- United States

- /

- Retail Distributors

- /

- NasdaqGM:GCT

A Look at GigaCloud Technology’s Valuation After UBS Global Technology and AI Conference Appearance (GCT)

Reviewed by Simply Wall St

UBS conference puts GigaCloud in the spotlight

GigaCloud Technology (GCT) is stepping onto a bigger stage as CEO Larry Wu and CFO Erica Wei present at the UBS Global Technology and AI Conference, drawing fresh attention to the stock’s long term story and valuation.

See our latest analysis for GigaCloud Technology.

The UBS appearance comes after a powerful run, with GigaCloud’s share price delivering a roughly 39 percent 1-month return and more than doubling year to date. This signals building momentum rather than a one-off spike.

If GigaCloud’s surge has your attention, it could be a good moment to scout other high growth tech and AI names using our high growth tech and AI stocks.

Yet with shares now above the latest analyst target but still trading at a hefty intrinsic discount, investors face a key question: Is GigaCloud genuinely undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 7.9% Overvalued

With GigaCloud’s most followed narrative placing fair value below the recent 38.84 dollar close, investors face a subtle gap between model and market expectations.

Scale driven network expansion, evidenced by the opening of new fulfillment centers and growth in active sellers and buyers, is expected to create operational efficiencies, reduce per unit costs, and bolster future profitability and earnings as GigaCloud's fixed costs get leveraged across higher GMV.

Want to see how modest growth, shifting margins and a re rated earnings multiple still add up to a richer valuation than today’s price suggests? The full narrative unpacks the exact revenue path, profit squeeze, and future PE that need to line up almost perfectly for that fair value to hold.

Result: Fair Value of $36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the thesis could unravel if European growth stalls or if fresh tariff shocks squeeze margins faster than GigaCloud can offset with efficiency gains.

Find out about the key risks to this GigaCloud Technology narrative.

Another Take on Value: Market Ratios Tell a Different Story

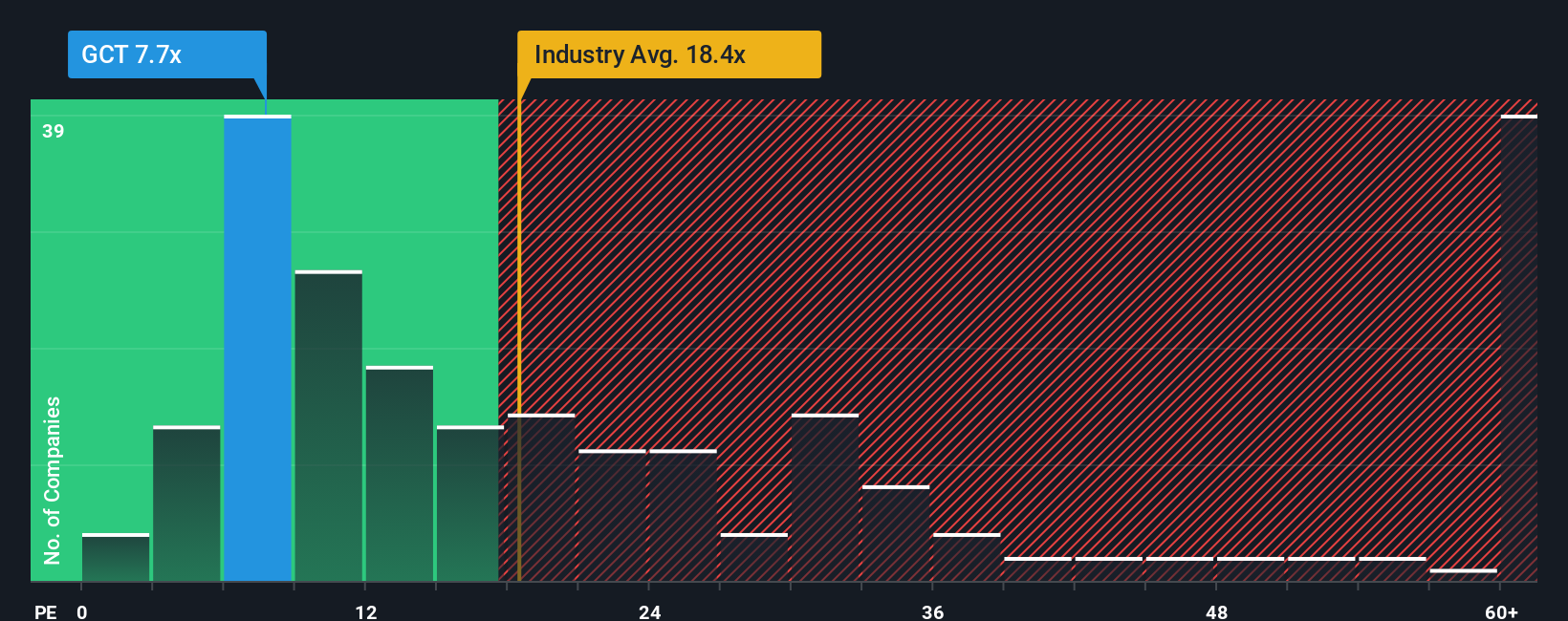

While the narrative model flags GigaCloud as 7.9 percent overvalued, its 11.1 times earnings multiple looks cheap against a 15.3 times fair ratio and a 17.7 times industry average, as well as even richer 34.7 times peers. Is the market underestimating how durable its profits really are?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GigaCloud Technology Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your GigaCloud Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing angles?

Before you log off, you can scan for fresh opportunities in minutes with the Simply Wall Street Screener instead of waiting for the next headline.

- Capture potential bargains early by targeting companies trading below their cash flow value using these 933 undervalued stocks based on cash flows before the crowd catches on.

- Explore the machine learning, automation, and data infrastructure theme by reviewing these 24 AI penny stocks that may benefit from these trends.

- Seek a steadier income stream by focusing on businesses in these 14 dividend stocks with yields > 3% that currently yield more than 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GCT

GigaCloud Technology

Provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026