- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:ETSY

Etsy's (NASDAQ:ETSY) Conflict With Sellers Will Bring More Short-Term Turbulence

While 60% declines in stock prices can be painful, they aren't unusual for growth companies like Etsy, Inc. ( NASDAQ: ETSY ) during the broad market declines.

However, when profit margins start declining as growth becomes expensive, businesses might look to ramp up the margins leaving unsatisfied parties.

Check out our latest analysis for Etsy

Fee Increase and a Backlash From Vendors

Etsy's revenues come from the marketplace and services, but mainly from fees on sales deduced from the seller's profit. In the past, this fee was 5%, but it is 6.5% as of yesterday. This is not the first time the platform increased the fee , as it went from 3,5% to 5% back in 2018.

Unsurprisingly, sellers are not happy with those developments, as they're pushing back with a strike. Over 60,000 stakeholders signed the petition addressed to CEO with the following demands:

- Cancel the fee increase

- Crackdown on resellers (improve quality over quantity)

- Improve sellers' customer service

- End the star seller program

- Let all sellers opt out of offsite ads

Meanwhile, Loop Capital Markets (LCM) cut the rating from Buy to Hold , quoting a deteriorating macroeconomic environment. LCM saw heightened customer acquisition costs and thus issued a second downward revision of gross merchandise sales growth. The price target has been slashed from US$245 to US$140 – about 15% above the current levels.

The Current State of Etsy's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio . In plain English, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period.The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is good because it shows that the company is bringing in more free cash flow than its profit would suggest.While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing because it indicates paper profits are not matched by cash flow.Notably, some academic evidence suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

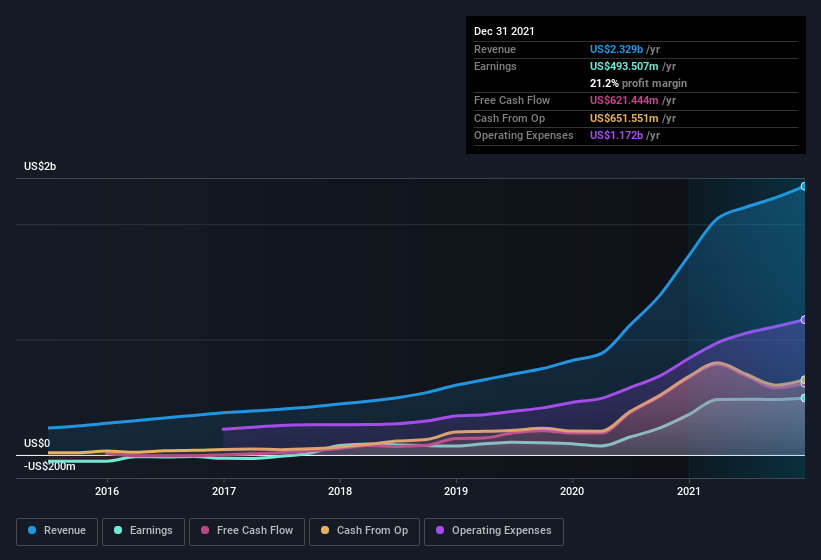

Over the twelve months to December 2021, Etsy recorded an accrual ratio of -0.12.That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. In fact, it had a free cash flow of US$621m in the last year, which was a lot more than its statutory profit of US$493.5m . Etsy did see its free cash flow drop year on year , which is less than ideal.

That might leave you wondering what analysts forecast in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How can this impact the investors?

Quality sellers are the lifeblood of Etsy, as the platform can attribute much of its success to their work. Thus. any conflicts and strikes have the potential to impact short-term earnings results.

If anything, sellers' demands are all about reducing the revenues (fees, lower turnover, opt-out) or increasing costs (better customer service). Furthermore, a deteriorating macroeconomic environment doesn't help either because it drives up the cost of customer acquisition .

For Etsy, this can mean more short-term pain unless the company finds different sources of monetization or ways to operate leaner . The following earnings report should come out on May 4. If you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. In terms of investment risks, we've identified 2 warning signs with Etsy , and understanding them should be part of your investment process.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers in the United States, the United Kingdom, Germany, Canada, Australia, and France.

Slightly overvalued with imperfect balance sheet.