- United States

- /

- Software

- /

- NasdaqGS:ALKT

Three High Growth US Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the United States stock market faces a potential end to its longest winning streak of the year, with major indices like the S&P 500 and Nasdaq showing slight declines, investors are closely monitoring economic indicators and Federal Reserve comments for future guidance. In such an environment, stocks with high insider ownership can be particularly appealing as they often signal confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.6% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.8% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Underneath we present a selection of stocks filtered out by our screen.

Bowman Consulting Group (NasdaqGM:BWMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. offers real estate, energy, infrastructure, and environmental management solutions in the United States and has a market cap of $423.09 million.

Operations: Bowman Consulting Group Ltd. generates revenue of $386.81 million by providing engineering and related professional services to its customers.

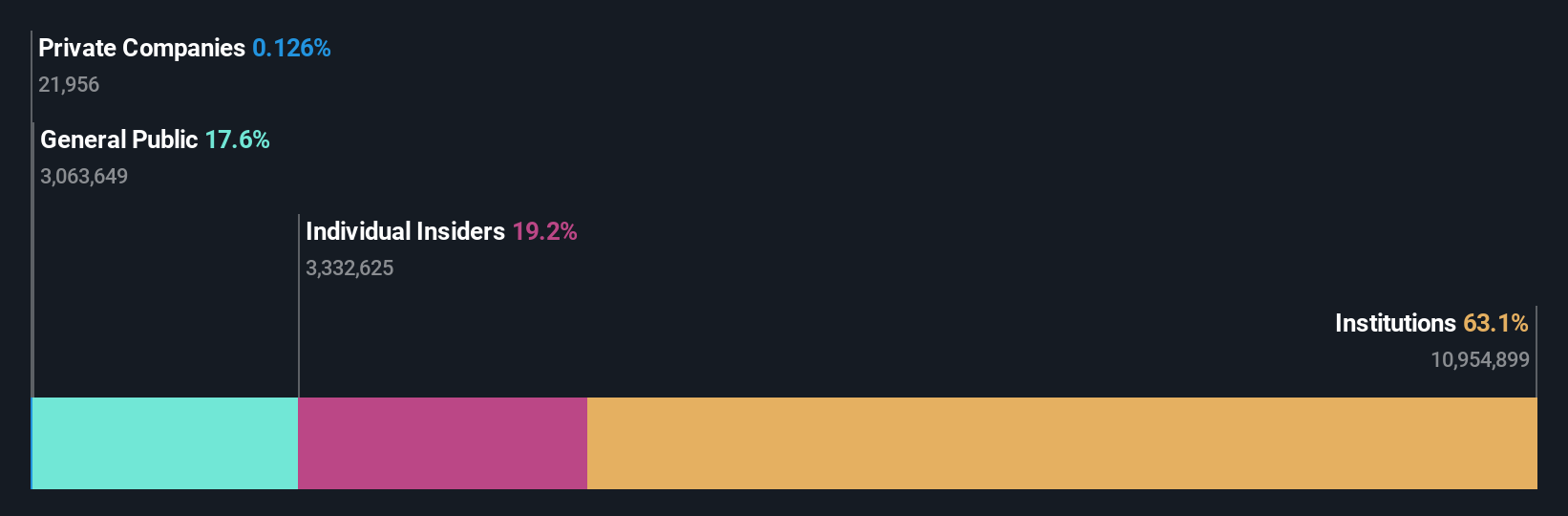

Insider Ownership: 18.6%

Bowman Consulting Group is actively pursuing acquisitions to drive growth, leveraging a mix of cash, debt, and equity. Recent earnings guidance projects net service billing between US$375 million and US$385 million for 2024. Despite reporting a net loss of US$2.08 million in Q2 2024, revenue increased to US$104.5 million from the previous year’s US$82.76 million. Analysts expect the company to become profitable within three years, with revenue growing faster than the broader U.S. market at 13% annually.

- Click to explore a detailed breakdown of our findings in Bowman Consulting Group's earnings growth report.

- Our expertly prepared valuation report Bowman Consulting Group implies its share price may be lower than expected.

GigaCloud Technology (NasdaqGM:GCT)

Simply Wall St Growth Rating: ★★★★★★

Overview: GigaCloud Technology Inc. offers comprehensive B2B ecommerce solutions for large parcel merchandise both in the United States and internationally, with a market cap of $926.50 million (NasdaqGM:GCT).

Operations: GigaCloud Technology Inc. generates revenue primarily from online retailers, amounting to $984.85 million.

Insider Ownership: 25.7%

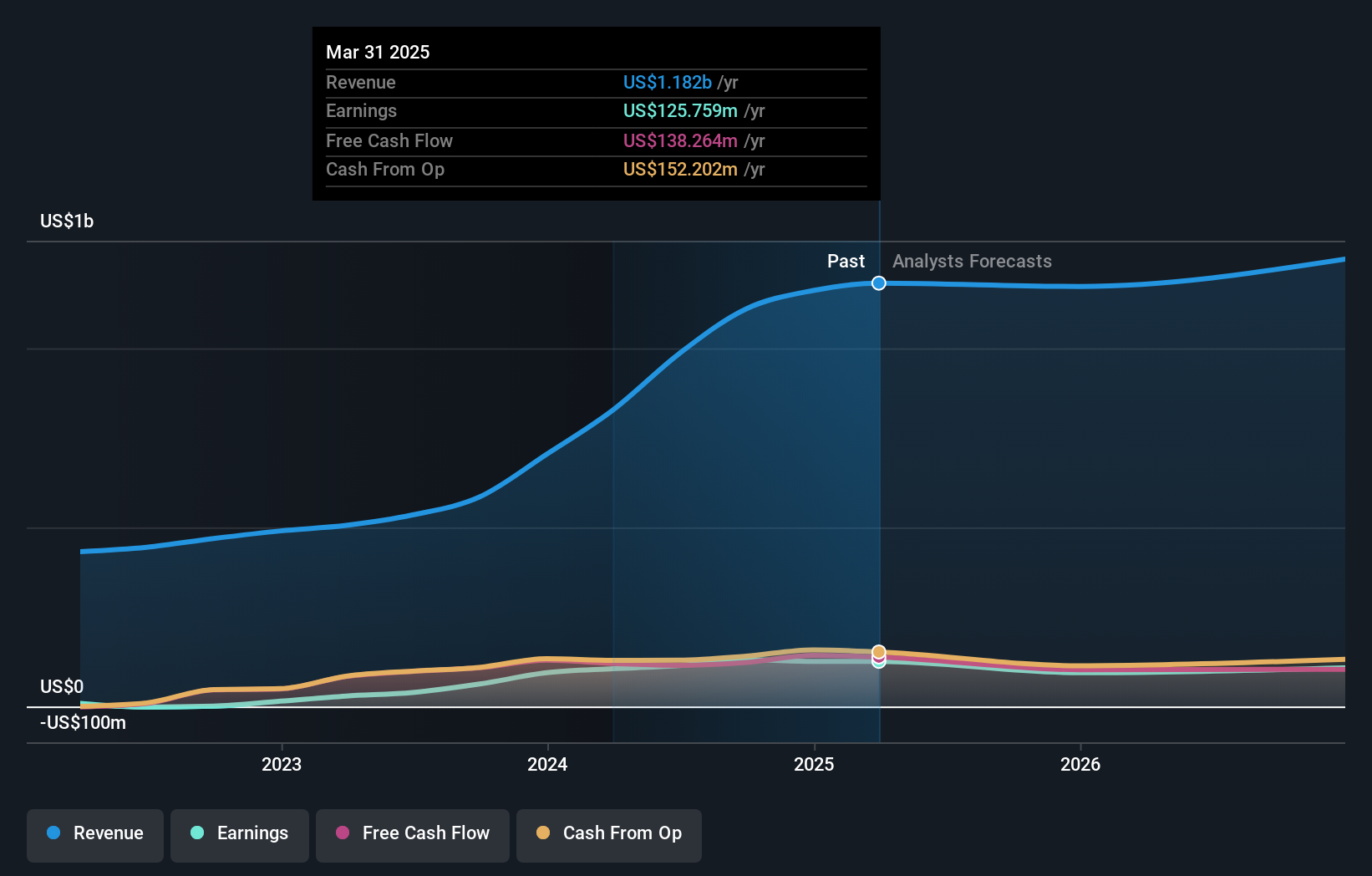

GigaCloud Technology's revenue surged to US$310.87 million in Q2 2024, nearly doubling from the previous year. Net income also increased significantly. The company forecasts continued strong revenue growth and expects earnings to grow faster than the U.S. market over the next three years. Despite recent executive changes, including a new interim CFO, GigaCloud remains focused on its growth strategy and has been added to multiple Russell indices, enhancing its visibility among investors.

- Get an in-depth perspective on GigaCloud Technology's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, GigaCloud Technology's share price might be too pessimistic.

Alkami Technology (NasdaqGS:ALKT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States and has a market cap of approximately $3.10 billion (NasdaqGS:ALKT).

Operations: Alkami Technology generates $297.36 million in revenue from its Internet Software & Services segment.

Insider Ownership: 11.3%

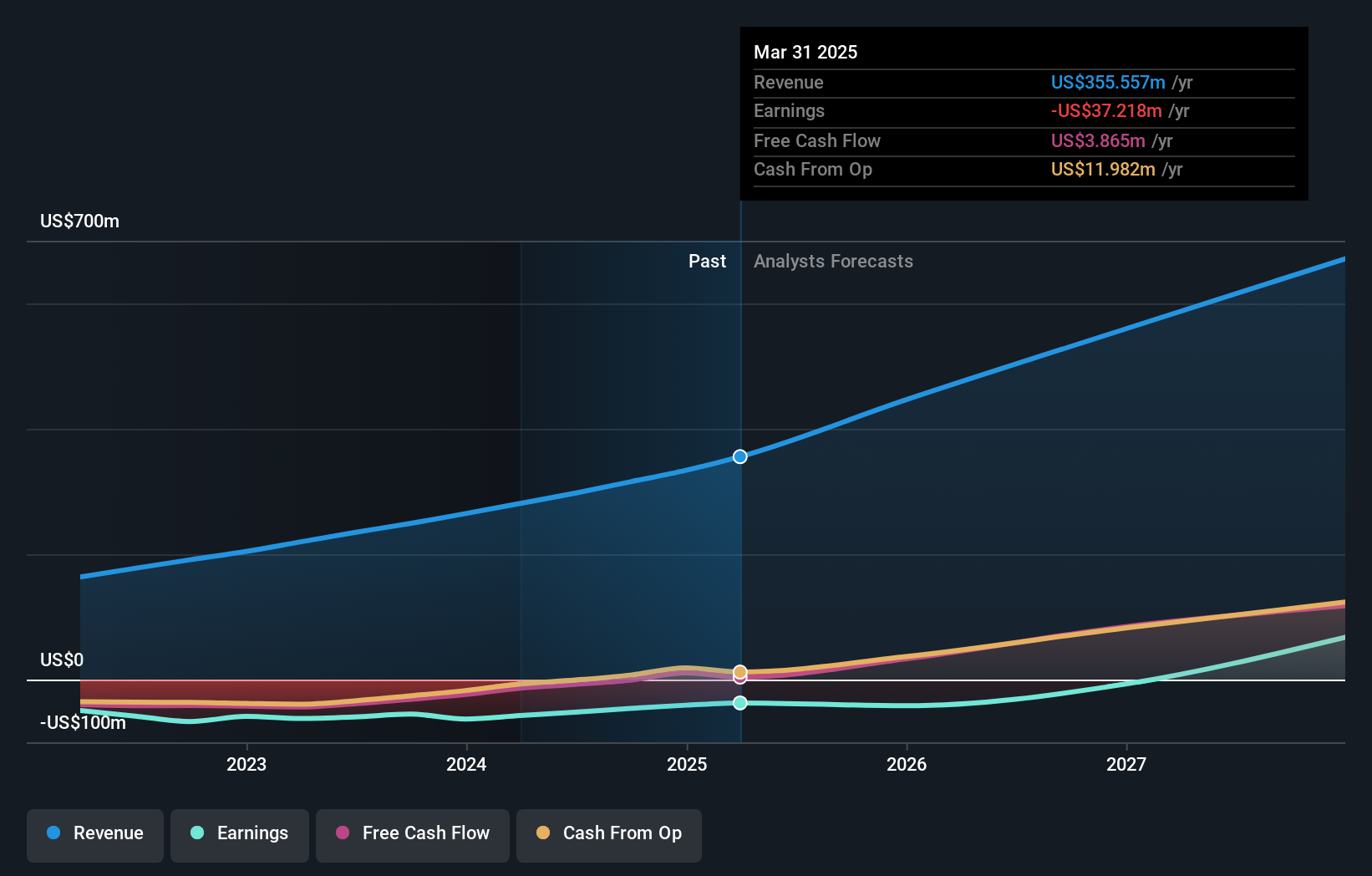

Alkami Technology's Q2 2024 revenue rose to US$82.16 million, up from US$65.76 million year-over-year, with a reduced net loss of US$12.32 million. The company expects annual revenue between US$330.5 and $333.5 million for 2024 and aims for profitability within three years, outpacing market growth rates. Recent initiatives include enhanced fraud protection features in its digital banking platform and a follow-on equity offering of 5 million shares, reflecting ongoing innovation and strategic financing efforts.

- Take a closer look at Alkami Technology's potential here in our earnings growth report.

- Our valuation report unveils the possibility Alkami Technology's shares may be trading at a premium.

Taking Advantage

- Investigate our full lineup of 177 Fast Growing US Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Offers cloud-based digital banking solutions in the United States.

High growth potential with excellent balance sheet.