- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

How Investors May Respond To O'Reilly Automotive (ORLY) Q3 Beat, Higher 2025 Outlook, Bullish Analysts

Reviewed by Sasha Jovanovic

- In recent days, O'Reilly Automotive reported past third-quarter results that exceeded expectations, raised its 2025 comparable-store sales guidance, and drew an "Outperform" initiation from Baird alongside broadly positive broker sentiment.

- This combination of stronger-than-expected operating performance and reinforced analyst confidence highlights how execution on market share and margin improvement is shaping perceptions of O'Reilly's long-term positioning.

- We'll now consider how the better-than-expected quarter and upgraded comparable-sales guidance influence O'Reilly Automotive's existing investment narrative and assumptions.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

O'Reilly Automotive Investment Narrative Recap

To own O’Reilly Automotive, you generally need to believe it can keep gaining market share and protecting margins in a competitive, cost sensitive auto parts market. The key near term catalyst is execution on same store sales and profitability, and the latest Q3 beat plus higher 2025 comparable sales guidance supports that story, even though the share price has lagged peers recently. The biggest risk remains cost and margin pressure from tariffs, inflation and competition, which this news does not remove.

Within the recent announcements, the raised 2025 comparable store sales guidance to 4% to 5% stands out as most relevant, because it directly links to the core thesis of steady, execution driven growth. Stronger same store sales expectations, combined with Baird’s new Outperform rating and broad analyst support, reinforce the idea that O’Reilly’s inventory, sourcing and service initiatives are feeding into better sales productivity, even as investors weigh ongoing cost inflation and competitive pressures.

Yet while the stronger quarter helps the story, investors still need to be aware of the risk that rising tariffs and input costs could...

Read the full narrative on O'Reilly Automotive (it's free!)

O'Reilly Automotive's narrative projects $20.5 billion revenue and $3.0 billion earnings by 2028.

Uncover how O'Reilly Automotive's forecasts yield a $110.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

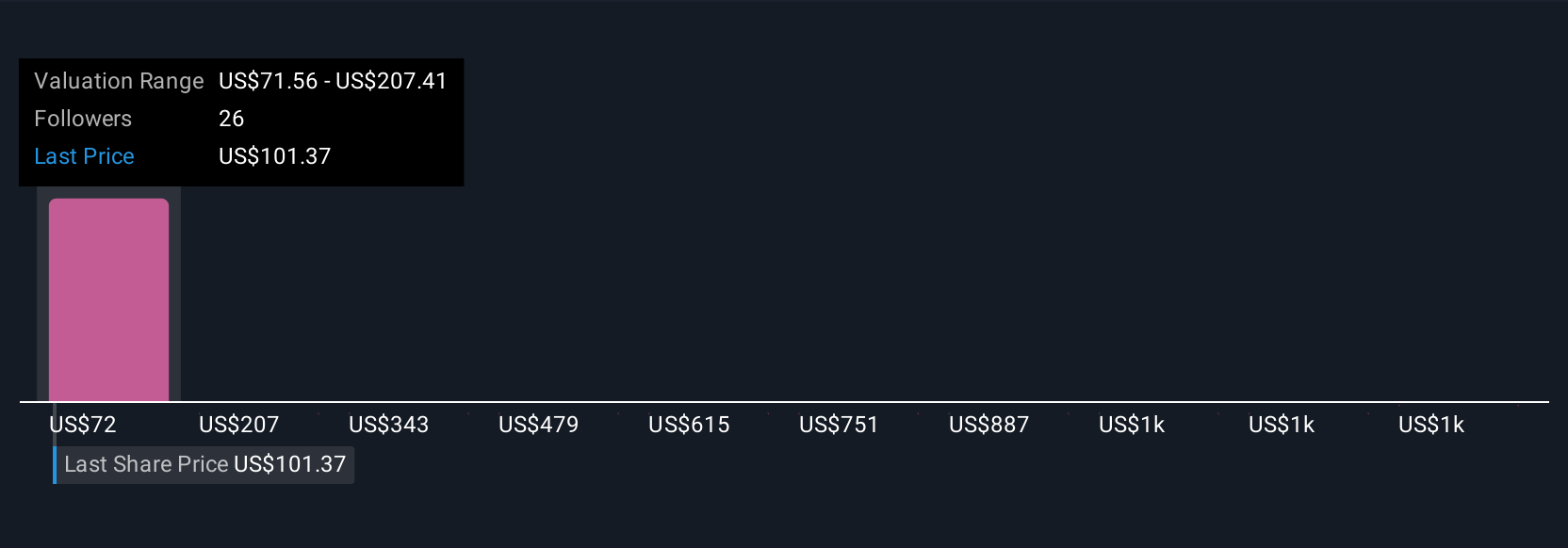

Five fair value estimates from the Simply Wall St Community span a very wide range, from about US$67 to over US$1,430 per share, showing how far apart individual views can be. Against that backdrop, the recent Q3 beat and higher 2025 comparable sales guidance highlight how much O’Reilly’s operational execution and cost pressures may influence which of these differing views proves closer to reality over time.

Explore 5 other fair value estimates on O'Reilly Automotive - why the stock might be a potential multi-bagger!

Build Your Own O'Reilly Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your O'Reilly Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free O'Reilly Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate O'Reilly Automotive's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Low risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026