- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

Will eBay’s (EBAY) Social Marketplace Push Redefine Its Competitive Edge in Resale Commerce?

Reviewed by Sasha Jovanovic

- eBay recently acquired Tise, a Norway-based social marketplace, to integrate community features such as followers, likes, and personalized feeds and strengthen its appeal among Gen Z and Millennial consumers in the global resale market.

- This development highlights eBay's efforts to compete more effectively with rivals by advancing social commerce elements, signaling a broader push to drive user engagement and long-term growth through enhanced marketplace experiences.

- We'll explore how adding social marketplace features through the Tise acquisition could affect eBay's long-term growth and user engagement prospects.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

eBay Investment Narrative Recap

To be an eBay shareholder today, you need to believe that the company can reignite consistent growth in a challenging and competitive e-commerce arena, especially by courting younger buyers through new social commerce features like those brought in from the Tise acquisition. While the integration of Tise highlights eBay's push to deepen engagement and diversify appeal, it is unlikely to materially affect the most pressing short-term catalyst: the need for revenue reacceleration outside its strongest categories. The biggest risk remains potential stagnation in core segments if new initiatives do not expand the active user base or reverse competitive pressures.

Among recent announcements, the launch of eBay International Shipping in Canada is especially relevant as it aims to broaden global reach for sellers and tap into international demand, important context as eBay seeks to boost marketplace activity and mitigate single-market weaknesses. Expanding cross-border capabilities could support both revenue growth and user engagement, reinforcing efforts to balance out category concentration risks and offset slower growth in established markets.

Yet, in contrast, investors should be aware that persistent weakness in eBay's core business growth means...

Read the full narrative on eBay (it's free!)

eBay's outlook projects $12.3 billion in revenue and $2.3 billion in earnings by 2028. This requires 5.4% yearly revenue growth and a $0.1 billion increase in earnings from the current $2.2 billion.

Uncover how eBay's forecasts yield a $88.07 fair value, in line with its current price.

Exploring Other Perspectives

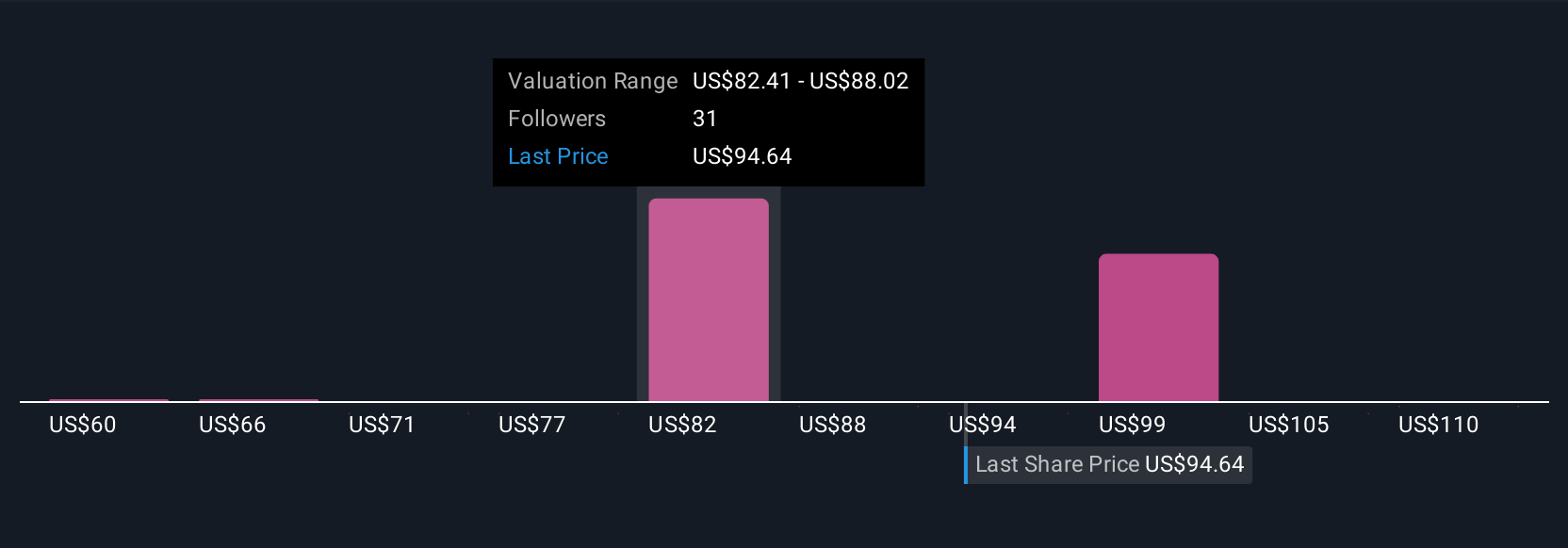

Simply Wall St Community members have submitted nine fair value estimates for eBay, ranging widely from US$60 to US$142, with several higher than current analyst targets. Against this backdrop, broadening user engagement, especially among Gen Z and Millennials, remains critical for long-term revenue stability and future growth potential.

Explore 9 other fair value estimates on eBay - why the stock might be worth as much as 61% more than the current price!

Build Your Own eBay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your eBay research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free eBay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate eBay's overall financial health at a glance.

No Opportunity In eBay?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives