- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

MercadoLibre (NasdaqGS:MELI): Evaluating Valuation Following Bold Expansion and New Market Entry

Reviewed by Kshitija Bhandaru

See our latest analysis for MercadoLibre.

MercadoLibre’s bold regional moves have made headlines, but this energy hasn’t shielded investors from volatility. After strong gains earlier this year, the stock has pulled back with a 17.2% 1-month share price decline and a 2.6% fall in total return over the past year. Yet, long-term holders are still sitting on an impressive 140% total return for the past three years, underscoring the company’s enduring momentum even through recent bumps.

If you're looking to expand beyond a single player, now is the perfect moment to discover fast growing stocks with high insider ownership.

With MercadoLibre trading nearly 25% below its analyst price target and recent volatility clouding its upward trajectory, the question now is whether the stock is trading at a bargain or if the market has already priced in its growth potential.

Most Popular Narrative: 30% Undervalued

With MercadoLibre's most-followed narrative pricing the stock at $2,893, well above its last close of $2,025, the stage is set for a debate over whether strong financial expansion can justify a higher market valuation.

Significant investments in lowering free shipping thresholds and reducing seller fees are increasing buyer conversion, attracting new users, and expanding assortment. This sets up sustained GMV and user growth as more retail moves online and is likely to accelerate topline revenue over the coming quarters.

Think this valuation is just hype? The entire premise relies on rapid sales and a bold plan for margin improvement. Which core financial forecasts drive this ambitious target? Discover what’s fueling this optimism, and what must go right to make it real.

Result: Fair Value of $2,893 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened credit risk in Brazil and rising logistics costs could derail MercadoLibre’s growth narrative if these challenges intensify in coming quarters.

Find out about the key risks to this MercadoLibre narrative.

Another View: Is the Market Right?

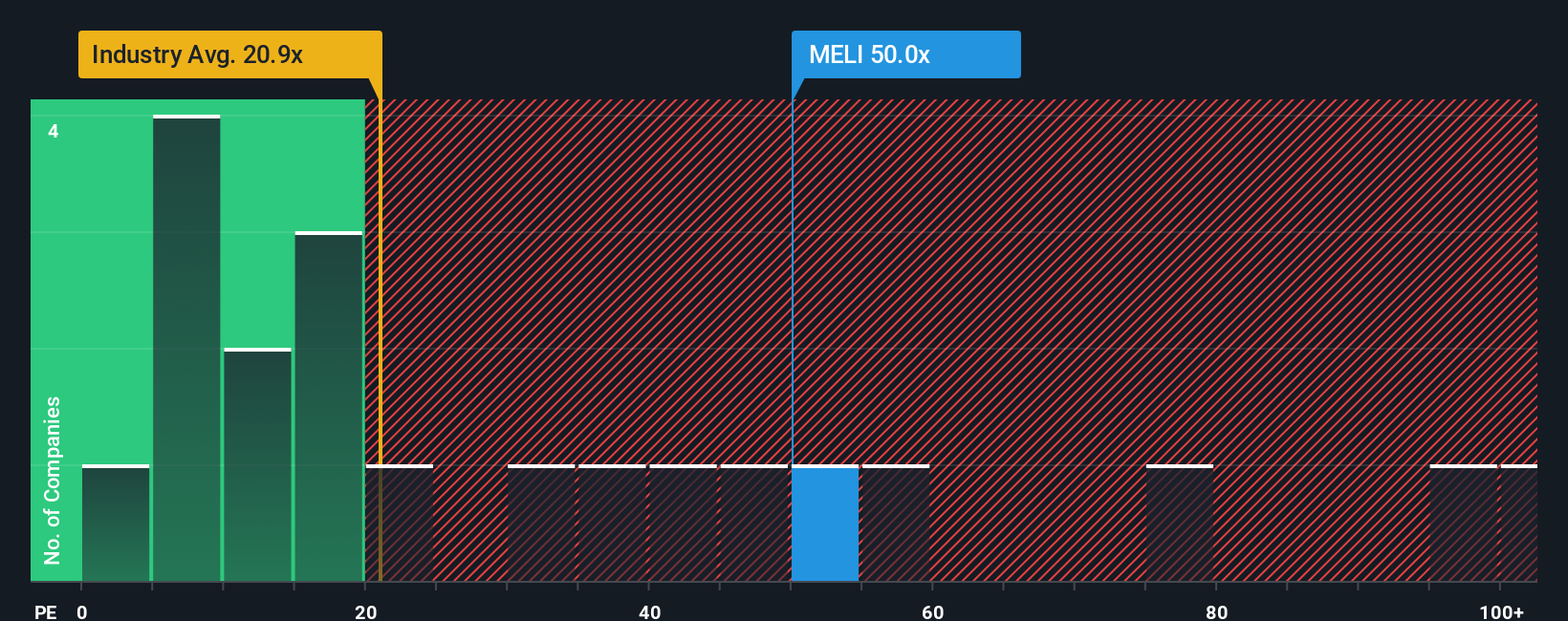

Looking through the lens of price-to-earnings, MercadoLibre trades at 50x earnings, a hefty premium compared with both the global industry average of 20.6x and a peer group average of 64.3x. The market’s current multiple also stands well above the fair ratio of 33.6x, raising the stakes for future growth to deliver. Could this premium signal untapped upside, or does it point to meaningful valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MercadoLibre Narrative

If you have a different perspective or want to dive into the numbers on your own terms, you can shape your own story in just a few minutes with Do it your way.

A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Make sure your next big move isn't just a hunch. Use the Simply Wall Street Screener to spot fresh ideas that most investors overlook and ignite your portfolio's potential.

- Uncover high-yield potential alongside stability by checking out these 18 dividend stocks with yields > 3%, which consistently deliver stronger income streams than the market average.

- Ride the wave of AI innovation when you scan these 24 AI penny stocks, showing exceptional promise in artificial intelligence breakthroughs and rapid business scaling.

- Capitalize on unbeatable value by reviewing these 878 undervalued stocks based on cash flows, poised for long-term growth yet still flying under the radar of most market-watchers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives