- United States

- /

- Retail Distributors

- /

- NasdaqGS:LKQ

It's A Story Of Risk Vs Reward With LKQ Corporation (NASDAQ:LKQ)

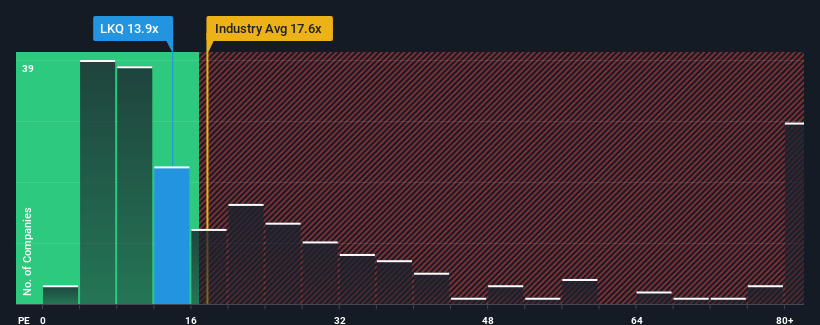

With a price-to-earnings (or "P/E") ratio of 13.9x LKQ Corporation (NASDAQ:LKQ) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

LKQ has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for LKQ

Is There Any Growth For LKQ?

There's an inherent assumption that a company should underperform the market for P/E ratios like LKQ's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 11% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 15% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

With this information, we find it odd that LKQ is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of LKQ's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - LKQ has 3 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LKQ

LKQ

Engages in the distribution of replacement parts, components, and systems used in the repair and maintenance of vehicles and specialty vehicle aftermarket products and accessories.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives