- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGM:OLLI

Ollie's Bargain Outlet Holdings (OLLI): Assessing Valuation After Recent Share Price Trends

Reviewed by Simply Wall St

Ollie's Bargain Outlet Holdings (OLLI) stock has seen some recent shifts, prompting investors to look closer at how the company’s valuation stacks up after the latest developments. This period could offer a fresh perspective on OLLI’s current trajectory.

See our latest analysis for Ollie's Bargain Outlet Holdings.

OLLI’s share price has cooled in recent weeks, but it is still up 14.5% for the year to date. Long-term investors are sitting on a 30.7% total shareholder return over the past 12 months. Momentum may have faded lately; however, the company's robust return highlights enduring investor confidence and suggests the runway for future growth remains open.

If you’re curious about other compelling opportunities, now might be a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares off their highs but still boasting solid gains so far this year, the next question is whether Ollie's is trading at a discount to fair value or if the market has already factored in the company’s growth prospects. Is this an opening for buyers, or is all the good news already reflected in the price?

Most Popular Narrative: 15.4% Undervalued

With a fair value estimate of $146.60 and a recent closing price of $123.99, the most popular narrative signals Ollie's could have meaningful upside if key projections hold. Analysts are weighing store growth, market share, and profit expansion as the battleground for valuation.

Ongoing retail bankruptcies and store closures are providing attractive and abundant real estate opportunities for Ollie's to expand its footprint in prime locations. This is fueling accelerated store openings above their long-term target and supporting sustained double-digit annual unit growth. (Revenue and earnings growth)

Want to know the secret behind this optimistic price target? The forecast banks on a growth surge and profit improvement, but with bold assumptions built in. Curious about which eye-popping figures analysts are betting on to justify that premium? The full story might surprise you.

Result: Fair Value of $146.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Ollie's rapid expansion and limited e-commerce exposure could pressure margins if store growth slows or if consumer habits shift further online.

Find out about the key risks to this Ollie's Bargain Outlet Holdings narrative.

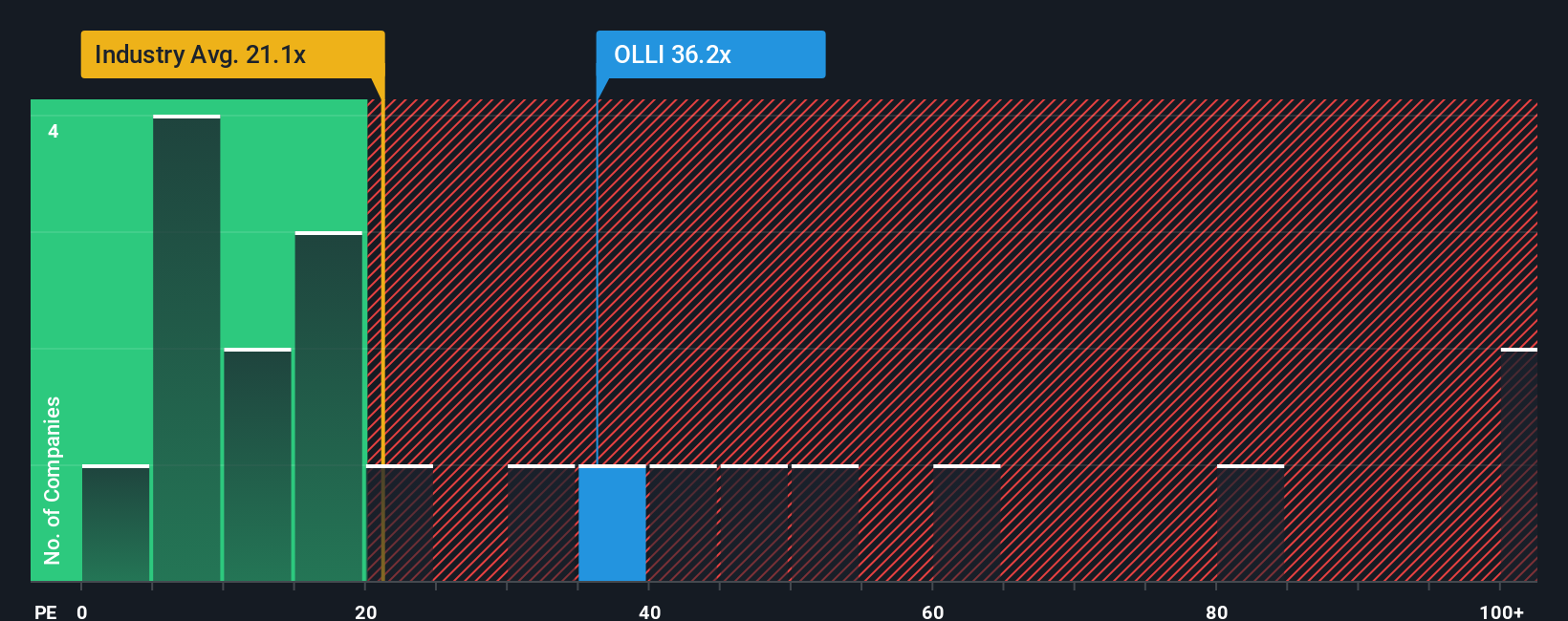

Another View: Are Valuation Ratios Too High?

While the consensus price target hints at upside, Ollie's trades at a price-to-earnings ratio of 35.6x, far above the global industry average of 19.5x, its peer average of 19.1x, and even its own fair ratio of 19x. This steep premium suggests investors have high expectations built in. Could that make the shares vulnerable if results fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ollie's Bargain Outlet Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can create your own Ollie’s narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ollie's Bargain Outlet Holdings.

Looking for more investment ideas?

Take control of your financial future and get ahead of the market by uncovering new stocks with growth potential and exciting sector trends.

- Cash in on future market leaders and pinpoint value with these 844 undervalued stocks based on cash flows, which highlights stocks trading below intrinsic worth.

- Capture attractive yields and steady returns by scanning these 20 dividend stocks with yields > 3%, featuring payouts above 3%.

- Ride the cutting edge of medicine and tech by reviewing these 33 healthcare AI stocks, designed to tap into breakthroughs reshaping healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OLLI

Ollie's Bargain Outlet Holdings

Operates as a retailer of closeout merchandise and excess inventory in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives