- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Does Five Below’s 70% Stock Surge in 2024 Still Have Room to Run?

Reviewed by Bailey Pemberton

Thinking about what to do with Five Below stock? You are not alone. Investors have watched this discount retailer’s share price climb an eye-catching 57.5% year-to-date and a remarkable 70% in the past year. Even though the last week and month have seen relatively muted returns of 0.5% and 1.7%, that kind of long-term performance is hard to ignore, and it is likely fueling some optimism around the company’s growth story.

The big question, of course, is whether that growth is set to continue or if the market’s enthusiasm has pushed Five Below’s valuation a bit too far. Recent market conditions have been supportive of specialty retail stocks, with consumer spending holding up and some investors revisiting the sector in search of resilient growth. Still, with Five Below’s value score coming in at just 1 out of 6 on our simple undervaluation checklist, there are signs that the stock is only undervalued in one key area. Caution might be warranted.

So, does that mean it is time to cash in or double down? To really answer that, we will break down the different ways analysts assess valuation, what those scores mean, and, at the end, introduce an even smarter way to think about whether Five Below is truly a buy.

Five Below scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Five Below Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the present value of a company by projecting its future cash flows and discounting them back to today's value. This approach provides insight into what the business is worth based on its ability to generate cash in the years ahead.

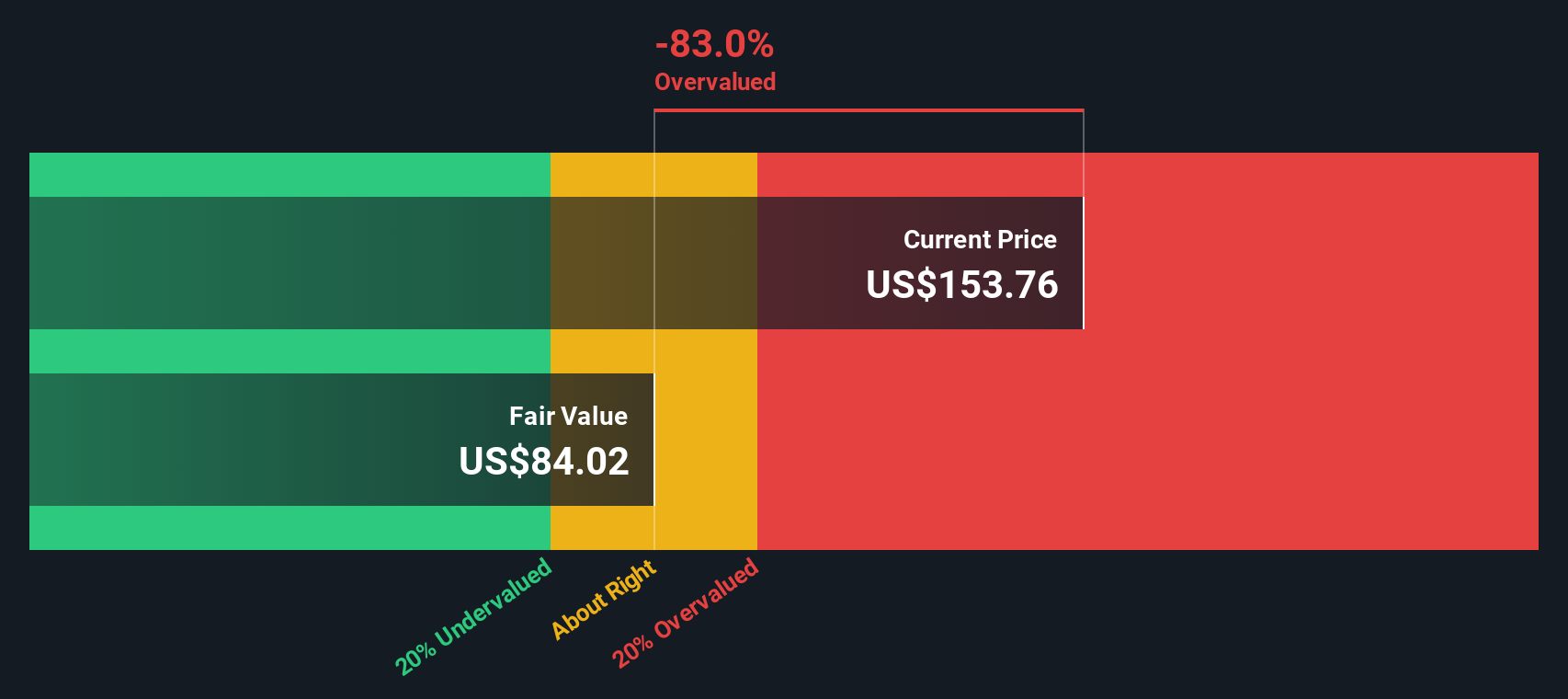

For Five Below, the latest reported Free Cash Flow sits at $224.7 million. Analysts forecast those cash flows to rise year after year, with projections reaching $301.7 million by 2026 and $309 million by 2029. Further out, estimates are extrapolated and suggest continued but moderate growth. All these forecasts are expressed in US dollars and assume a steady, sustainable business trajectory.

Taking all future cash flows into account, and discounting appropriately for time and risk, the DCF model estimates an intrinsic value of $84.39 per share. Right now, Five Below’s share price is sitting significantly above that intrinsic value, implying the stock is roughly 84.9% overvalued by this analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Five Below may be overvalued by 84.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Five Below Price vs Earnings (PE)

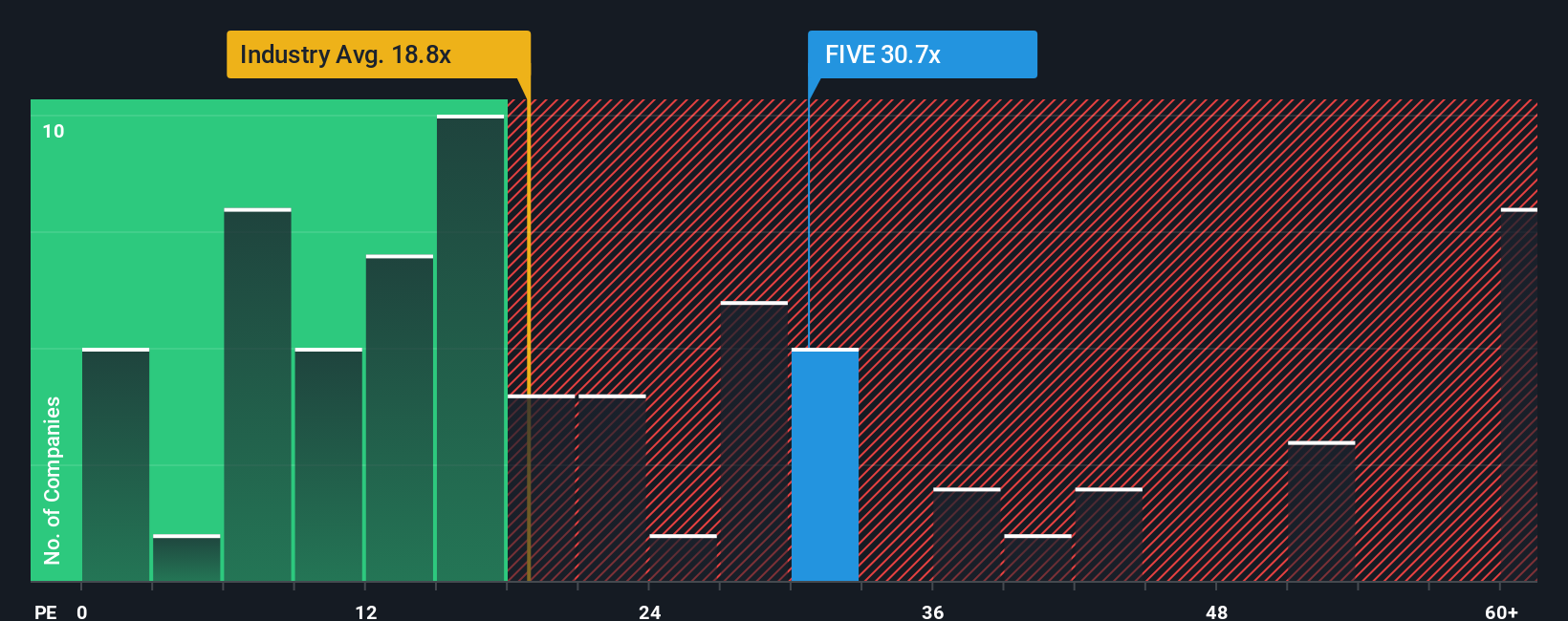

The Price-to-Earnings (PE) ratio is one of the most common and useful ways to value profitable companies like Five Below. It quickly tells investors how much they are paying for each dollar of the company’s earnings, making it well-suited for established businesses generating consistent profits.

A company’s “normal” or fair PE ratio is shaped by expectations for growth and risk. Higher expected earnings growth or lower risk typically justifies a higher PE, while slower growth or higher risk suggests a lower ratio is appropriate. For Five Below, the current PE ratio sits at 31.5x, which is notably ahead of the Specialty Retail industry average of around 17.3x and only slightly below the average for listed direct peers at 36.7x. This premium reflects that the market has high expectations for Five Below’s future performance compared to many industry peers.

Simply Wall St’s proprietary Fair Ratio, calculated for Five Below at 19.6x, estimates what the PE should be after considering the company’s unique outlook, growth forecasts, profit margins, size, and sector-specific risks. This tailored approach is more insightful than just looking at averages because it puts the company’s actual prospects and risks in context, giving you a more personalized benchmark than a one-size-fits-all industry figure.

When comparing the Fair Ratio of 19.6x to Five Below’s current PE of 31.5x, the stock appears to be trading at a substantially higher multiple than justified by its fundamentals, making it look overvalued by this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Five Below Narrative

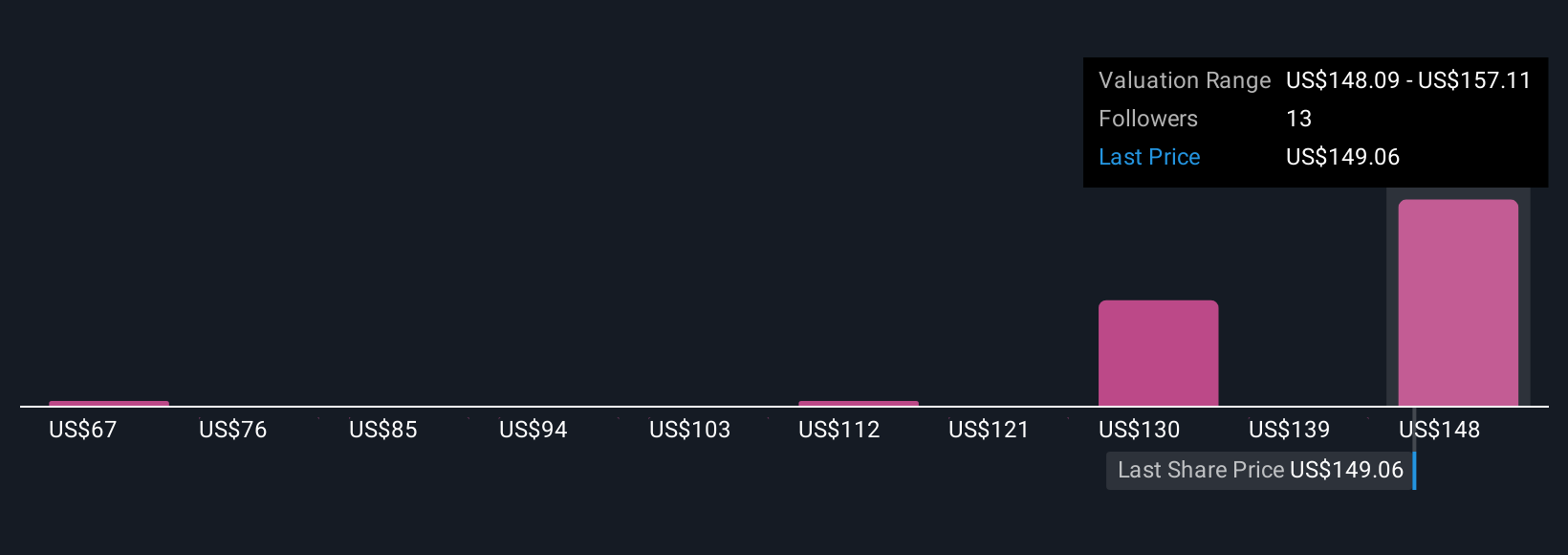

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply the story behind your numbers; it is your personal investment perspective, where you spell out what you believe about Five Below’s future revenue, earnings, and margins, and how those beliefs translate into a fair value estimate for the stock.

Unlike traditional models, Narratives help you clearly connect your thesis about the company's growth or risks with a financial forecast, and then directly to what you think its shares are truly worth. On Simply Wall St’s Community page, creating and tracking Narratives is straightforward, accessible for all investors, and already used by millions.

With Narratives, you can see at a glance how your Fair Value compares to the actual share price, making “buy,” “hold,” or “sell” decisions more evidence-based and aligned with your view. As new earnings or news updates are released, Narratives will automatically reflect the latest information, keeping your investment reasoning up to date.

For example, while some investors see strong Gen Z demand and rising store counts to forecast a Fair Value as high as $185 per share, others who focus on risks like rising costs and margin pressure set Fair Values closer to $90. Your Narrative makes your conviction clear, and keeps it current as facts change.

Do you think there's more to the story for Five Below? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives