- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

Can MercadoLibre's (MELI) B2B Expansion Offset Amazon’s Aggressive Moves in Brazil?

Reviewed by Sasha Jovanovic

- In recent days, MercadoLibre announced the launch of a new business-to-business (B2B) unit aimed at capturing corporate demand across major Latin American markets, while facing intensifying competition in Brazil as Amazon waives fulfillment fees for new merchants during the holiday season.

- This dual development highlights both the significant growth opportunity in the expansive corporate commerce sector and the increasing pressure from global competitors seeking share in MercadoLibre's core markets.

- We'll look at how MercadoLibre's aggressive B2B expansion in the face of Amazon's push into Brazil shapes its long-term growth narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

MercadoLibre Investment Narrative Recap

MercadoLibre shareholders need to believe in the strength and expansion potential of its integrated ecosystem across e-commerce and fintech in Latin America. While the recent share price drop highlights sensitivity to broad macroeconomic concerns and rising competition in Brazil, the company's core catalysts, ongoing investments in logistics, expanding digital payments, and platform integration, remain intact. The most significant short term catalyst is continued e-commerce and fintech adoption, while intensifying competitive pressure, particularly from Amazon in Brazil, is now the most immediate risk. Recent events have magnified, but not fundamentally changed, these dynamics.

Among the recent announcements, MercadoLibre’s launch of its business-to-business (B2B) unit stands out in context of these catalysts. The move is aimed at capturing the corporate commerce segment in major markets like Brazil, Mexico, and Argentina, potentially opening up an addressable market several times larger than its current consumer base. This step signals an effort to reinforce topline momentum even as pressure builds from global competitors.

But in contrast to these large opportunities, investors should be aware that the risk from aggressive margin pressure as both Amazon and local rivals escalate their investments is...

Read the full narrative on MercadoLibre (it's free!)

MercadoLibre's narrative projects $46.9 billion revenue and $5.1 billion earnings by 2028. This requires 24.8% yearly revenue growth and a $3.0 billion earnings increase from $2.1 billion today.

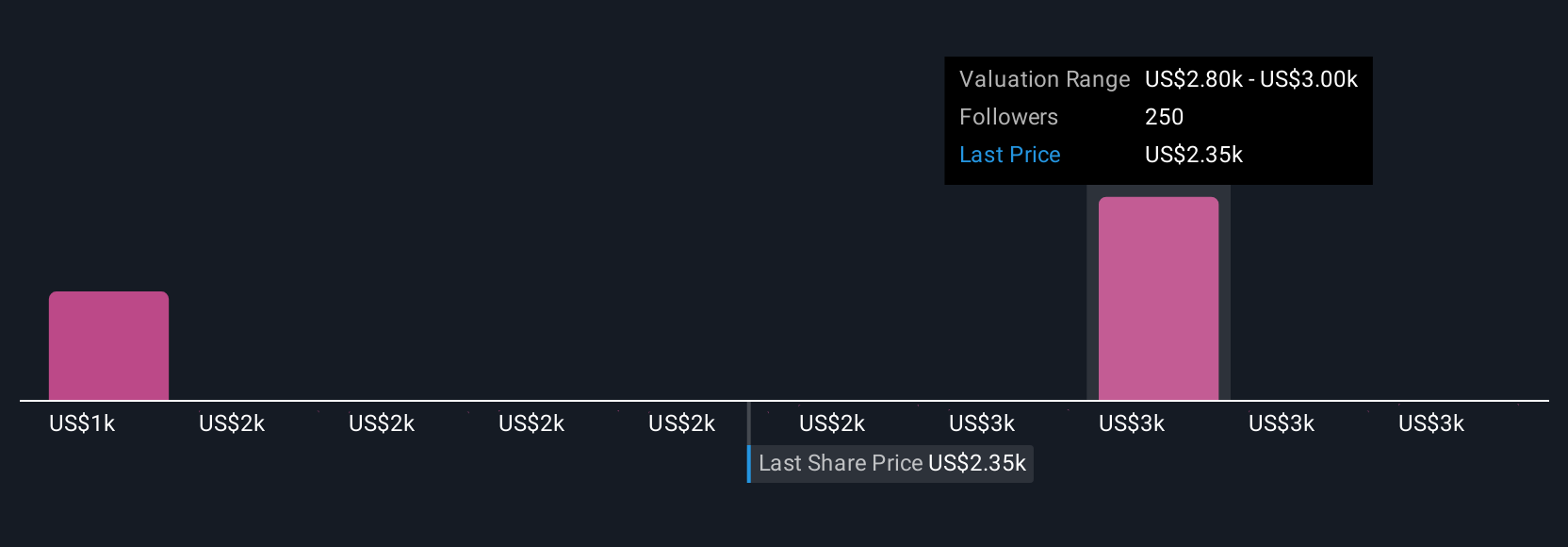

Uncover how MercadoLibre's forecasts yield a $2894 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community placed MercadoLibre's fair value between US$2,196.76 and US$3,406.20, based on 27 different forecasts. While these opinions reflect wide price targets, the looming risk of intensified competition for market share in Brazil may be front of mind for many market participants.

Explore 27 other fair value estimates on MercadoLibre - why the stock might be worth as much as 57% more than the current price!

Build Your Own MercadoLibre Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MercadoLibre research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MercadoLibre's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives