- United States

- /

- Specialty Stores

- /

- NasdaqGS:ASO

Will Academy Sports (ASO) Sustained Growth Justify Its Raised 2026 Guidance and Expansion Plans?

Reviewed by Simply Wall St

- In the past week, Academy Sports and Outdoors updated its full-year guidance for fiscal 2026, raising expected net sales, net income, and diluted earnings per share, while simultaneously announcing plans for further store expansions and affirming its quarterly dividend.

- This combination of heightened earnings expectations and ongoing growth efforts, alongside continued share buybacks and community engagement, marks a period of increased momentum for the company.

- We'll take a closer look at how Academy's improved earnings guidance and new store openings influence its investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Academy Sports and Outdoors Investment Narrative Recap

To be a shareholder in Academy Sports and Outdoors right now, you likely need to believe in the company's ability to regain revenue momentum through new store growth and expanded partnerships, even as comparable sales remain weak. The recent upward revision to full-year earnings guidance is encouraging, but it does not materially address the key short-term catalyst, which is driving a turnaround in underlying comparable store sales, nor does it mitigate the risk of margins being squeezed by ongoing freight and merchandise cost pressures.

Among the announcements, Academy's plan to open as many as 25 new stores this fiscal year stands out as directly relevant to future sales growth. This aligns closely with management's improved net sales outlook, serving as a critical catalyst for boosting overall revenue, although its near-term impact may be moderated if underlying trends in existing locations don't also improve.

On the other hand, investors should be aware that while new store openings create growth opportunities, the challenge of declining comparable sales in existing stores remains unresolved and could...

Read the full narrative on Academy Sports and Outdoors (it's free!)

Academy Sports and Outdoors is projected to reach $7.2 billion in revenue and $446.4 million in earnings by 2028. This outlook assumes annual revenue growth of 6.8% and an increase in earnings of $58.3 million from the current $388.1 million.

Uncover how Academy Sports and Outdoors' forecasts yield a $57.28 fair value, a 16% upside to its current price.

Exploring Other Perspectives

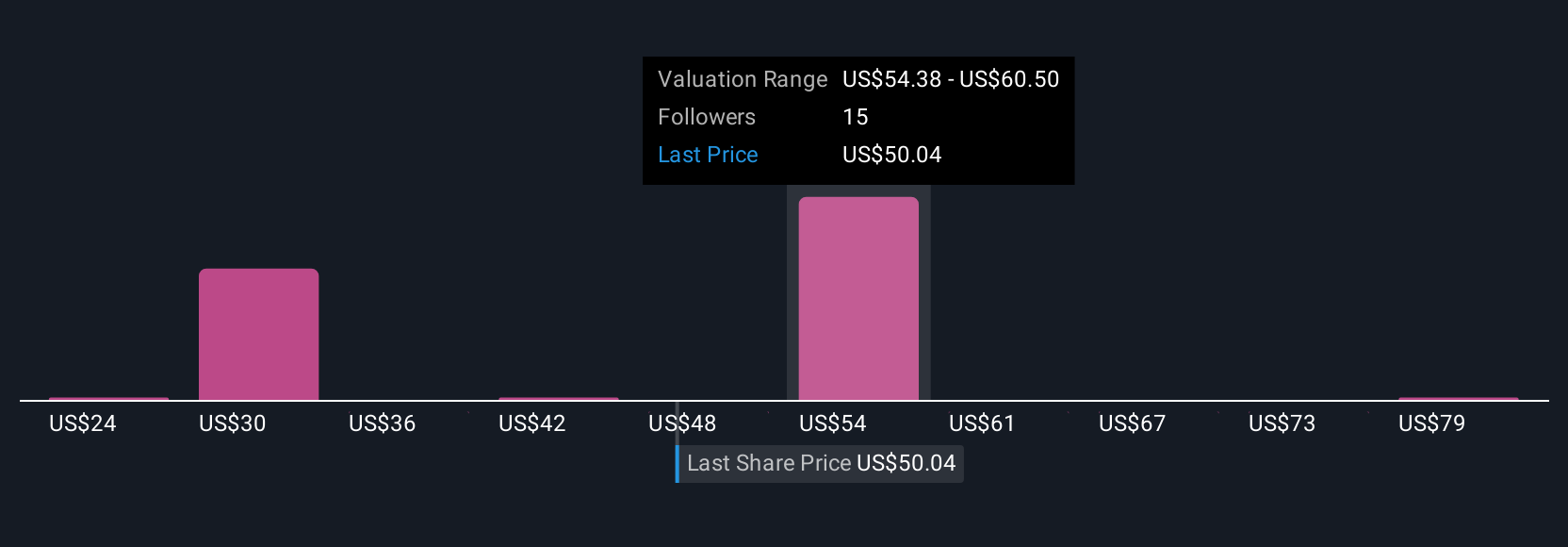

Five members of the Simply Wall St Community have estimated fair values ranging widely from US$23.75 to US$85 per share. While this reflects varied market views, flat comparable sales and margin pressures are top of mind for many, highlighting how expectations can shape investment outcomes.

Explore 5 other fair value estimates on Academy Sports and Outdoors - why the stock might be worth less than half the current price!

Build Your Own Academy Sports and Outdoors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Academy Sports and Outdoors research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Academy Sports and Outdoors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Academy Sports and Outdoors' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASO

Academy Sports and Outdoors

Through its subsidiaries, operates as a sporting goods and outdoor recreational retailer in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives