- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

Could eBay’s (EBAY) Livestream Expansion Signal a Shift in Its Long-Term Competitive Strategy?

Reviewed by Sasha Jovanovic

- In recent days, eBay expanded its livestream selling platform to include categories such as Hard Goods, Health & Beauty, and Art & Antiques, aiming to attract sellers with livestream experience and strong social media presence. This move underscores eBay's push to capture a greater share of the rapidly growing livestream commerce market, particularly as collectibles continue to drive sales momentum.

- We'll explore how eBay's category expansion and livestreaming focus could influence its long-term investment story and business outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

eBay Investment Narrative Recap

To be a shareholder in eBay right now, you have to believe in the platform’s ability to leverage category expansion, tech-driven features, and premium buyer-seller experiences to reignite growth beyond its core collectibles verticals. The recent expansion into new livestreaming categories may support this goal, but technical issues like shipping glitches impact seller sentiment and are unlikely to be a material short-term catalyst or major risk unless persistent operational problems emerge.

Among recent announcements, eBay’s launch of International Shipping in Canada directly addresses one of the core friction points for cross-border sellers and buyers. While this may not immediately resolve episodic glitches, it aligns with broader efforts to streamline logistics, a recurring risk investors watch given eBay’s reliance on third-party fulfillment and ongoing competition with logistics-integrated platforms.

However, investors should pay close attention to how eBay handles challenges with shipping reliability, as one critical weak point is...

Read the full narrative on eBay (it's free!)

eBay's narrative projects $12.3 billion in revenue and $2.3 billion in earnings by 2028. This requires 5.4% yearly revenue growth and a $0.1 billion increase in earnings from the current $2.2 billion.

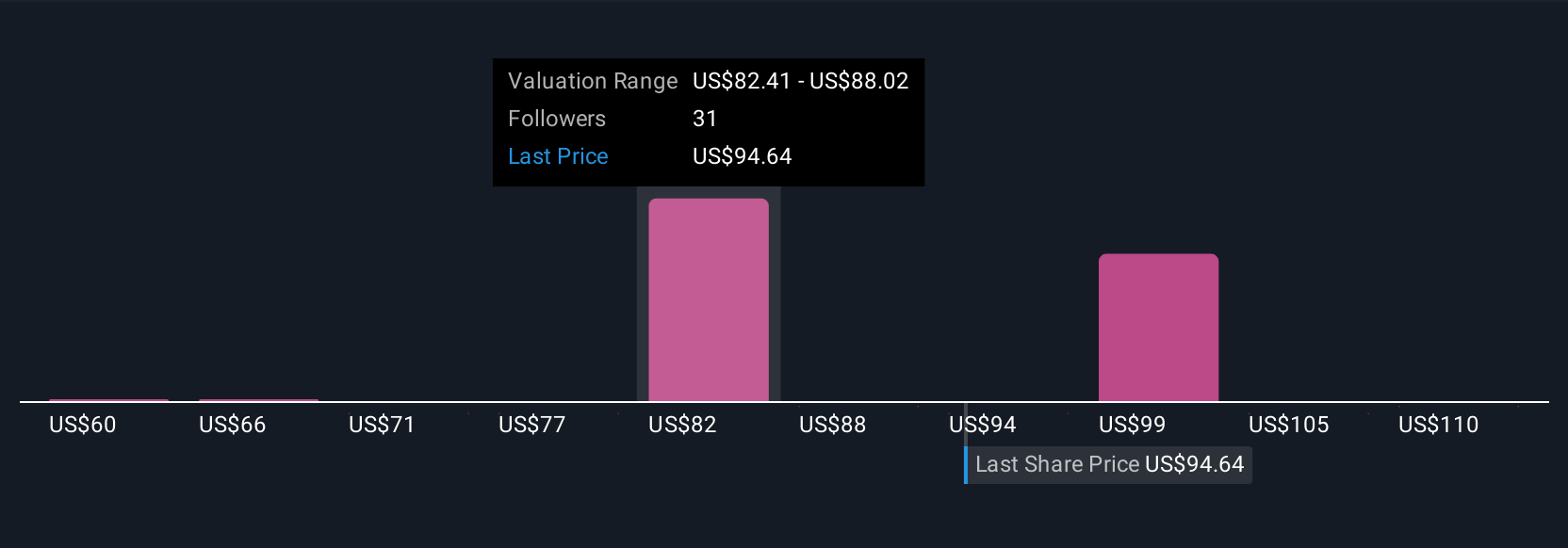

Uncover how eBay's forecasts yield a $89.00 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate eBay’s fair value from US$63.45 up to US$116.03, based on five unique forecasts. With ongoing competitive pressure in focus categories, these opinions reflect a wide range of expectations about future earnings and growth potential, reminding you to weigh different approaches to the company’s prospects.

Explore 5 other fair value estimates on eBay - why the stock might be worth as much as 21% more than the current price!

Build Your Own eBay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your eBay research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free eBay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate eBay's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives