- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:ETSY

Why Etsy (ETSY) Is Up 14.1% After New ChatGPT Partnership Unlocks Instant AI-Powered Checkout

Reviewed by Sasha Jovanovic

- OpenAI recently announced a partnership with Etsy, allowing U.S. users to purchase products directly from Etsy sellers via ChatGPT’s new Instant Checkout feature.

- This integration marks a significant expansion of agentic commerce, enabling AI-powered shopping within chats and broadening Etsy’s exposure to more digitally engaged consumers.

- We’ll explore how direct purchasing through ChatGPT could influence Etsy’s investment narrative and longer-term marketplace growth prospects.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Etsy Investment Narrative Recap

To own Etsy, investors need to believe the company can reverse its slowing buyer growth and stabilize gross merchandise sales through product innovation and improved engagement. The recent OpenAI partnership, which enables direct purchasing via ChatGPT, has quickly become the most important short-term catalyst, as it could increase traffic and buyer activity; however, persistent declines in active buyers and GMS remain the biggest risks if adoption of these new channels disappoints or fails to boost loyalty.

Among the latest company announcements, Etsy’s decision to transfer its stock listing to the New York Stock Exchange stands out. This move has the potential to improve visibility among institutional and retail investors, though it does not have a direct impact on marketplace growth or the adoption of agentic commerce initiatives like the ChatGPT integration.

But while enthusiasm for new features runs high, investors should also be mindful of what happens if declining buyer activity continues in spite of these efforts...

Read the full narrative on Etsy (it's free!)

Etsy's outlook anticipates $3.2 billion in revenue and $377.3 million in earnings by 2028. This projection assumes a 3.5% annual revenue growth and an earnings increase of $213.3 million from current earnings of $164.0 million.

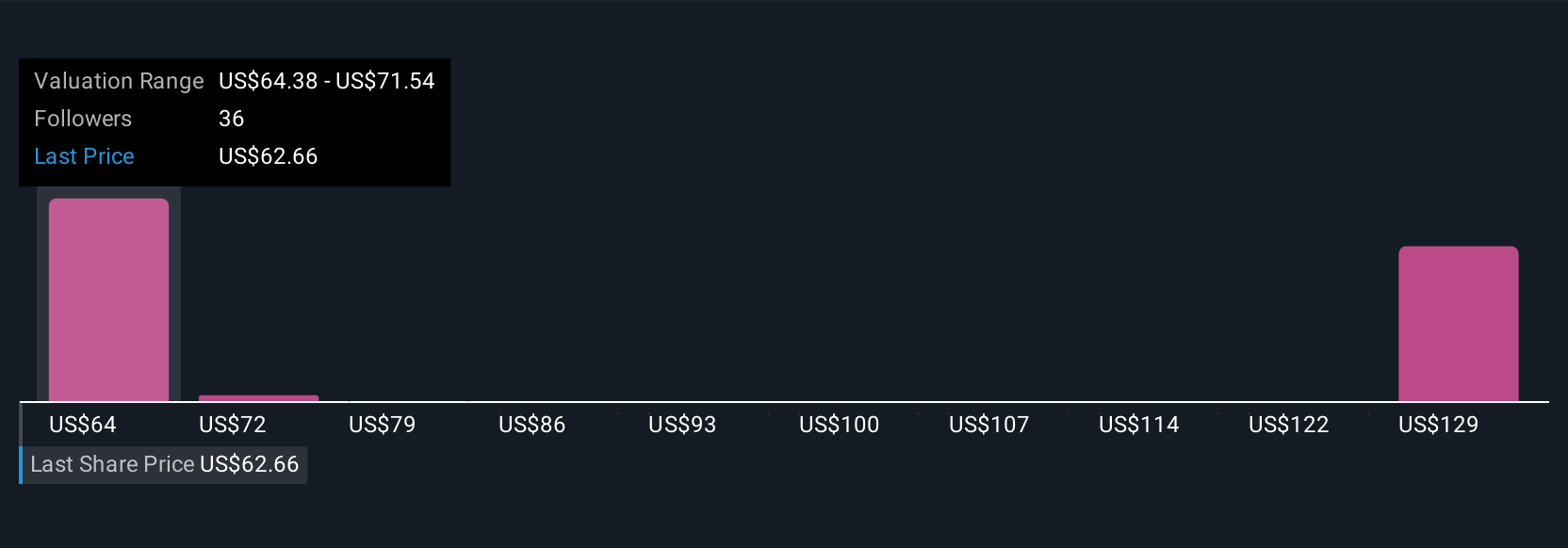

Uncover how Etsy's forecasts yield a $65.12 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Seven individual fair value estimates from the Simply Wall St Community range from US$65.12 to US$121.47 per share. These diverse opinions meet a backdrop in which the effectiveness of AI-driven commerce could significantly shape Etsy’s ability to recover buyer engagement and improve future growth; explore what other investors think and compare their reasoning.

Explore 7 other fair value estimates on Etsy - why the stock might be worth 10% less than the current price!

Build Your Own Etsy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Etsy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Etsy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Etsy's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 33 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives