- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

Is It Too Late to Consider PDD Holdings After Strong Cash Flow and Global Growth?

Reviewed by Bailey Pemberton

- Wondering if PDD Holdings is still a bargain or if the easy money has already been made? You are not alone. This stock has quietly become one of the most hotly debated value stories in Chinese tech.

- Despite some sharp swings lately, including a 1.3% gain over the last week, a 13.7% pullback over the last month, and a still solid 21.4% gain year to date, long term holders are sitting on a 31.1% 3 year return and 17.7% over the last year.

- Those moves have played out against a backdrop of intense competition in Chinese e commerce and shifting sentiment around consumer spending and platform regulation, which often drives rapid changes in risk appetite. At the same time, investors have been reacting to headlines about the continued global expansion of PDD's discount driven platforms and their ability to capture value conscious shoppers worldwide.

- On our numbers, PDD scores a 6/6 valuation check, suggesting it screens as undervalued across all the metrics we use. However, how we get to that score and what it really means for future returns depends on the valuation lens you use, and we will wrap up by looking at an even richer way to think about fair value than the usual models.

Approach 1: PDD Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today. For PDD Holdings, the model used is a 2 stage Free Cash Flow to Equity approach, built on cash flow projections in CN¥.

PDD’s latest twelve month free cash flow is about CN¥111.4 billion, and analysts expect this to keep growing strongly in the next few years. By 2027, free cash flow is projected to reach roughly CN¥164.6 billion, with further growth extrapolated out to 2035 based on moderating but still positive expansion in cash generation.

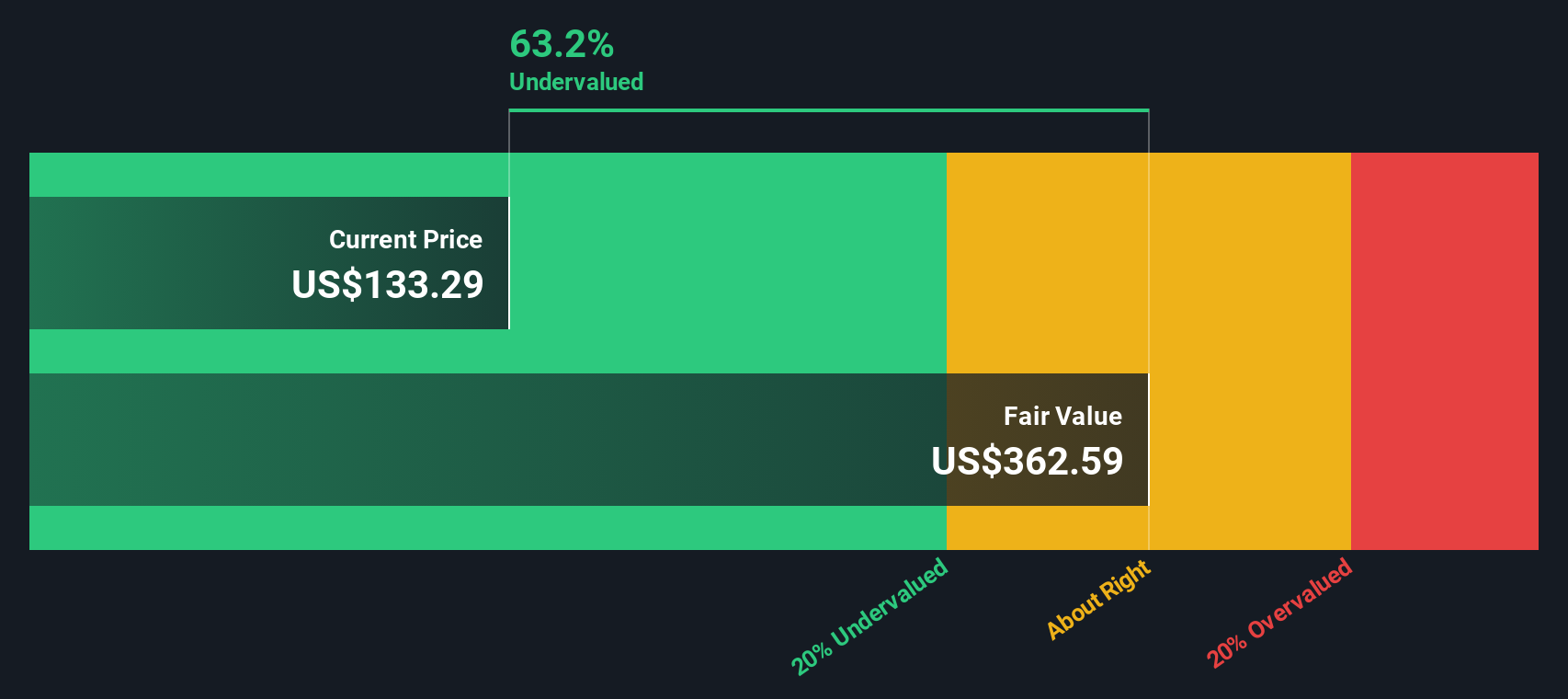

When all these future cash flows are discounted back and summed, the model arrives at an intrinsic value of about $345.10 per share. Versus the current market price, this implies the shares trade at roughly a 65.9% discount. This suggests investors may be heavily underpricing PDD’s long term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PDD Holdings is undervalued by 65.9%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: PDD Holdings Price vs Earnings

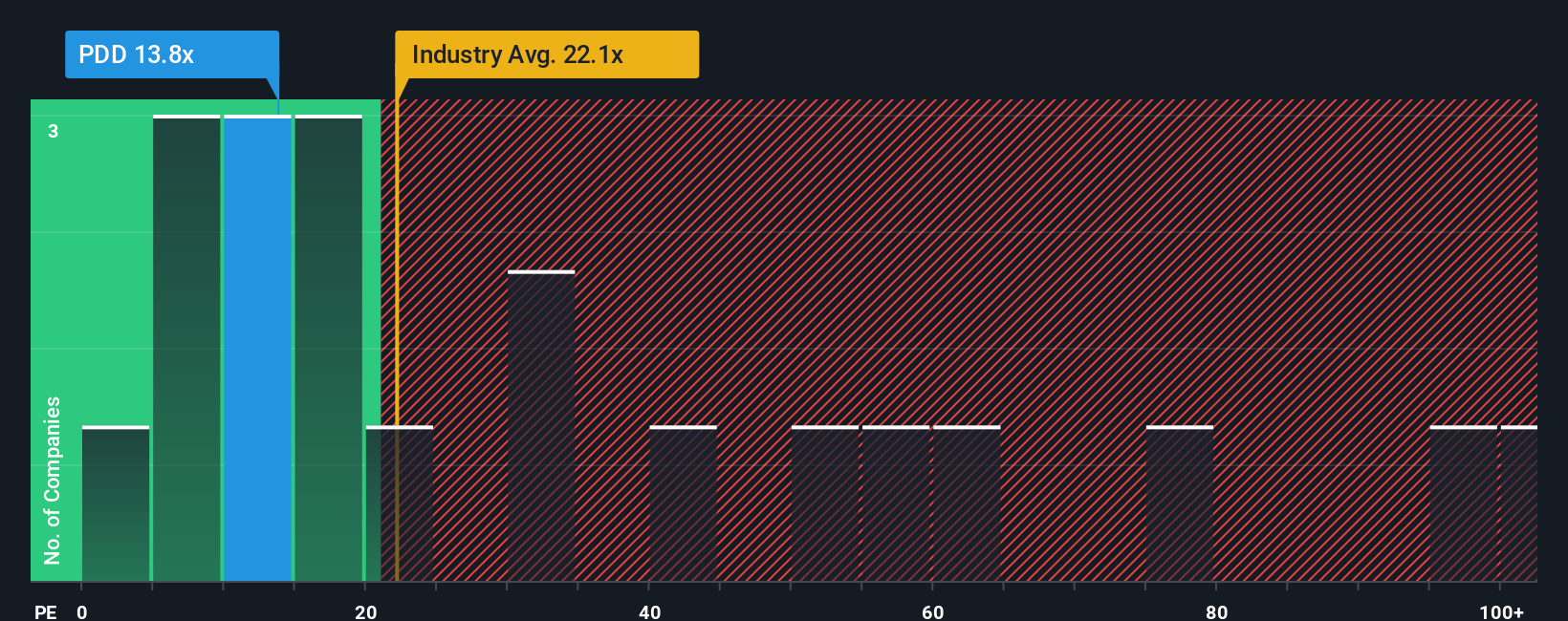

For a profitable and rapidly scaling platform like PDD, the price to earnings ratio is a useful yardstick because it links what investors pay today directly to the company’s current earnings power. In general, faster and more reliable earnings growth supports a higher PE, while higher perceived risk, regulatory uncertainty, or earnings volatility usually justify a lower one.

PDD currently trades at about 11.5x earnings, which is well below both the broader Multiline Retail industry average of roughly 19.8x and an even richer 63.3x average across its high growth peers. That big gap suggests the market is still assigning a substantial discount to PDD despite its strong fundamentals.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple would be reasonable for PDD given its specific earnings growth profile, margins, industry, market cap, and risk factors. On this basis, PDD’s Fair Ratio is around 26.9x, implying that, after adjusting for the company’s strengths and risks, the shares trade on a materially lower multiple than this level. Comparing the actual 11.5x to the Fair Ratio of 26.9x indicates the stock appears undervalued on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PDD Holdings Narrative

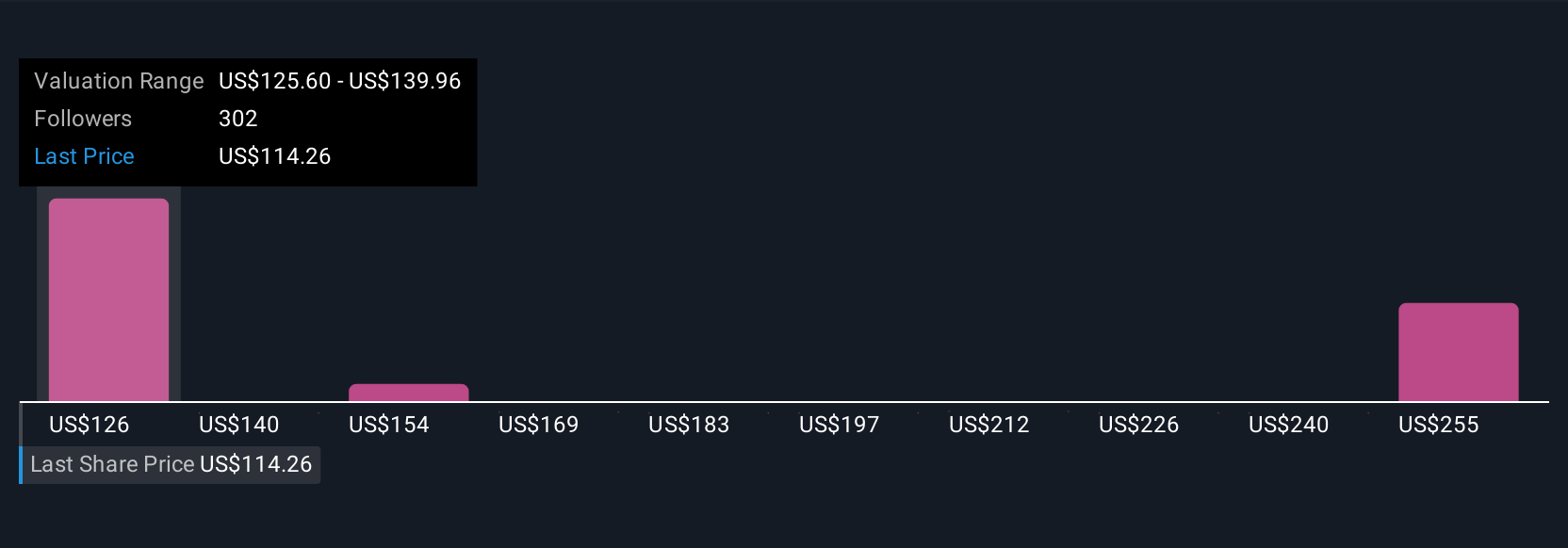

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to link your view of a company’s story to a financial forecast and then to a fair value estimate. On Simply Wall St’s Community page, Narratives let you spell out how you think PDD’s revenue, earnings, and margins will evolve, and the platform automatically turns that story into numbers and a fair value you can compare to today’s share price to decide whether it looks like a buy, hold, or sell. Because Narratives update dynamically as new news, earnings, or guidance emerges, they stay in sync with the latest information instead of being a one off calculation. For example, one PDD Narrative on the platform might see accelerating international growth and superior execution justifying a fair value around $176, while another, more cautious view that emphasizes margin pressure and competitive risk lands closer to $117. These two perspectives can coexist transparently so you can see where your own view fits on that spectrum.

Do you think there's more to the story for PDD Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026