- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:GRPN

Will Groupon's (GRPN) Return to Profitability in Q2 2025 Change Its Investment Narrative?

Reviewed by Simply Wall St

- Groupon recently reported its second quarter 2025 financial results, revealing sales of US$125.7 million and a shift from a net loss last year to net income of US$20.34 million.

- This transition to profitability not only marks a significant operational improvement for the company but also reverses a multi-year trend of losses.

- We will examine how Groupon’s move to net income this quarter could impact the broader outlook for its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Groupon Investment Narrative Recap

For shareholders, the core belief centers on Groupon’s ability to build a more profitable, resilient business by curating merchant partnerships and enhancing user engagement. The recent move to net income is a clear operational milestone, but with revenue growth remaining modest, the most important near-term catalyst remains successful execution on platform upgrades and customer retention efforts. The biggest risk, seasonal fluctuations in demand, especially during critical shopping periods, remains intact, and this quarter’s improvement does not materially alter that exposure.

Among recent company announcements, the decision to complete its substantial share buyback program earlier this year stands out. While this returned value to existing shareholders and reduced share count, its relevance is heightened by the shift to profitability, spotlighting the importance of sustained operational gains to support both earnings and capital management initiatives.

In contrast, investors should be aware that results in key seasonal periods could still...

Read the full narrative on Groupon (it's free!)

Groupon's outlook anticipates $635.9 million in revenue and $75.5 million in earnings by 2028. This scenario implies a 9.3% annual revenue growth rate and a $114.6 million earnings increase from the current earnings of -$39.1 million.

Uncover how Groupon's forecasts yield a $30.00 fair value, in line with its current price.

Exploring Other Perspectives

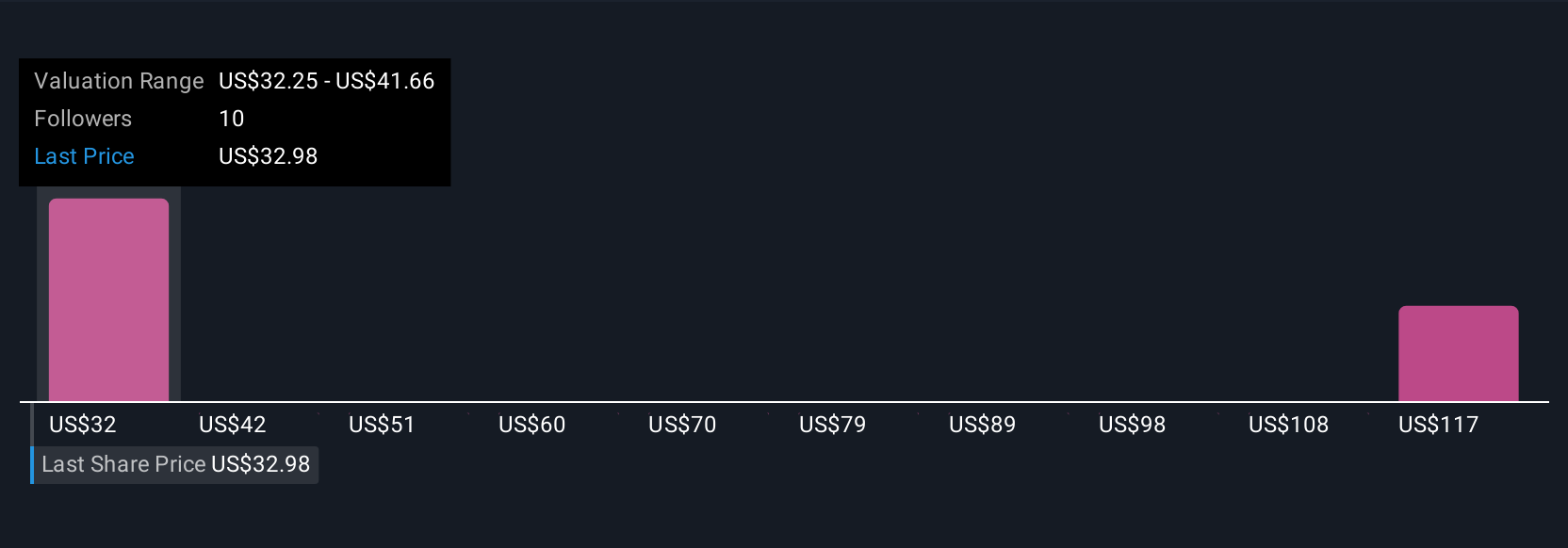

The Simply Wall St Community’s fair value estimates for Groupon range widely from US$30.00 to US$155.56, based on 2 unique analyses. While this diversity signals differing convictions, persistent exposure to uneven seasonal sales may continue to influence the company’s results and broader outlook. Explore how others are interpreting these signals and forming their own expectations.

Explore 2 other fair value estimates on Groupon - why the stock might be worth over 5x more than the current price!

Build Your Own Groupon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Groupon research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Groupon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Groupon's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRPN

Groupon

Operates a marketplace that connects consumers to merchants by offering goods and services at a discount in North America and international.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion