- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

A Look at Five Below’s (FIVE) Valuation Following Pacific Northwest Expansion Announcement

Reviewed by Simply Wall St

Five Below (FIVE) is making its entrance into the Pacific Northwest with eight store openings across Washington and Oregon next month. This strategic move brings the discount retailer to a new region just as holiday shopping ramps up.

See our latest analysis for Five Below.

With momentum building from its Pacific Northwest expansion and a fresh lineup of affordable products for the holidays, Five Below has notched a 52.9% share price gain so far in 2025. The company’s twelve-month total shareholder return stands at an impressive 71.3%, highlighting how enthusiasm around store growth and new market entries has fueled broader optimism about the brand's outlook.

If you’re curious what other retailers are capturing growth in surprising places, now’s a great moment to discover fast growing stocks with high insider ownership.

But with shares near all-time highs after a major run-up, investors must ask whether Five Below is now undervalued or if the stock's impressive gains are already reflecting all of its future store growth. Is there still a compelling buying opportunity, or has the market already priced in all that expansion?

Most Popular Narrative: 5.4% Undervalued

Five Below's most widely followed narrative places its fair value at $160 per share, modestly above the last close of $151.50. This perspective suggests the market may not be fully pricing in the company's future expansion and transformation.

Five Below's commitment to providing extreme value and trend-right products at low price points is driving broad-based transaction growth, especially as consumers across demographics become increasingly value-focused due to persistent economic pressures. This is expanding the store traffic and addressable market, supporting higher revenue and potential sustained comp sales growth.

Curious what’s fueling that optimism? Behind that headline price target are bold assumptions about relentless revenue expansion and a retail model designed to capture tomorrow’s consumers. The story hinges on future momentum you cannot see in the reported numbers. Do not miss the details that could surprise even experienced retail investors.

Result: Fair Value of $160 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and the risk of store saturation could quickly test the optimism around Five Below’s long-term margin and growth story.

Find out about the key risks to this Five Below narrative.

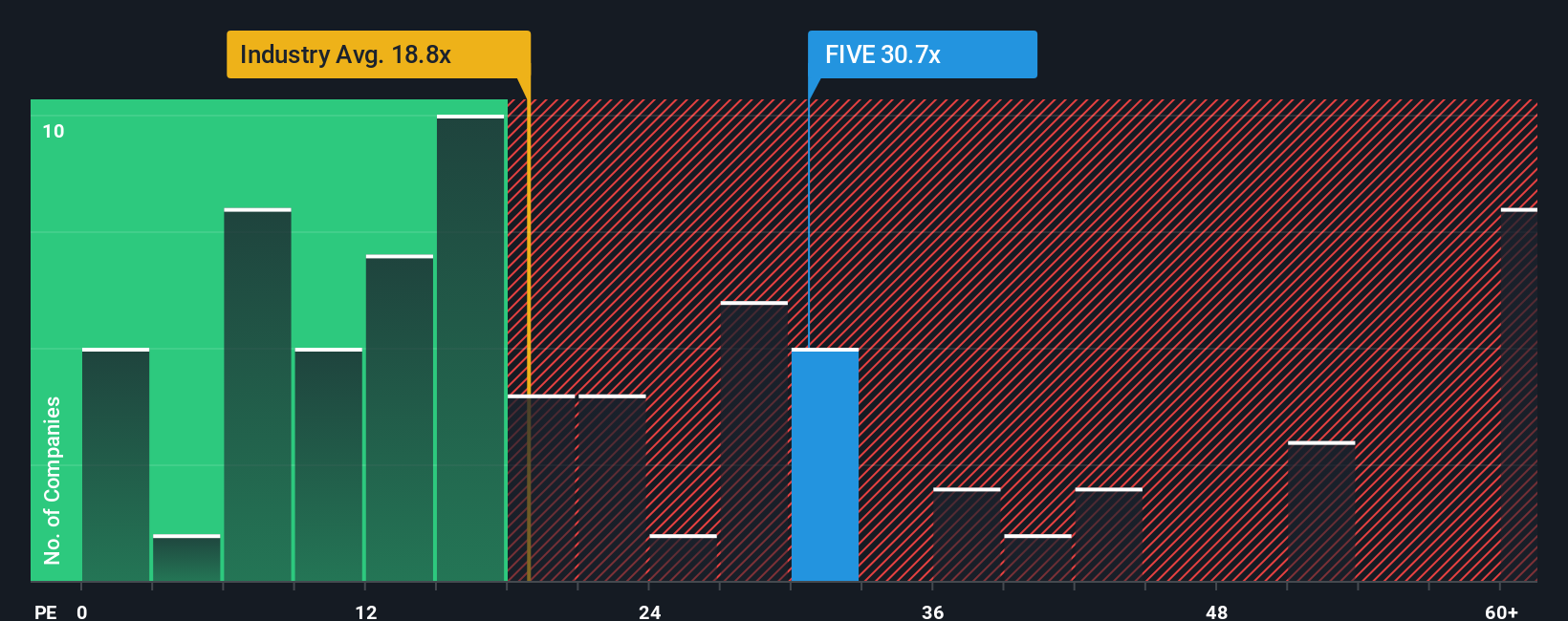

Another View: Multiples Tell a Different Story

While some see the shares as modestly undervalued, our look at the company's price-to-earnings ratio offers a caution. Five Below trades at 30.6 times earnings, far above the US Specialty Retail industry average of 16.8 times and well over its own fair ratio of 19.7 times. This sharp premium suggests the market is already banking on future growth, which raises the question: is there really value left for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five Below Narrative

If you’re keen to challenge these perspectives or want to dig into the numbers yourself, you can build a personalized view in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Five Below.

Looking for more investment ideas?

Smart investors do not settle for the obvious. Broaden your portfolio and find your next opportunity using these pre-screened lists tailored to explosive trends, stable growth, and market innovation.

- Supercharge your search for yield by reviewing these 17 dividend stocks with yields > 3% offering steady income potential above 3% annual returns.

- Get ahead of the curve by targeting these 26 AI penny stocks capturing the surge in artificial intelligence and shaping tomorrow’s tech landscape.

- Seize the chance to uncover these 878 undervalued stocks based on cash flows positioned to outperform, all identified by robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives