- United States

- /

- Specialty Stores

- /

- NasdaqGS:EYE

National Vision Holdings, Inc. (NASDAQ:EYE) Investors Are Less Pessimistic Than Expected

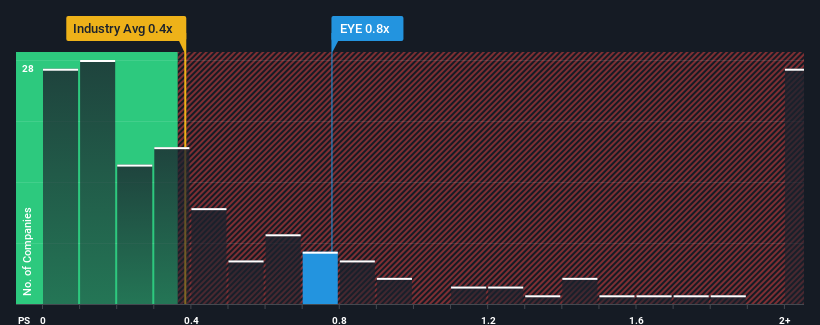

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Specialty Retail industry in the United States, you could be forgiven for feeling indifferent about National Vision Holdings, Inc.'s (NASDAQ:EYE) P/S ratio of 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for National Vision Holdings

What Does National Vision Holdings' Recent Performance Look Like?

Recent revenue growth for National Vision Holdings has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on National Vision Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like National Vision Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 3.7% gain to the company's revenues. Revenue has also lifted 29% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue growth is heading into negative territory, declining 3.9% over the next year. Meanwhile, the broader industry is forecast to expand by 5.4%, which paints a poor picture.

In light of this, it's somewhat alarming that National Vision Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From National Vision Holdings' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of National Vision Holdings' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for National Vision Holdings with six simple checks.

If you're unsure about the strength of National Vision Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade National Vision Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if National Vision Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EYE

National Vision Holdings

Through its subsidiaries, operates as an optical retailer in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives