- United States

- /

- Retail Distributors

- /

- NasdaqGM:GCT

GigaCloud Technology (NasdaqGM:GCT) Reports Increased Revenue US$295M Q4 2024 And New CFO Appointment

Reviewed by Simply Wall St

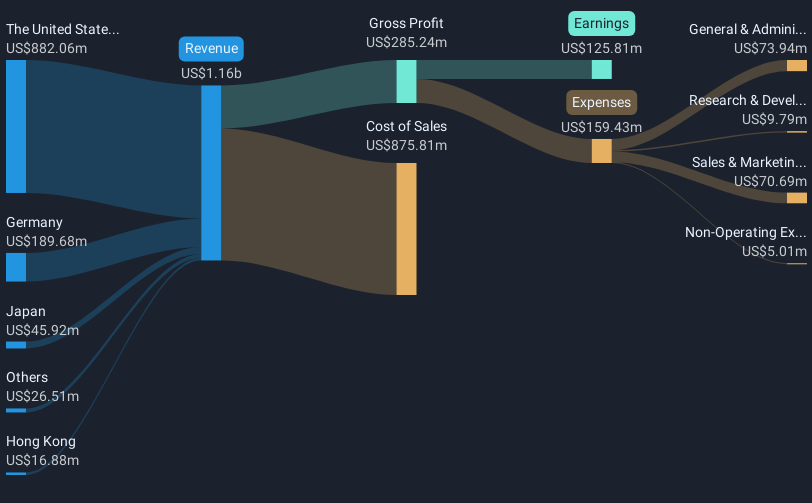

GigaCloud Technology (NasdaqGM:GCT) recently experienced a significant 11% decrease in its share price over the last week. This decline coincided with its fourth-quarter 2024 earnings release, which highlighted that while the company's revenue rose to USD 296 million, net income decreased compared to the previous year. The company's new guidance for Q1 2025, indicating expected revenues between USD 250 million and USD 265 million, might not have entirely mitigated investor concerns about future profitability pressures. Compounding these issues were broader market challenges, with the Dow Jones and S&P 500 both experiencing a 1.8% decline due to macroeconomic concerns like U.S. trade tariffs and inflation fears. Despite an overall 2.5% market drop during the week, the company's more pronounced share price fall could reflect investors' reactions particularly sensitive to its financial results and new CFO appointment amidst uncertain external economic conditions.

Navigate through the intricacies of GigaCloud Technology with our comprehensive report here.

Over the last year, GigaCloud Technology faced a challenging market environment, resulting in a total return of 60.43%, underperforming the US Retail Distributors industry, which had a 17.2% decline. The company's addition to the S&P TMI and S&P Global BMI indices in late September 2024 aimed to provide broader market recognition but didn't translate into positive price momentum. Noteworthy events include a share buyback, where GigaCloud repurchased 468,559 shares for US$11.4 million between September and November 2024, likely intending to support the stock price amidst market volatility.

The appointment of Ms. Xiaoyang Wei as CFO in February 2025 and the expansion of their global fulfillment network demonstrated efforts to stabilize and grow the business infrastructure. Additionally, new strategic partnerships announced in February 2025 helped reinforce GigaCloud's presence in the B2B sector as it onboarded suppliers like Purple Innovation Inc., enhancing its product offering. These moves reflect a focus on long-term growth potential despite short-term returns.

- See how GigaCloud Technology measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting GigaCloud Technology's growth trajectory—explore our risk evaluation report.

- Are you invested in GigaCloud Technology already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GCT

GigaCloud Technology

Provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally.

Flawless balance sheet and undervalued.