- United States

- /

- Specialty Stores

- /

- NasdaqCM:NEGG

Will Newegg’s (NEGG) Enhanced Store Card Deepen Customer Loyalty or Pressure Margins?

Reviewed by Sasha Jovanovic

- Newegg Commerce recently announced enhancements to its Newegg Store Credit Card, offering cardholders a new 4% discount on everyday purchases along with the option to choose instant savings at checkout or special financing.

- This added flexibility is designed to strengthen customer loyalty while providing greater value for shoppers making tech purchases through the platform.

- We’ll explore how expanding cardholder benefits, including the new 4% savings option, influences Newegg’s broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Newegg Commerce's Investment Narrative?

Anyone considering Newegg Commerce stock today is essentially betting on the company's ability to spark a return to growth in a volatile specialty retail and tech hardware market, while managing persistent operating losses. The recent boost to the Newegg Store Credit Card, with a new 4% savings option and enhanced checkout flexibility, marks a potentially positive step for customer engagement, but is unlikely to address the core risks at the center of the investment case, namely, ongoing unprofitability, highly volatile share price movement, and the challenge of reversing five-year declines in earnings. While this card enhancement supports Newegg’s ongoing push for loyalty and sales, especially after a modest improvement in half-year losses, the most important catalysts remain a sustained sales rebound and progress toward profitability. The risk profile, mainly tied to high losses and rapid return swings, remains as important as ever despite these incremental product moves.

But, even with new customer perks, volatility in returns remains a stark risk investors should track. Newegg Commerce's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

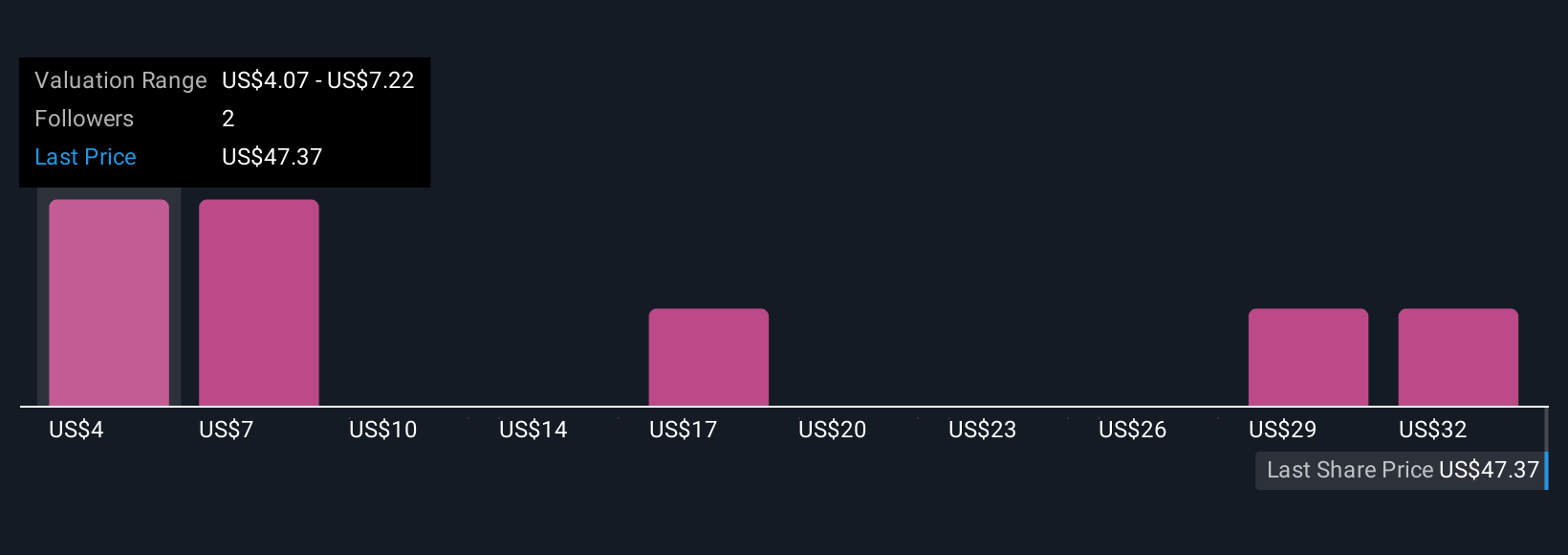

Explore 6 other fair value estimates on Newegg Commerce - why the stock might be worth less than half the current price!

Build Your Own Newegg Commerce Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newegg Commerce research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Newegg Commerce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newegg Commerce's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newegg Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEGG

Newegg Commerce

Operates as an electronics-focused e-retailer in the United States, Canada, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives