- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGM:OLLI

Should You Revisit Ollie’s After Its 29.7% Share Price Surge and Sector Acquisition Buzz?

Reviewed by Bailey Pemberton

- Curious if Ollie's Bargain Outlet Holdings is trading at a steal or getting pricey? You are not alone. Taking a closer look at value could make all the difference for your next investment move.

- After gaining a solid 29.7% over the past year and climbing 14.6% year-to-date, Ollie's share price reflects both growing enthusiasm and shifting expectations among investors.

- Several notable acquisitions in the discount retail sector and changing consumer spending patterns have set the tone for recent market moves. For Ollie's, the buzz around competitors and broader shifts in bargain shopping trends have fueled speculation about future growth and resilience.

- So, how does Ollie's stack up on value? According to our checks, it scores 0 out of 6 for being undervalued. Before you draw conclusions, let us explore the different valuation methods and uncover an even smarter way to judge value at the end.

Ollie's Bargain Outlet Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ollie's Bargain Outlet Holdings Discounted Cash Flow (DCF) Analysis

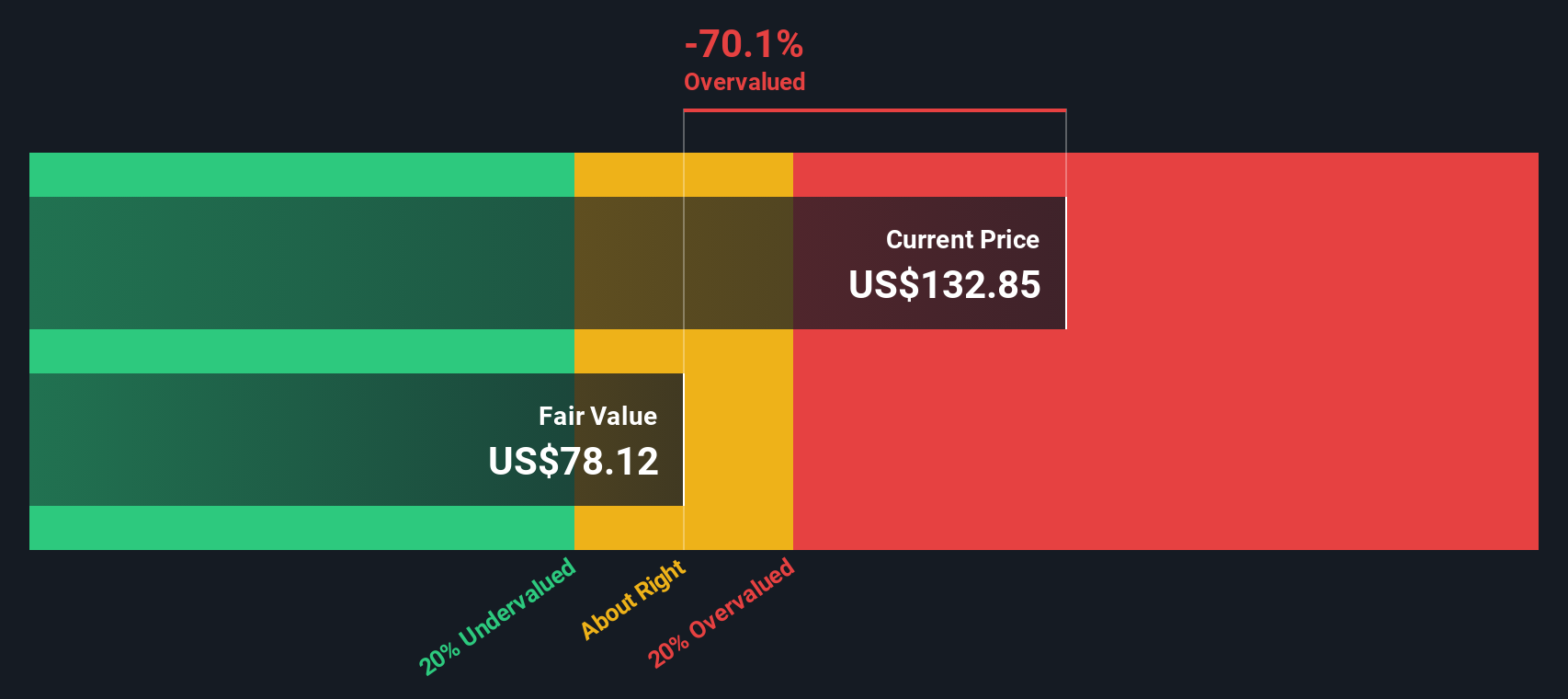

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and discounting them back to today, recognizing that money now is worth more than the same amount in the future. For Ollie's Bargain Outlet Holdings, this analysis takes its current Free Cash Flow of $131.9 million and forecasts growth over the coming years.

Analysts directly project Free Cash Flow out to 2028, expecting it to rise to $234.0 million. Beyond that, further increases are extrapolated, reaching a projected $345.7 million by 2035. All these figures are reported in US dollars. Any values in future years that are greater than $1 billion would be discussed, but all Ollie's numbers here remain in the millions.

Based on this trajectory and using a two-stage Free Cash Flow to Equity method, the DCF model calculates an intrinsic value of $74.94 per share for Ollie's. When compared to the current share price, this implies the stock is trading at a 65.6% premium to its estimated fair value. In other words, Ollie's is significantly overvalued according to the DCF approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ollie's Bargain Outlet Holdings may be overvalued by 65.6%. Discover 844 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ollie's Bargain Outlet Holdings Price vs Earnings

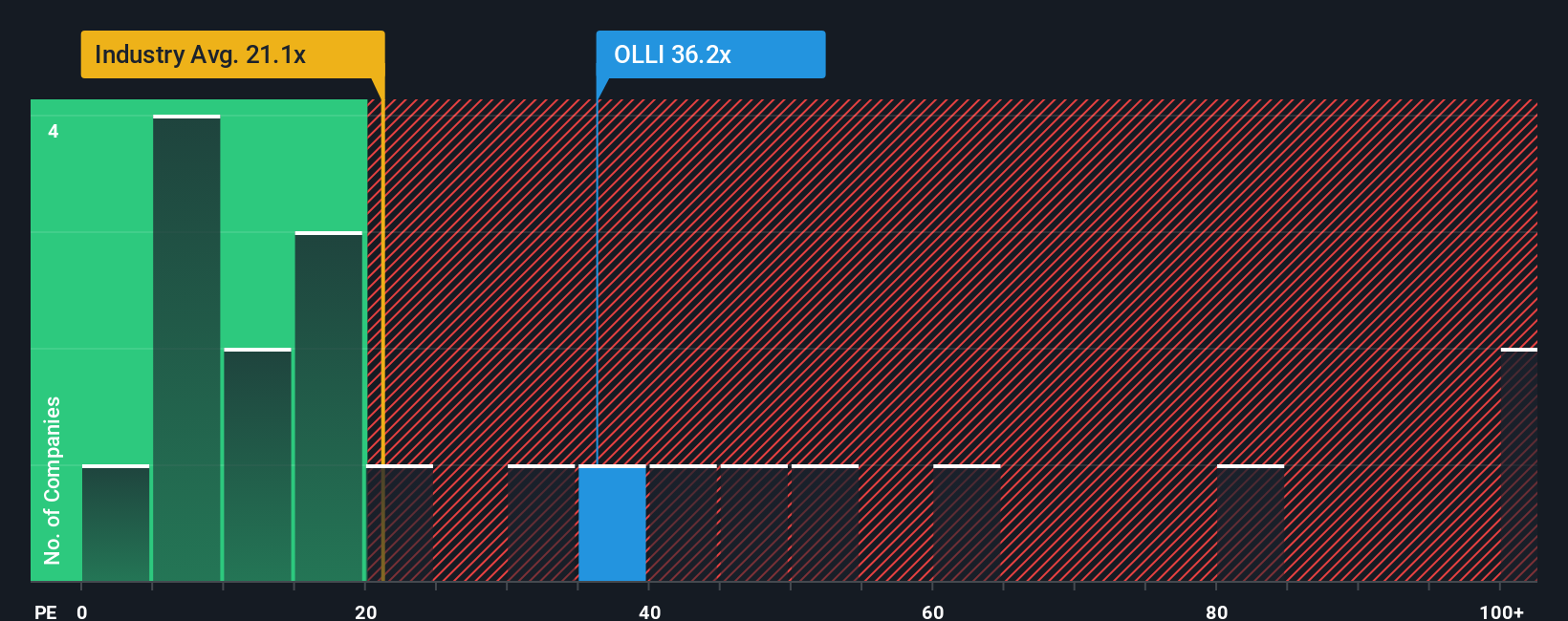

For companies like Ollie's Bargain Outlet Holdings that are both profitable and growing, the price-to-earnings (PE) ratio is a popular way to assess valuation. It offers a straightforward look at how much investors are willing to pay for each dollar of earnings, making it a useful gauge for mature businesses with consistent profits.

Growth expectations and the perceived risks of a business play a major role in what counts as a "normal" or "fair" PE ratio. Companies with rapid earnings growth or lower risk tend to attract higher PE multiples, while slower-growing or riskier companies typically trade at lower ratios.

Currently, Ollie's trades at a PE ratio of 35.7x, comfortably above both the Multiline Retail industry average of 19.9x and the peer average of 19.6x. This premium highlights the market's optimism about Ollie's future compared to its competitors and the broader sector.

Simply Wall St's proprietary "Fair Ratio" for Ollie's sits at 19.0x. This metric is more insightful than simply comparing to peers or the industry because it incorporates not just growth and risk, but also factors like profit margins and market capitalization. It provides a tailored benchmark that adjusts for what genuinely matters in valuing Ollie's unique business profile.

Comparing the Fair Ratio of 19.0x to the current 35.7x PE, Ollie's stock is trading well above what is justified by its fundamentals and growth prospects. This suggests the market’s enthusiasm may be overextended.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ollie's Bargain Outlet Holdings Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your story behind the numbers, combining your perspective on a company with your own estimates for its future revenue, earnings, and profit margins to arrive at a personalized fair value. Narratives link this story directly to a forecast and a fair value, so your investment view is rooted in both context and calculation.

Narratives are easy to use and available for free within Simply Wall St's Community page, allowing millions of investors to explore, create, and share their viewpoints. By connecting fair value to today’s share price, Narratives let you quickly see if Ollie's is a buy, hold, or sell, backed not only by financials but by your unique expectations. When new news or earnings are released, Narratives automatically update, keeping your view dynamic and relevant.

For example, using Ollie’s Bargain Outlet Holdings, one investor might think recent expansion will fuel high growth and set a fair value at $159.00, while another may worry about aggressive competition and set theirs at $130.00. The choice of narrative, and the insight it brings, is yours to make.

Do you think there's more to the story for Ollie's Bargain Outlet Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OLLI

Ollie's Bargain Outlet Holdings

Operates as a retailer of closeout merchandise and excess inventory in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives