- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGM:OLLI

Reassessing Ollie’s (OLLI) Valuation as Economic Uncertainty Prompts Investor Debate

Reviewed by Kshitija Bhandaru

Ollie's Bargain Outlet Holdings (OLLI) is in focus as investors respond to fresh economic data showing rising inflation expectations and a softer labor market, both of which could impact consumer-focused retailers. At the same time, debate is heating up about whether the stock’s premium valuation can be justified in this climate.

See our latest analysis for Ollie's Bargain Outlet Holdings.

Ollie's share price has seen a pullback this month after months of strong momentum, with its latest close at $122.81 following a 7.94% drop over the past 30 days. Still, the one-year total shareholder return stands at an impressive 29.99%, and over three years shareholders have seen more than a twofold gain. The latest moves suggest investors are re-evaluating risk and growth as economic signals become less predictable. However, the longer-term returns underline just how much optimism has been priced in.

If you’re watching the price swings and want to spot other potential winners, now’s the perfect time to discover fast growing stocks with high insider ownership.

This raises a crucial question for investors: is Ollie's truly offering value at today’s prices, or has the market already factored in all the future growth and optimism, leaving little room for upside?

Most Popular Narrative: 16.2% Undervalued

Ollie's Bargain Outlet Holdings is trading at $122.81, while the most followed analyst narrative estimates fair value at $146.60. With this spread and anticipation building around rising consumer demand, investors are watching closely to see what the underlying drivers mean for Ollie’s trajectory.

The company is benefiting from a growing value-conscious consumer base, amplified by economic uncertainty and inflation. This trend is driving more customers toward discount retailers like Ollie's, boosting both store traffic and revenue growth, as seen by accelerated customer acquisition and rising loyalty program membership. (Revenue)

Want to know what’s fueling analyst optimism in the face of inflation and shaky retail trends? There’s a bold case here, built on sharp revenue projections and surprisingly aggressive future margin targets. Which numbers are really behind that price? Find out what sets this stock apart and why the narrative’s math might shock you.

Result: Fair Value of $146.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid store expansion and reliance on closeout inventory could threaten profitability if new locations underperform or if inventory sources dry up.

Find out about the key risks to this Ollie's Bargain Outlet Holdings narrative.

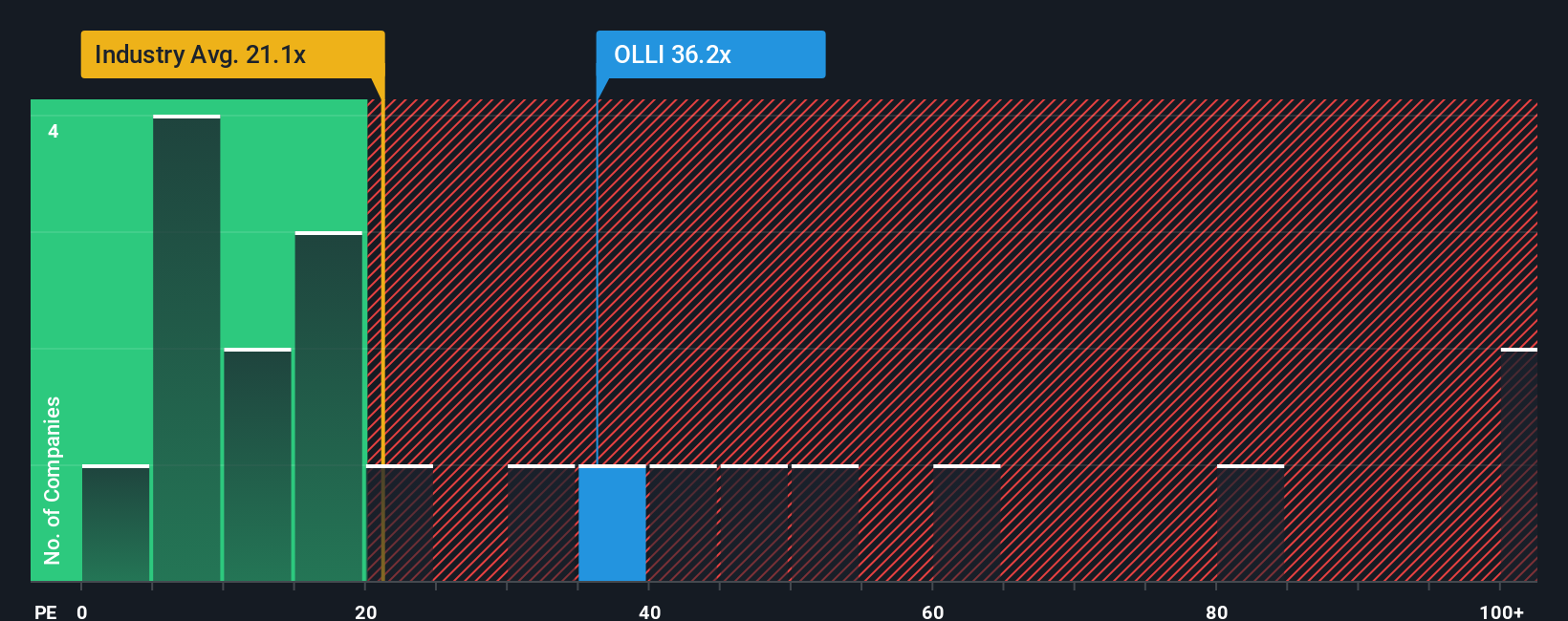

Another View: High Valuation on Earnings Multiples

Despite optimism from analysts, Ollie's stock trades at a lofty price-to-earnings ratio of 35.3x, well above the Global Multiline Retail industry average of 21.8x and even higher than the peer average of 22.4x. The fair ratio sits at 19.5x, which suggests sellers are demanding a premium for the growth story. Does this gap suggest there could be more risk than upside? The market may not always reward high expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ollie's Bargain Outlet Holdings Narrative

If you like to challenge the consensus or want to run your own numbers, you can easily craft a narrative of your own in just minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ollie's Bargain Outlet Holdings.

Looking for More Investment Ideas?

Sharpen your portfolio with companies reshaping markets and harnessing innovation. These hand-picked stock ideas could be the smart moves that give you an edge before everyone else catches on.

- Accelerate your wealth goals by targeting reliable income streams through these 19 dividend stocks with yields > 3% with yields above 3 percent, even as markets fluctuate.

- Tap into big technology revolutions by searching these 25 AI penny stocks to find companies on the front lines of artificial intelligence breakthroughs and disruptive automation trends.

- Position yourself for future growth by scanning these 898 undervalued stocks based on cash flows that the market hasn't fully priced in yet, giving you a head start on opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OLLI

Ollie's Bargain Outlet Holdings

Operates as a retailer of closeout merchandise and excess inventory in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives