- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:GLBE

Investors Appear Satisfied With Global-e Online Ltd.'s (NASDAQ:GLBE) Prospects As Shares Rocket 29%

Global-e Online Ltd. (NASDAQ:GLBE) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The last month tops off a massive increase of 109% in the last year.

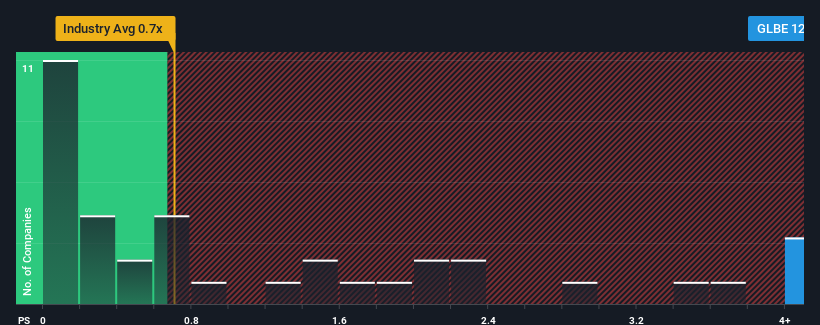

After such a large jump in price, you could be forgiven for thinking Global-e Online is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 12.6x, considering almost half the companies in the United States' Multiline Retail industry have P/S ratios below 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Global-e Online

What Does Global-e Online's Recent Performance Look Like?

Global-e Online certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Global-e Online will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Global-e Online?

In order to justify its P/S ratio, Global-e Online would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 49% gain to the company's top line. The latest three year period has also seen an excellent 285% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 30% each year over the next three years. That's shaping up to be materially higher than the 14% per year growth forecast for the broader industry.

In light of this, it's understandable that Global-e Online's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Global-e Online's P/S Mean For Investors?

The strong share price surge has lead to Global-e Online's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Global-e Online's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Global-e Online is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GLBE

Global-E Online

Provides a platform to enable and accelerate direct-to-consumer cross-border e-commerce in Israel, the United Kingdom, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives