- United States

- /

- Specialty Stores

- /

- NasdaqCM:EM

Discovering Undiscovered Gems in the US Stock Market January 2025

Reviewed by Simply Wall St

The United States stock market has experienced a flat performance over the last week, yet it boasts an impressive 24% increase over the past year with anticipated earnings growth of 15% annually in the coming years. In this dynamic environment, identifying stocks that are undervalued or overlooked can present unique opportunities for investors seeking to capitalize on potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Smart Share Global (NasdaqCM:EM)

Simply Wall St Value Rating: ★★★★★★

Overview: Smart Share Global Limited is a consumer tech company offering mobile device charging services in the People's Republic of China, with a market cap of $258.19 million.

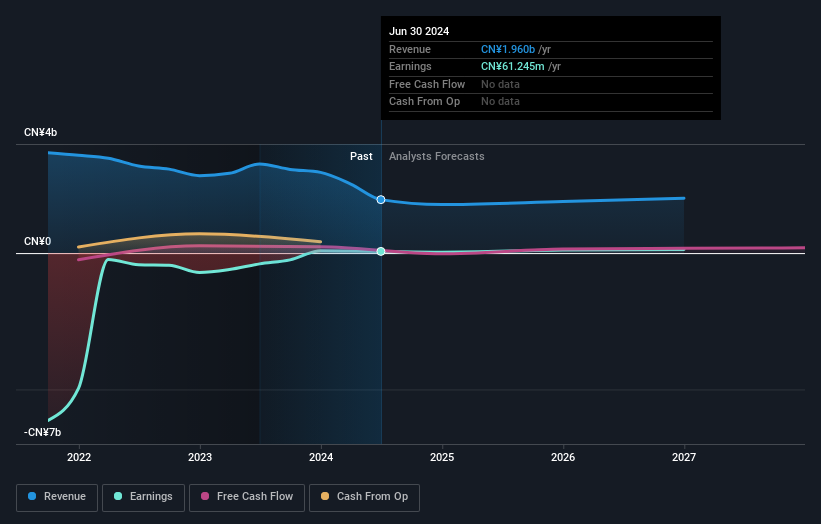

Operations: Smart Share Global generates revenue primarily through rental and leasing services, amounting to CN¥1.96 billion. The company's financial performance is influenced by its cost structure and operational efficiency.

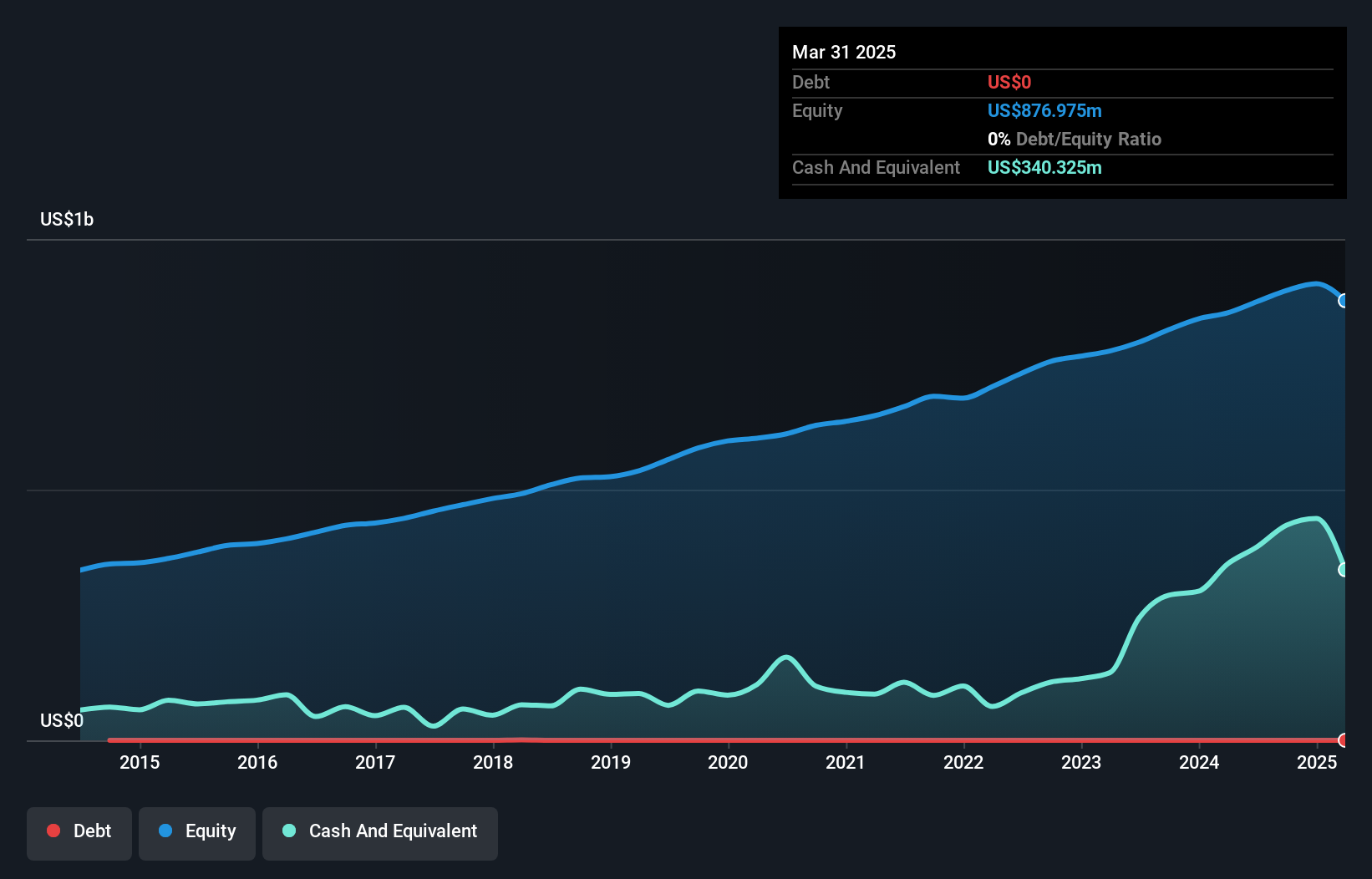

Smart Share Global, a promising player in the U.S. market, has recently turned profitable, positioning itself uniquely against the backdrop of the Specialty Retail industry which saw a -5.3% earnings growth last year. The company is trading at 51.8% below its estimated fair value, suggesting potential undervaluation opportunities for investors. With no debt on its books currently or five years ago, it eliminates concerns over interest coverage and financial leverage. Recently, an acquisition proposal valued at $130 million was announced by Trustar Capital and others to acquire an 83% stake in Smart Share Global at $0.625 per share.

- Navigate through the intricacies of Smart Share Global with our comprehensive health report here.

Evaluate Smart Share Global's historical performance by accessing our past performance report.

PC Connection (NasdaqGS:CNXN)

Simply Wall St Value Rating: ★★★★★★

Overview: PC Connection, Inc., along with its subsidiaries, offers a range of IT solutions globally and has a market cap of approximately $1.83 billion.

Operations: PC Connection generates revenue through three primary segments: Business Solutions ($1.06 billion), Enterprise Solutions ($1.20 billion), and Public Sector Solutions ($528.65 million).

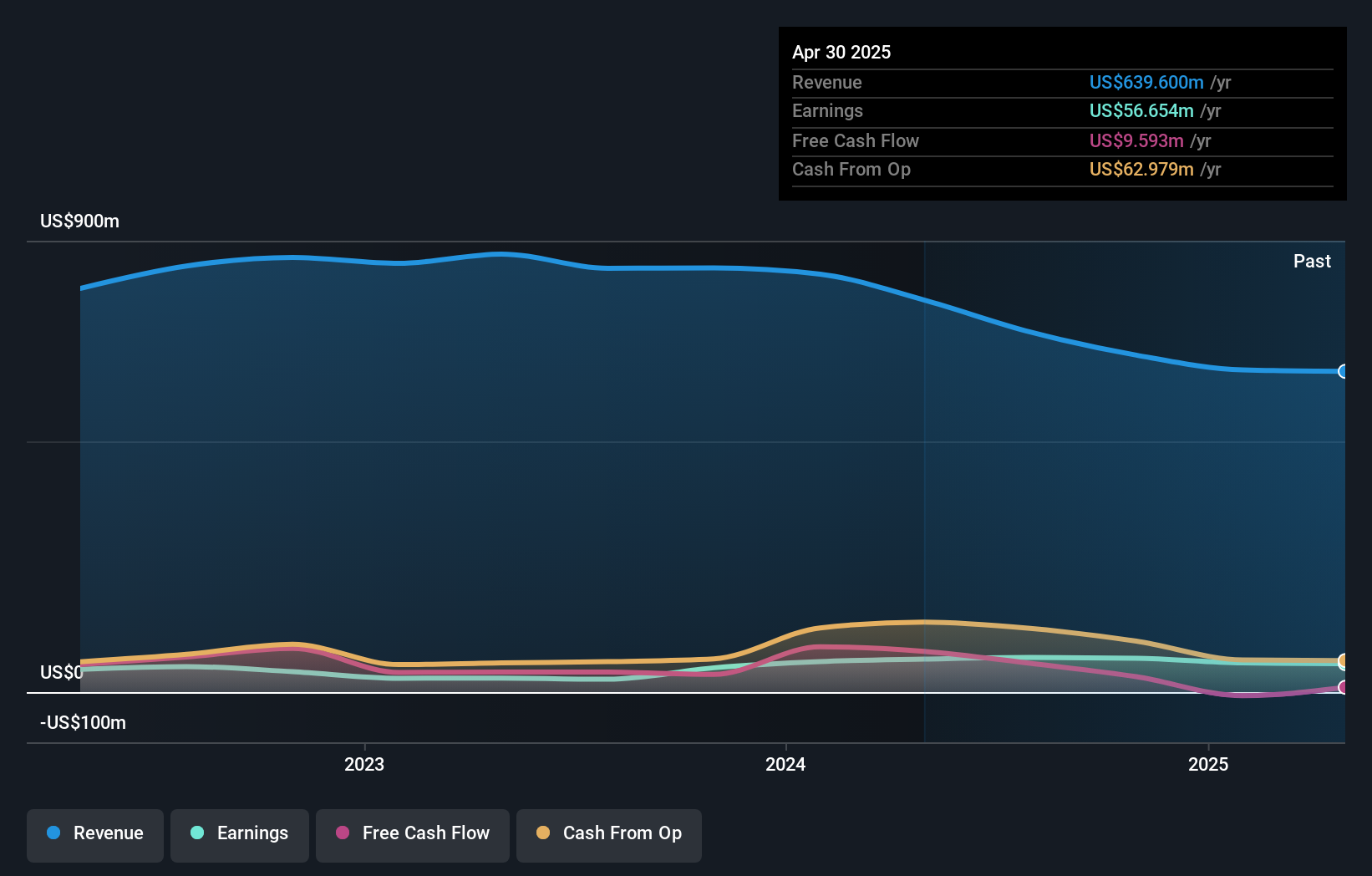

PC Connection, a nimble player in the tech space, has been making waves with its debt-free status and robust earnings growth of 15.1% last year, outpacing the electronic industry's -5%. The company’s recent share buyback saw 59,192 shares repurchased for US$3.91 million between July and September 2024. Trading at about 15% below its estimated fair value, this firm is strategically investing in AI to boost customer engagement across healthcare and retail sectors. Despite some insider selling recently, PC Connection's high-quality earnings paint an optimistic picture for potential investors seeking undervalued opportunities.

REX American Resources (NYSE:REX)

Simply Wall St Value Rating: ★★★★★★

Overview: REX American Resources Corporation, along with its subsidiaries, focuses on the production and sale of ethanol in the United States, with a market capitalization of $766.63 million.

Operations: REX generates revenue primarily from the ethanol and by-products segment, amounting to $671.88 million.

REX American Resources, a nimble player in the ethanol sector, showcases robust financial health with no debt and high-quality earnings. Recent expansions in ethanol production capacity and advancements in carbon capture technology are likely to drive revenue growth, though regulatory hurdles and margin pressures pose risks. The company reported third-quarter sales of US$174.88 million, down from US$221.08 million the previous year, while net income was US$24.5 million compared to US$26.08 million prior. Despite challenges, REX trades at 63% below its estimated fair value with analysts projecting a potential upside as it navigates market dynamics effectively.

Where To Now?

- Navigate through the entire inventory of 246 US Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Smart Share Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EM

Smart Share Global

A consumer tech company, provides mobile device charging services in the People's Republic of China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives