- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Will Five Below’s (FIVE) Pacific Northwest Launch Reveal the Limits of Its Expansion Strategy?

Reviewed by Sasha Jovanovic

- Five Below, Inc. recently launched its first stores in the Pacific Northwest, opening eight new locations across Washington and Oregon in November as it extends its value-focused retail experience into new markets.

- This expansion introduces Five Below’s budget-friendly assortment to an untapped regional audience just ahead of the busy holiday shopping season.

- We'll examine how Five Below’s move into the Pacific Northwest shapes its growth trajectory and long-term expansion narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Five Below Investment Narrative Recap

To own Five Below, you need to believe that its unique value proposition and aggressive nationwide expansion will continue drawing budget-focused shoppers, especially amid persistent economic pressures. The recent Pacific Northwest launch brings the Five Below experience to fresh markets just before the holidays, but as a single regional rollout, it’s unlikely to meaningfully move the needle against the company’s biggest short-term catalyst: broad-based transaction growth from expanding customer reach. The core risk remains whether new store productivity can offset mounting cost pressures, especially as expansion accelerates and labor/tariff headwinds persist.

Among the latest announcements, the appointment of experienced retail executives Daniel Sullivan (CFO) and Michelle Israel (Chief Merchandising Officer) is especially relevant. Their expertise will be front and center as Five Below balances rapid new store growth with the need to manage margin pressures and safeguard profitability, both crucial factors for sustaining momentum through new market entries like the Pacific Northwest.

However, investors should also be mindful that even as new stores open quickly, the risk of declining productivity and market saturation could prove a significant challenge if...

Read the full narrative on Five Below (it's free!)

Five Below's narrative projects $5.7 billion in revenue and $352.1 million in earnings by 2028. This requires 10.6% yearly revenue growth and a $79 million earnings increase from current earnings of $273.1 million.

Uncover how Five Below's forecasts yield a $160.10 fair value, a 4% upside to its current price.

Exploring Other Perspectives

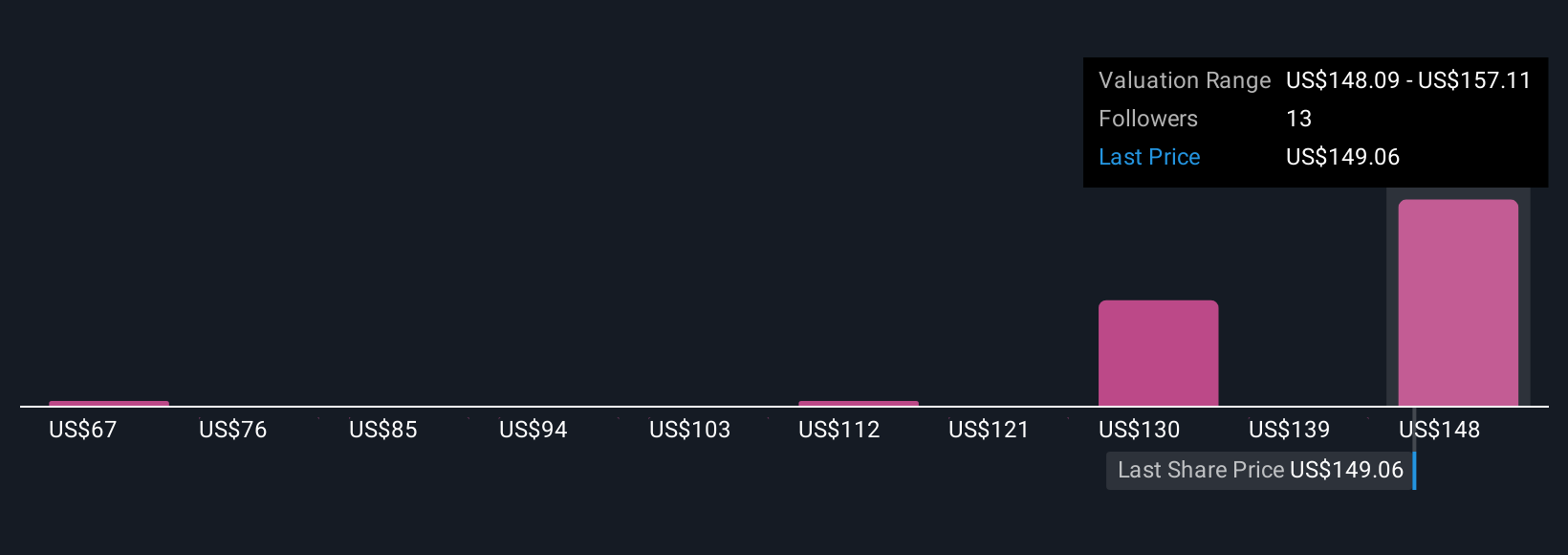

The Simply Wall St Community’s fair value estimates for Five Below range from as low as US$67 to US$160 across four different valuations. While you weigh these divergent opinions, remember the key issue of whether rapid expansion may begin to erode new store productivity and impact future returns.

Explore 4 other fair value estimates on Five Below - why the stock might be worth as much as $160.10!

Build Your Own Five Below Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Five Below research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Five Below research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Five Below's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives