- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

A Fresh Look at Five Below (FIVE) Valuation Following Key Executive Appointments and Leadership Team Expansion

Reviewed by Kshitija Bhandaru

Five Below (FIVE) caught the market’s eye this week following the announcement that Daniel Sullivan will become Chief Financial Officer and Michelle Israel will step in as Chief Merchandising Officer. Both will start on October 6, 2025.

See our latest analysis for Five Below.

Momentum has been building for Five Below, with recent leadership changes arriving alongside standout operational news such as strong second-quarter comps and the opening of new stores. The stock recently touched a 52-week high of $156.51, and while its 1-year total shareholder return of 65.5% leads the sector, long-term shareholders have also enjoyed solid multiyear gains as the business continues to prioritize growth and innovation.

If these strategic moves have you wondering where else opportunity might be building, now’s a perfect time to expand your scope and discover fast growing stocks with high insider ownership

But with shares now trading near all-time highs, the big question is whether Five Below’s current valuation reflects all that future promise or if there is still room for investors to buy in before another leg up.

Most Popular Narrative: 2% Undervalued

Five Below's most-followed narrative points to a fair value of $159.48, which is just above the last close of $156.05. The narrative sees the stock with slight upside, but all eyes are on whether recent growth and leadership changes justify the current premium.

Five Below's commitment to providing extreme value and trend-right products at low price points is driving broad-based transaction growth, especially as consumers across demographics become increasingly value-focused due to persistent economic pressures. This is expanding the store traffic and addressable market, supporting higher revenue and potential sustained comp sales growth.

Want to know what ambitious growth milestones underpin that price target? The calculus behind this valuation hinges on stellar future gains and a profit multiple rarely linked to traditional retailers. Discover which bold forecasted metrics set the stage for Five Below's potential next leg up, and read the full breakdown to see the narrative's strategic logic in detail.

Result: Fair Value of $159.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, external factors such as persistent tariff pressures or aggressive expansion could still challenge Five Below's impressive momentum in the quarters ahead.

Find out about the key risks to this Five Below narrative.

Another View: Comparing Ratios Raises a Red Flag

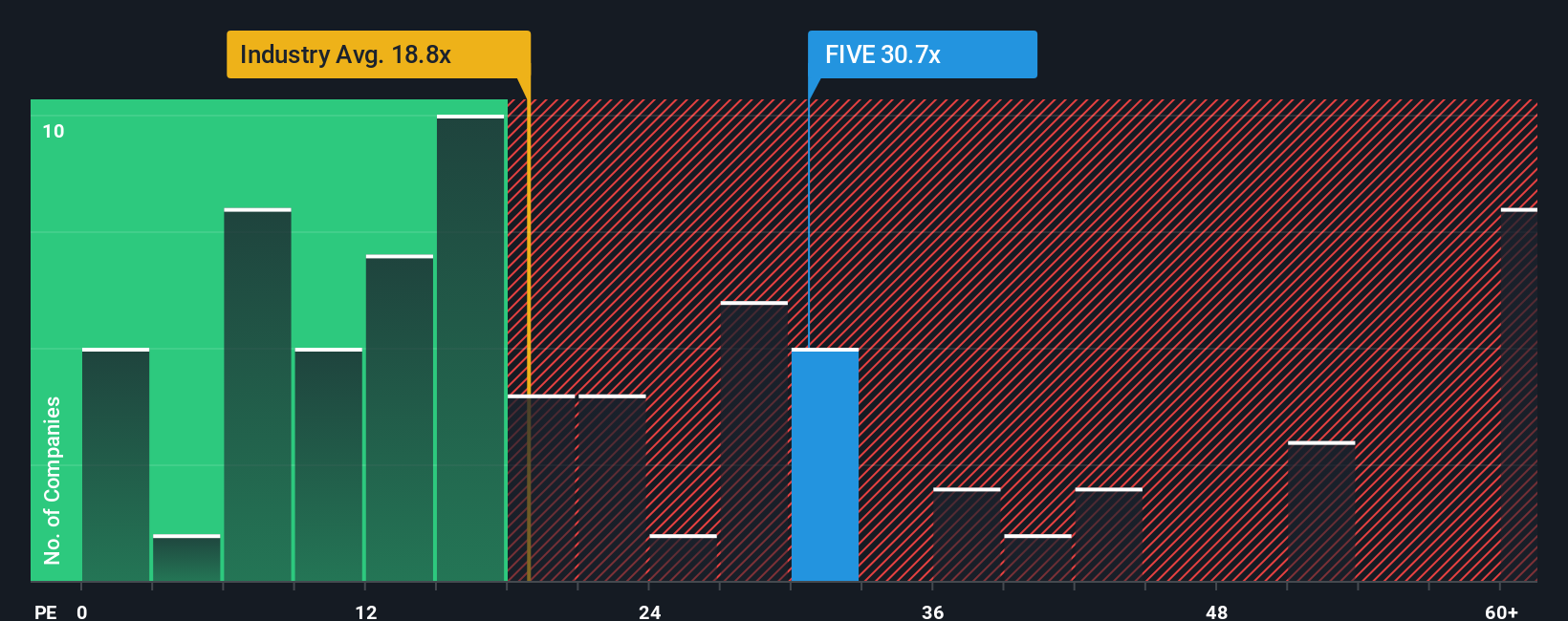

Looking at Five Below's valuation through its price-to-earnings ratio, there is a different story. The company trades at 31.5 times earnings, which is much higher than the US Specialty Retail industry average of 17.2 and also above its fair ratio of 19.6. This sizable gap suggests the share price already bakes in a lot of optimism and leaves less room for disappointment. Are investors giving Five Below too much credit, or is there more upside yet to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five Below Narrative

If the current narrative does not match your view or you want a hands-on look at the figures, you can build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Five Below.

Looking for More Investment Ideas?

Don’t let your search for smart opportunities stop here. Expand your watchlist and catch trends before the crowd using these carefully selected investment ideas:

- Capitalize on resilient income streams as you review these 19 dividend stocks with yields > 3% yielding above 3% and boosting portfolio stability.

- Seize the AI transformation by tapping into rapid growth with these 24 AI penny stocks powering the future of automation, analytics, and innovation.

- Take advantage of deep value opportunities and scan these 896 undervalued stocks based on cash flows to spot stocks currently trading beneath their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives