- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

Does MercadoLibre Still Offer Growth After Amazon’s Rappi Stake and Recent Share Price Declines?

Reviewed by Bailey Pemberton

Trying to decide what to do with MercadoLibre stock right now? You are not alone. After a wild ride, investors are wrestling with whether these latest price swings mean it is time to act or time to wait. The stock has seen some turbulence lately, dropping 5.1% over the last week and 17.2% in the past month, but if you zoom out, the picture changes. MercadoLibre is still up 14.7% year-to-date and an impressive 139.7% over the past three years. That kind of growth is enough to catch anyone’s attention.

The headlines are swirling, too. One recent move by Amazon into Latin America, picking up a stake in Rappi, has many wondering if competitive pressure could shift the momentum in MercadoLibre’s key delivery markets. While it is too soon to know how much this will shake things up, it is worth considering in your analysis of the company’s risk profile and future growth potential.

All that excitement leads to a central question: is MercadoLibre actually undervalued right now? By the numbers, the company has a value score of 4 out of 6, meaning it passes four major checks for being undervalued. In other words, there is a strong argument that the market is not giving full credit for MercadoLibre’s fundamentals, even amid all the volatility.

Let us break down what those valuation checks really mean, how they can help guide your decision, and why there might be an even better way to judge whether MercadoLibre’s stock deserves a place in your portfolio.

Why MercadoLibre is lagging behind its peers

Approach 1: MercadoLibre Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model helps estimate a company's value by projecting its future cash flows and discounting them back to their present value. This approach attempts to answer the question, "What is MercadoLibre really worth, based on the cash it will generate in the years ahead?"

Currently, MercadoLibre reports Free Cash Flow (FCF) of $7.5 Billion. Analyst forecasts suggest steady growth, with Free Cash Flow expected to reach approximately $9.6 Billion by 2027. Looking further out, projections estimate FCF will climb to nearly $14.1 Billion in 2035. These later numbers are extrapolated using conservative growth assumptions. All cash flow figures are presented in US Dollars, providing a consistent benchmark for valuation.

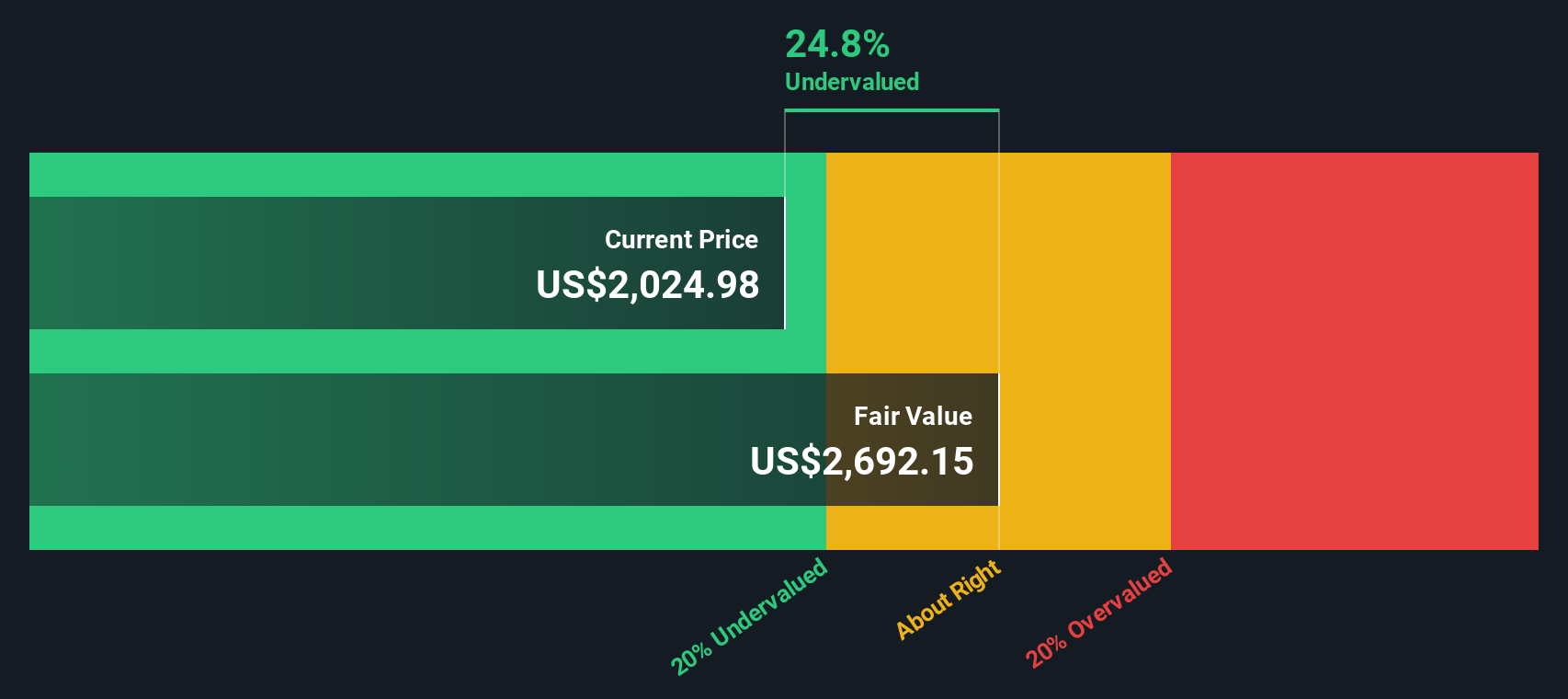

After crunching the numbers, the DCF model calculates an intrinsic fair value for MercadoLibre shares at $2,692.15. Given the current share price, this means the stock is trading at a 24.8% discount to its estimated intrinsic value. In summary, the DCF model suggests the market is not fully recognizing MercadoLibre’s long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MercadoLibre is undervalued by 24.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: MercadoLibre Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred valuation metric for companies that are solidly profitable, like MercadoLibre. It offers a straightforward way to measure market expectations by comparing the company’s current share price with its earnings per share. Investors often look to the PE ratio for a quick sense of whether a stock is expensive or cheap. What is considered “fair” depends on the company’s growth prospects and risk profile. Higher growth companies and those with fewer risks usually command a premium PE multiple, while slower-growing or riskier businesses tend to trade at lower PE levels.

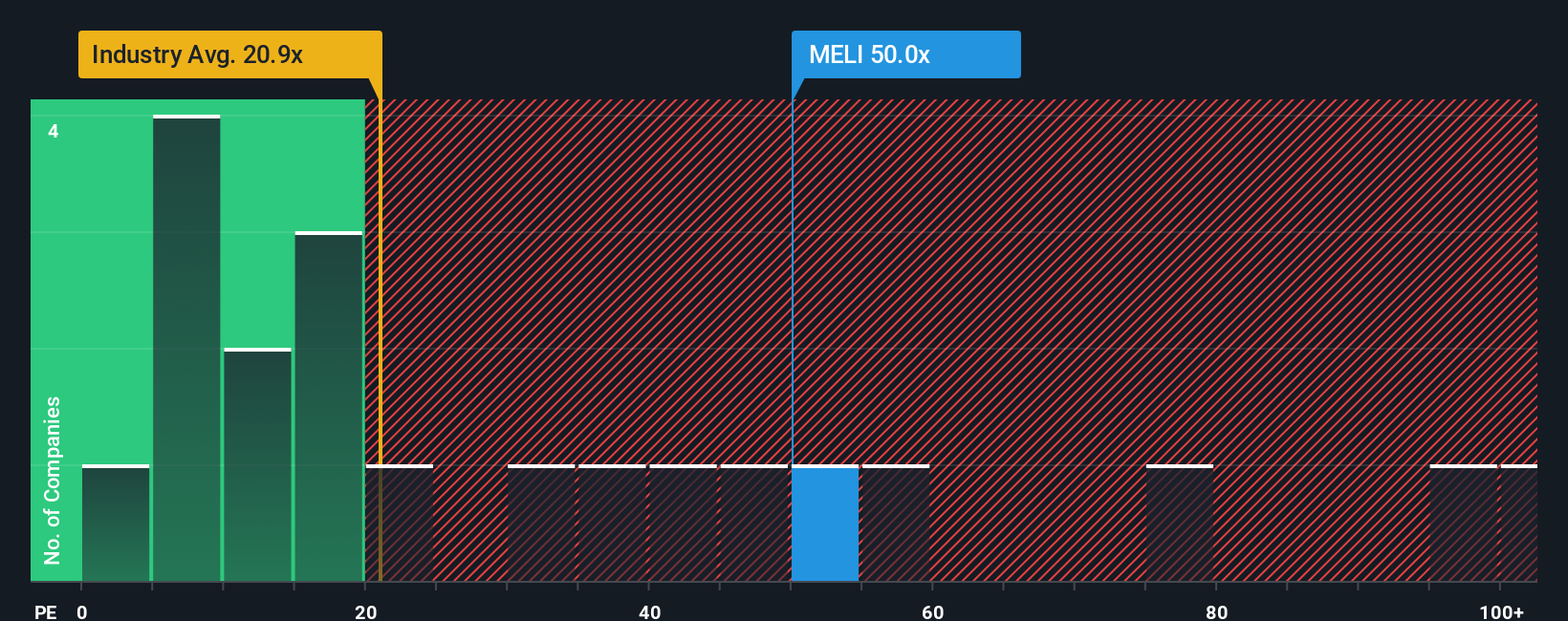

Currently, MercadoLibre trades at a PE ratio of 50.0x. For context, this is well above the Multiline Retail industry average PE of 20.6x, but it is below the peer average of 64.3x. At first glance, this may make the stock appear pricey. However, instead of relying solely on peer or industry comparisons, it is more insightful to use the “Fair Ratio” developed by Simply Wall St. Their Fair Ratio for MercadoLibre stands at 33.6x, which factors in not just earnings growth and profit margin, but also company size, industry dynamics, and the company’s risk profile. This approach offers a more precise benchmark that is tailored to MercadoLibre’s unique characteristics, rather than a one-size-fits-all comparison.

Comparing the Fair Ratio of 33.6x to MercadoLibre's actual PE of 50.0x suggests the stock is currently overvalued using this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MercadoLibre Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative combines your perspective on a company’s future, such as what you expect for revenue growth, earnings, and margins, with your assessment of fair value. This approach helps you tell the story behind the numbers.

Narratives work by linking a company’s big-picture story with a forecast and an individualized fair value. You articulate why you believe MercadoLibre’s investments, strategies, or risks will lead to certain financial outcomes, and then see how those assumptions would translate into a share price today. Narratives are simple to use and available to all investors on Simply Wall St’s Community page, empowering millions of users to share and discuss their outlooks.

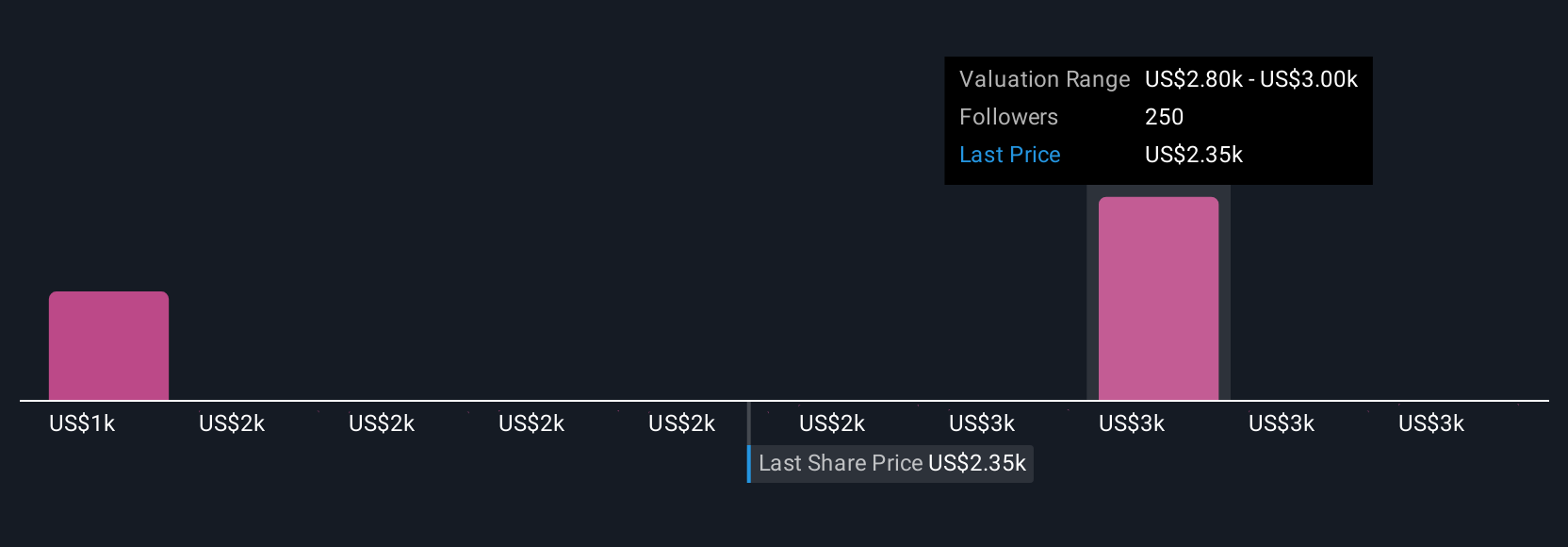

With Narratives, you are not just reacting to headlines. You are actively deciding when to buy or sell by comparing your calculated Fair Value with the current Price. As fresh news or earnings updates arrive, Narratives automatically update your forecasts, keeping your investment process dynamic and adaptive. For MercadoLibre, for example, some investors believe aggressive investments in digital payments and retail integration justify reaching a fair value of $3,500 per share. Others highlight stiffer competition and margin risks, estimating a fair value as low as $2,170.

Do you think there's more to the story for MercadoLibre? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives