- United States

- /

- Specialty Stores

- /

- NasdaqGM:FRG

If EPS Growth Is Important To You, Franchise Group (NASDAQ:FRG) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Franchise Group (NASDAQ:FRG), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Franchise Group

How Fast Is Franchise Group Growing Its Earnings Per Share?

Franchise Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Franchise Group's EPS catapulted from US$1.02 to US$1.97, over the last year. It's not often a company can achieve year-on-year growth of 94%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

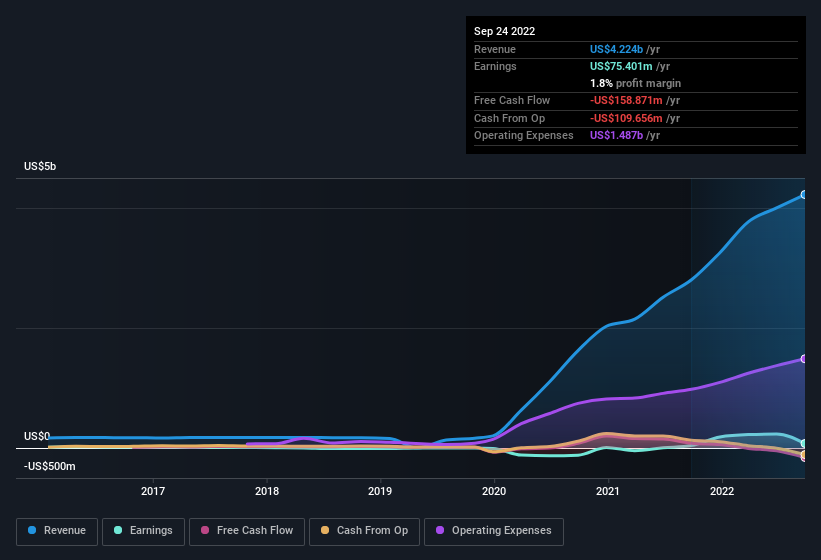

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Franchise Group maintained stable EBIT margins over the last year, all while growing revenue 51% to US$4.2b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Franchise Group's forecast profits?

Are Franchise Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The real kicker here is that Franchise Group insiders spent a staggering US$4.0m on acquiring shares in just one year, without single share being sold in the meantime. Knowing this, Franchise Group will have have all eyes on them in anticipation for the what could happen in the near future. Zooming in, we can see that the biggest insider purchase was by President Brian Kahn for US$3.8m worth of shares, at about US$37.50 per share.

Along with the insider buying, another encouraging sign for Franchise Group is that insiders, as a group, have a considerable shareholding. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$311m. That equates to 33% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add Franchise Group To Your Watchlist?

Franchise Group's earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Franchise Group deserves timely attention. You should always think about risks though. Case in point, we've spotted 3 warning signs for Franchise Group you should be aware of, and 2 of them are concerning.

The good news is that Franchise Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FRG

Franchise Group

Franchise Group, Inc. owns and operates franchised and franchisable businesses.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives