What JD.com (JD)'s Planned JingDong Industrials IPO Means For Shareholders

Reviewed by Sasha Jovanovic

- Recently, reports emerged that JD.com's industrial services arm, JingDong Industrials, is preparing for a Hong Kong IPO targeted to raise about US$500 million, while Chinese tech stocks advanced amid sector enthusiasm for artificial intelligence.

- An interesting aspect is that retail investors hold the largest ownership in JD.com, potentially positioning them to benefit from any value unlocked through the planned IPO.

- We'll examine how the upcoming IPO of JingDong Industrials could impact JD.com's investment narrative and growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

JD.com Investment Narrative Recap

To believe in JD.com, you need confidence in its ability to execute on diversification and logistics efficiency, driving sustainable growth and margin expansion despite fierce competition and shifting consumer habits. The planned Hong Kong IPO of JingDong Industrials could add capital and sharpen focus on JD.com's core retail business, but does not materially change that the most important near-term catalyst remains customer growth, while profitability challenges in newer segments continue to be the biggest risk.

Among recent announcements, JD.com's Q2 results showed solid revenue up to CNY 356.66 billion but a significant decline in net income, highlighting ongoing margin pressure as the company invests in expansion. Paired with the IPO news, this puts even more emphasis on the need for successful scaling of new businesses and efficiency initiatives to support long-term value creation.

In contrast, ongoing margin pressure from intense food delivery competition is a risk investors cannot afford to ignore...

Read the full narrative on JD.com (it's free!)

JD.com's outlook anticipates CN¥1,517.4 billion in revenue and CN¥45.1 billion in earnings by 2028. This implies a 6.2% annual revenue growth and a CN¥6.4 billion earnings increase from the current CN¥38.7 billion.

Uncover how JD.com's forecasts yield a $44.99 fair value, a 27% upside to its current price.

Exploring Other Perspectives

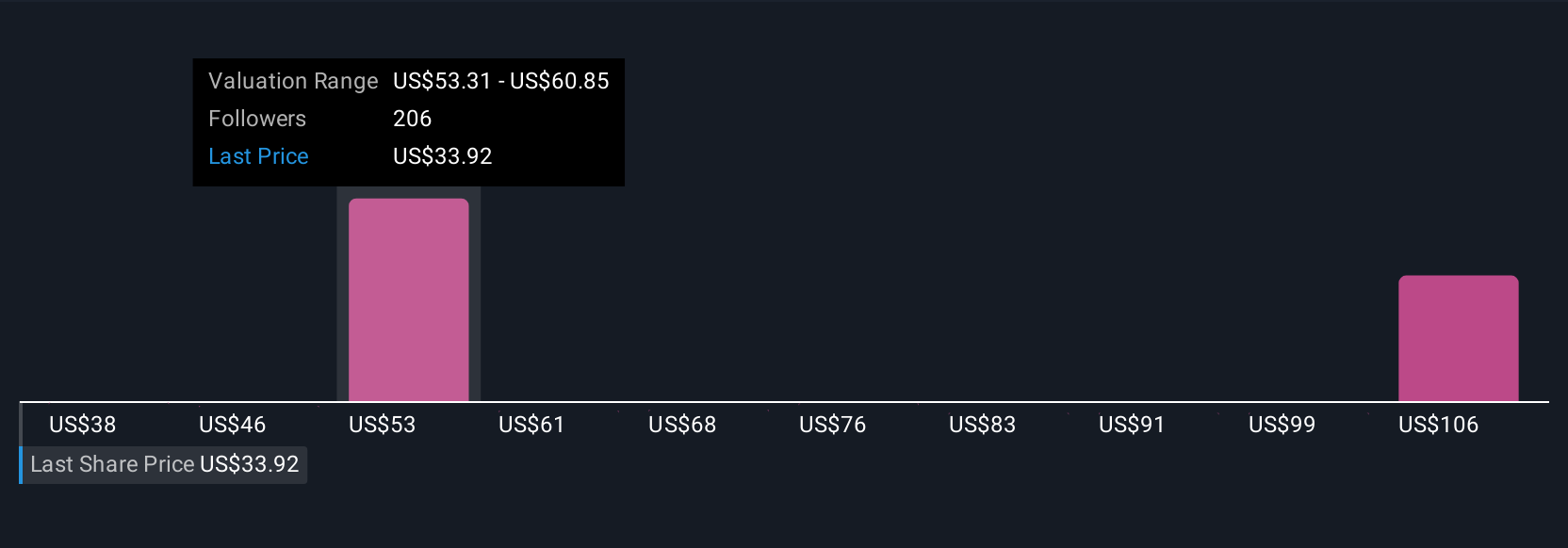

Simply Wall St Community members provided 28 independent fair value estimates for JD.com, ranging widely from US$30 to US$125.91 per share. Amid this diversity, continued margin pressure from expansion into challenging new markets remains a key concern for future returns, consider how your own forecasts stack up against these opinions.

Explore 28 other fair value estimates on JD.com - why the stock might be worth over 3x more than the current price!

Build Your Own JD.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JD.com research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JD.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JD.com's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JD

JD.com

Operates as a supply chain-based technology and service provider in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives