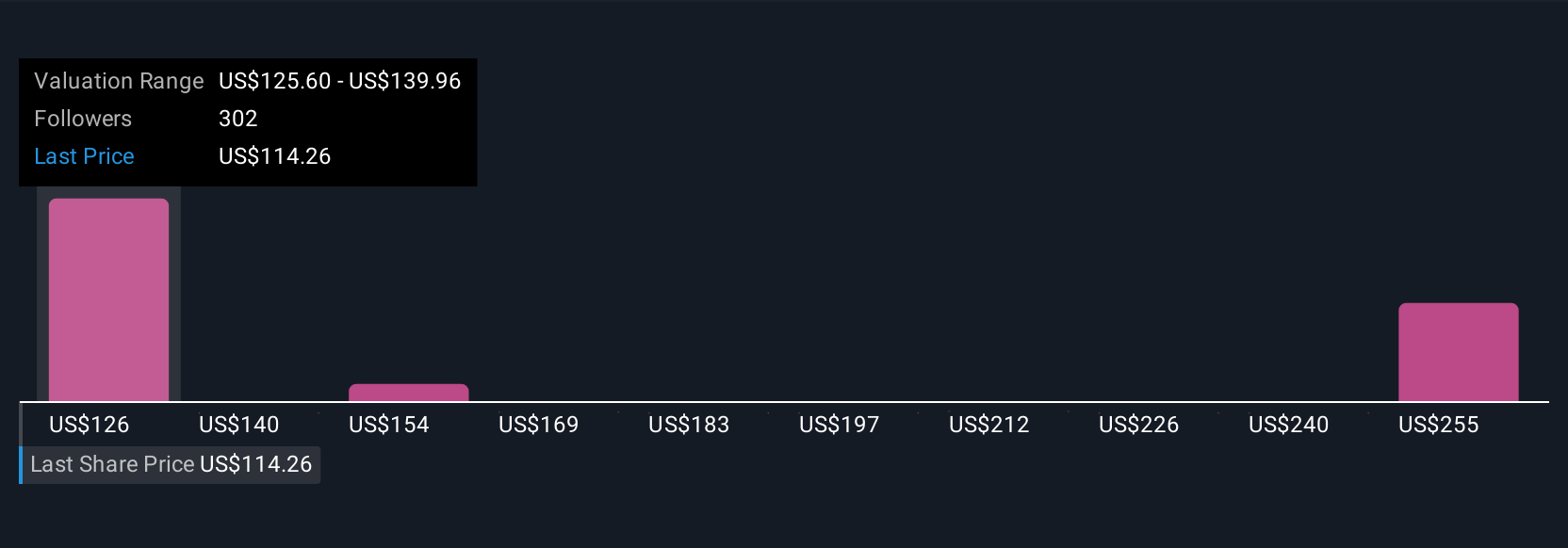

On Simply Wall St’s Community page, you can easily build or browse Narratives, a tool millions already use, to test out your investment thinking and see how your outlook compares to others. Narratives make it simple to track whether it is the right moment to buy or sell, since your fair value updates instantly as soon as new earnings or major news come in. For example, some PDD Narratives forecast a fair value as high as $165, highlighting strong growth and international expansion, while others set it as low as $117, citing rising competition and margin risks, offering you a dynamic view of what the market’s next big move could be.

Do you think there's more to the story for PDD Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives