- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

Leadership Revamp and Strong Q1 Earnings for eBay (NasdaqGS:EBAY)

Reviewed by Simply Wall St

eBay (NasdaqGS:EBAY) recently reported its first-quarter earnings with sales and net income showing year-over-year growth, and a revised leadership structure was unveiled to enhance innovation. During the past week, eBay's stock price moved up by 2.3%, closely aligning with the broader market movement of 2.7%. The corporate updates, including the CFO transition and positive earnings report, likely added weight to the stock's price movement, reflecting the company's strengthening financial position. Meanwhile, the market is buoyed by strong earnings from tech giants like Microsoft and Meta, contributing to the overall positive market sentiment.

Buy, Hold or Sell eBay? View our complete analysis and fair value estimate and you decide.

The recent news of eBay's first-quarter earnings growth and leadership restructuring could bolster market confidence, potentially leading to greater investor interest. The company's introduction of AI advancements and partnerships with Klarna and OpenAI appears aligned with these corporate changes, anticipated to further enhance marketplace reach and innovation. Over the past five years, eBay's total shareholder returns, including dividends, reached 81.46%. Despite current market fluctuations, this performance highlights the company's capability to sustain value growth over time.

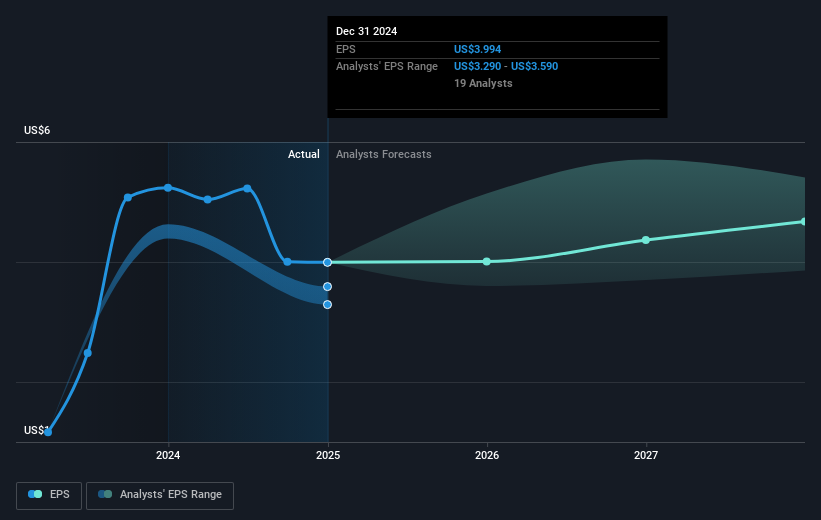

In contrast to the previous year, where eBay outperformed both the US Market's 9.9% return and the US Multiline Retail industry's 10.4% return, the strategic moves and innovations posited in eBay's narrative could influence future revenue and earnings trajectories. The company's ongoing initiatives in niche categories and technological enhancements may support the revenue growth forecasts of approximately 3.3% annually. Meanwhile, the current share price, although slightly above the consensus analyst price target of US$64.36, suggests a relatively fair valuation, with minor adjustment expected should forecasts materialize as anticipated.

Understand eBay's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives