- United States

- /

- Specialty Stores

- /

- NasdaqGS:DLTH

Duluth Holdings (DLTH) Q3: Loss Narrows to -$0.29 EPS, Testing Persistent Bearish Narratives

Reviewed by Simply Wall St

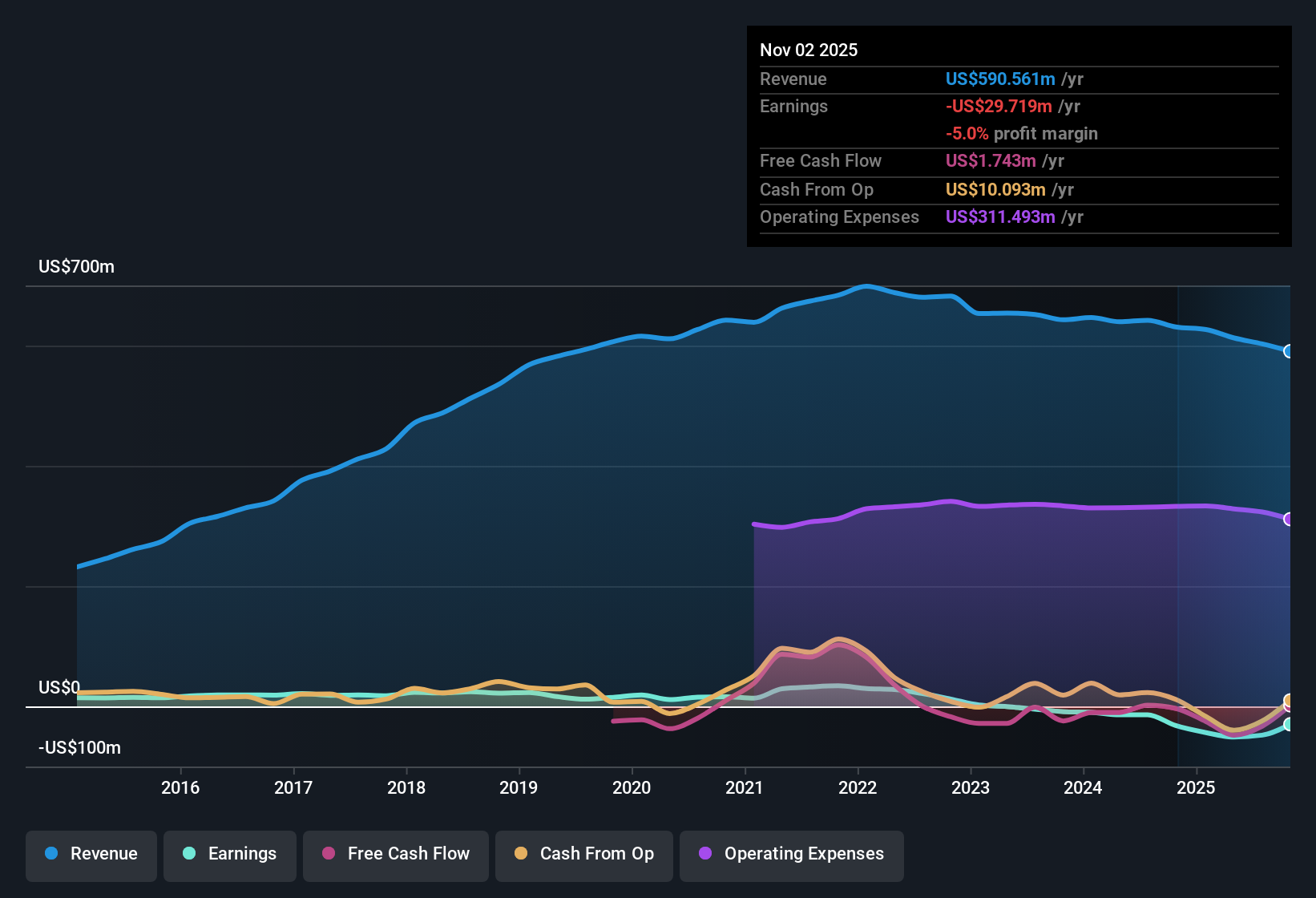

Duluth Holdings (DLTH) has just posted Q3 2026 results with revenue of $114.9 million and basic EPS of -$0.29, as investors continue to watch how its top line and per share losses evolve. The company has seen quarterly revenue move from $127.1 million in Q3 2025 to $114.9 million in Q3 2026, while basic EPS shifted from -$0.85 to -$0.29 over the same period. This sets the stage for a closer look at how stubborn losses are shaping margins and sentiment.

See our full analysis for Duluth Holdings.With the latest numbers on the table, the next step is to see how this margin picture lines up with the most widely held narratives about Duluth Holdings and whether any of those stories now need to be rethought.

See what the community is saying about Duluth Holdings

Losses Narrow Year on Year but Stay Steep

- Net income in Q3 2026 was a loss of $10.1 million compared with a $28.5 million loss in Q3 2025, while the trailing twelve month loss sits at $29.7 million on $590.6 million of revenue.

- Bears focus on the fact that Duluth has been unprofitable for at least five years, yet the latest numbers show a more mixed picture:

- Over the last twelve months, losses of $29.7 million compare with a deeper $51.1 million loss implied in earlier trailing data, so the multi year worsening trend is not uniformly one way in the recent period.

- At the same time, Q2 2026 briefly swung to a $1.3 million profit before slipping back to a $10.1 million loss this quarter, which supports the bearish view that profitability is not yet stable.

Revenue Drifts Lower While Cost Fixes Aim Higher

- Trailing twelve month revenue has edged down from $642.1 million to $590.6 million, and analysts expect further annual declines of around 1.3 percent over the next three years.

- Supporters highlight the bullish idea that operational upgrades could eventually counter that slow revenue slide:

- Consensus narrative points to direct to factory sourcing and a fulfillment center that already handles 60 percent of volume at lower cost as tools to defend margins even if revenue remains under pressure.

- Resetting promotions and improving inventory turns are also flagged as levers to lift gross margin, which would matter more as top line trends soften.

Cheap Sales Multiple Versus Ongoing Red Ink

- Duluth trades on a price to sales ratio of about 0.1 times against a US specialty retail average of 0.5 times, while the trailing twelve month loss of $29.7 million shows why the discount exists.

- Value oriented investors weigh this low multiple against the bearish narrative of persistent losses and forecast decline:

- Analysts expect Duluth to remain unprofitable over at least the next three years, which lines up with the history of multi year losses growing at roughly 71.5 percent annually.

- Because revenue is projected to contract modestly rather than grow, the valuation argument rests on eventual margin repair rather than a strong top line recovery.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Duluth Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that others might be missing? Turn that into a concise narrative in just a few minutes: Do it your way.

A great starting point for your Duluth Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Duluth Holdings faces shrinking revenue, persistent multi year losses, and uncertain profitability, leaving investors reliant on an unproven turnaround rather than demonstrated stability.

If you want businesses already proving they can grow steadily instead of waiting on a fragile recovery story, use our stable growth stocks screener (2087 results) to focus on companies with consistent, cycle tested performance right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTH

Duluth Holdings

Sells casual wear, workwear, outdoor apparel, and accessories for men and women in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)