- United States

- /

- Specialty Stores

- /

- NasdaqGS:EYE

Here's Why I Think National Vision Holdings (NASDAQ:EYE) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like National Vision Holdings (NASDAQ:EYE). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for National Vision Holdings

How Fast Is National Vision Holdings Growing Its Earnings Per Share?

Over the last three years, National Vision Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, National Vision Holdings's EPS soared from US$0.86 to US$1.41, in just one year. That's a impressive gain of 64%.

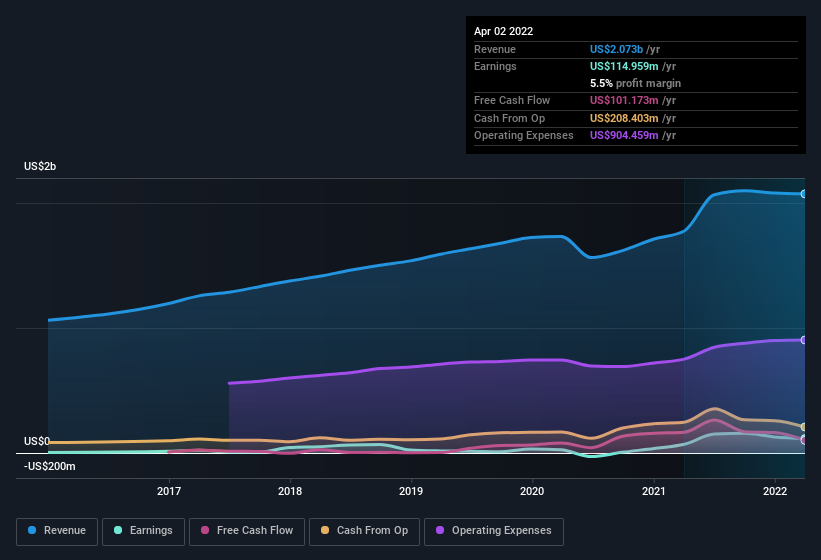

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. National Vision Holdings maintained stable EBIT margins over the last year, all while growing revenue 17% to US$2.1b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of National Vision Holdings's forecast profits?

Are National Vision Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent US$3.0m buying National Vision Holdings shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Independent Chairman David Peeler who made the biggest single purchase, worth US$2.0m, paying US$24.69 per share.

Along with the insider buying, another encouraging sign for National Vision Holdings is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$33m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 1.5% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does National Vision Holdings Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about National Vision Holdings's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. It is worth noting though that we have found 1 warning sign for National Vision Holdings that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of National Vision Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Vision Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EYE

National Vision Holdings

Through its subsidiaries, operates as an optical retailer in the United States.

Moderate growth potential with mediocre balance sheet.