- United States

- /

- Specialty Stores

- /

- NasdaqGS:MNRO

Monro (NASDAQ:MNRO) sheds US$60m, company earnings and investor returns have been trending downwards for past five years

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example the Monro, Inc. (NASDAQ:MNRO) share price dropped 70% over five years. That's not a lot of fun for true believers. The falls have accelerated recently, with the share price down 17% in the last three months.

If the past week is anything to go by, investor sentiment for Monro isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Monro

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

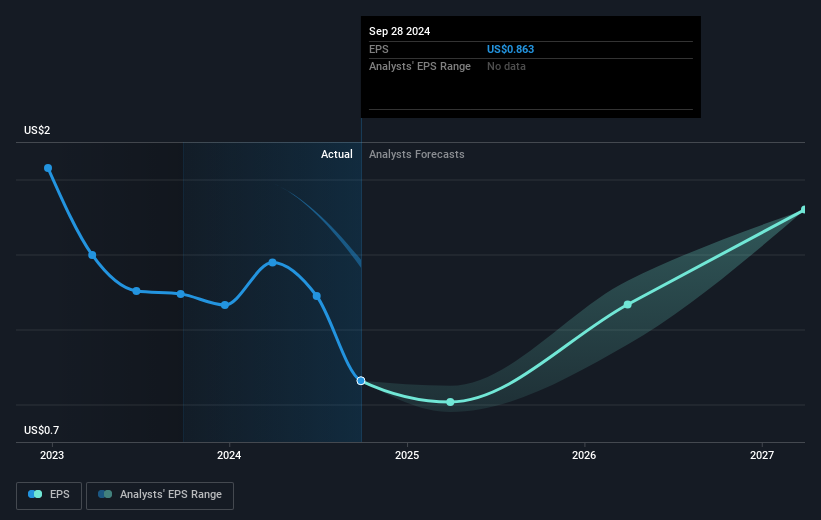

During the five years over which the share price declined, Monro's earnings per share (EPS) dropped by 18% each year. Notably, the share price has fallen at 21% per year, fairly close to the change in the EPS. This suggests that market participants have not changed their view of the company all that much. Rather, the share price change has reflected changes in earnings per share.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Monro's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Monro's TSR for the last 5 years was -66%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 26% in the last year, Monro shareholders lost 16% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Monro , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MNRO

Monro

Engages in the operation of retail tire and automotive repair stores in the United States.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives