Key Takeaways

- Strategic investments in AI and CRM systems are expected to drive efficiency, service capability, and revenue growth across key sectors like healthcare and retail.

- Stock repurchases and increased dividends indicate confidence in future earnings, potentially enhancing earnings per share by reducing share count.

- Lower-than-expected IT spending, decreased sales in key segments, rising expenses, and supply chain uncertainties threaten PC Connection's future revenue growth and profitability.

Catalysts

About PC Connection- Provides various information technology (IT) solutions worldwide.

- Investments in a world-class CRM system and AI-enabled workflow tools are expected to drive efficiency and sales effectiveness, potentially boosting revenue in 2025 and beyond.

- Increased investment in technical resources, including solution sales executives and technical sales experts, aims to enhance service capabilities and capture larger projects, which could improve gross margins through enhanced service offerings.

- Strategic focus on AI initiatives, such as the Helix AI platform, is poised to capture growing demand in data center and infrastructure projects, potentially driving revenue growth as AI adoption increases among clients.

- Expanded capabilities and resource investments in key sectors like healthcare, retail, and manufacturing are expected to yield significant project opportunities, contributing to both revenue growth and improved net margins.

- Planned continuation of stock repurchases and a 50% increase in quarterly dividends signal confidence in future earnings growth and provide potential EPS enhancement through reduced share count.

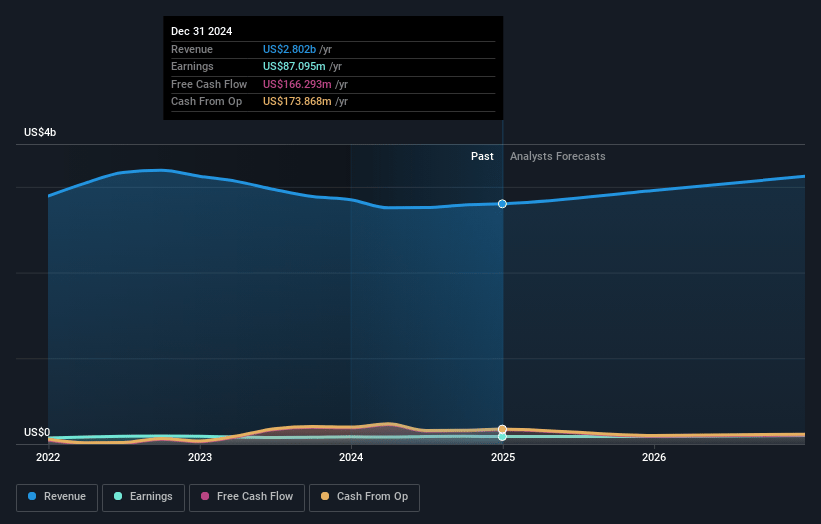

PC Connection Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PC Connection's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 3.2% in 3 years time.

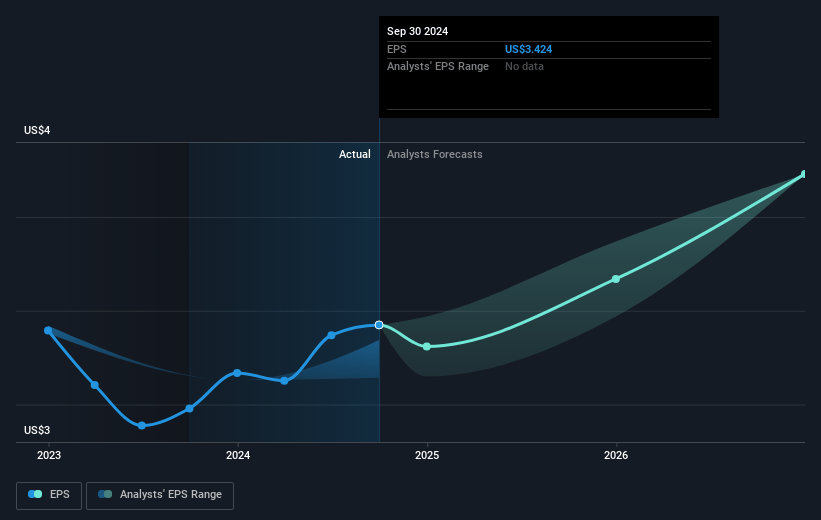

- Analysts expect earnings to reach $104.7 million (and earnings per share of $4.0) by about April 2028, up from $87.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.4x on those 2028 earnings, up from 17.8x today. This future PE is greater than the current PE for the US Electronic industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

PC Connection Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The overall IT spending remained lower than expected in both Q4 and the entire year 2024 due to delayed customer investments in advanced technology projects. This can impact future revenue growth negatively if the trend continues into 2025.

- The decrease in net sales for specific segments, such as a 6.4% decrease in Enterprise Solutions and a 3.7% decrease in Business Solutions, highlights potential challenges in maintaining sales growth, which could affect overall revenue performance.

- A 19% decrease in Q4 operating income year-over-year suggests profitability issues, potentially impacting net margins if not addressed through cost management or increased sales.

- An observed increase in SG&A expenses by 4% for the full year and 5.2% in Q4 may pressure net margins if revenue growth does not keep pace with the expense growth.

- Uncertainty around tariffs and supply chains, particularly with key suppliers' manufacturing activities in countries like China and Vietnam, could lead to cost increases and disruptions, affecting revenue and potentially compressing margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $76.0 for PC Connection based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $104.7 million, and it would be trading on a PE ratio of 22.4x, assuming you use a discount rate of 7.3%.

- Given the current share price of $59.92, the analyst price target of $76.0 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.