- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Is Amazon Stock Fairly Priced After Recent AI Expansion Drives 8.9% Weekly Gain?

Reviewed by Bailey Pemberton

- Wondering if Amazon.com stock is actually a bargain right now? Let's break down what is really driving its value, beyond the headlines and hype.

- Amazon shares have been on the move recently, climbing 8.9% in just the past week and delivering a 23.4% return over the last year. This suggests that sentiment and growth expectations may be shifting.

- Investors have shown increased interest in Amazon's expansion into artificial intelligence and logistics as the company continues to deepen its focus on new markets and technologies. News of major strategic partnerships and new product launches has supported the stock, increasing speculation about its future growth potential.

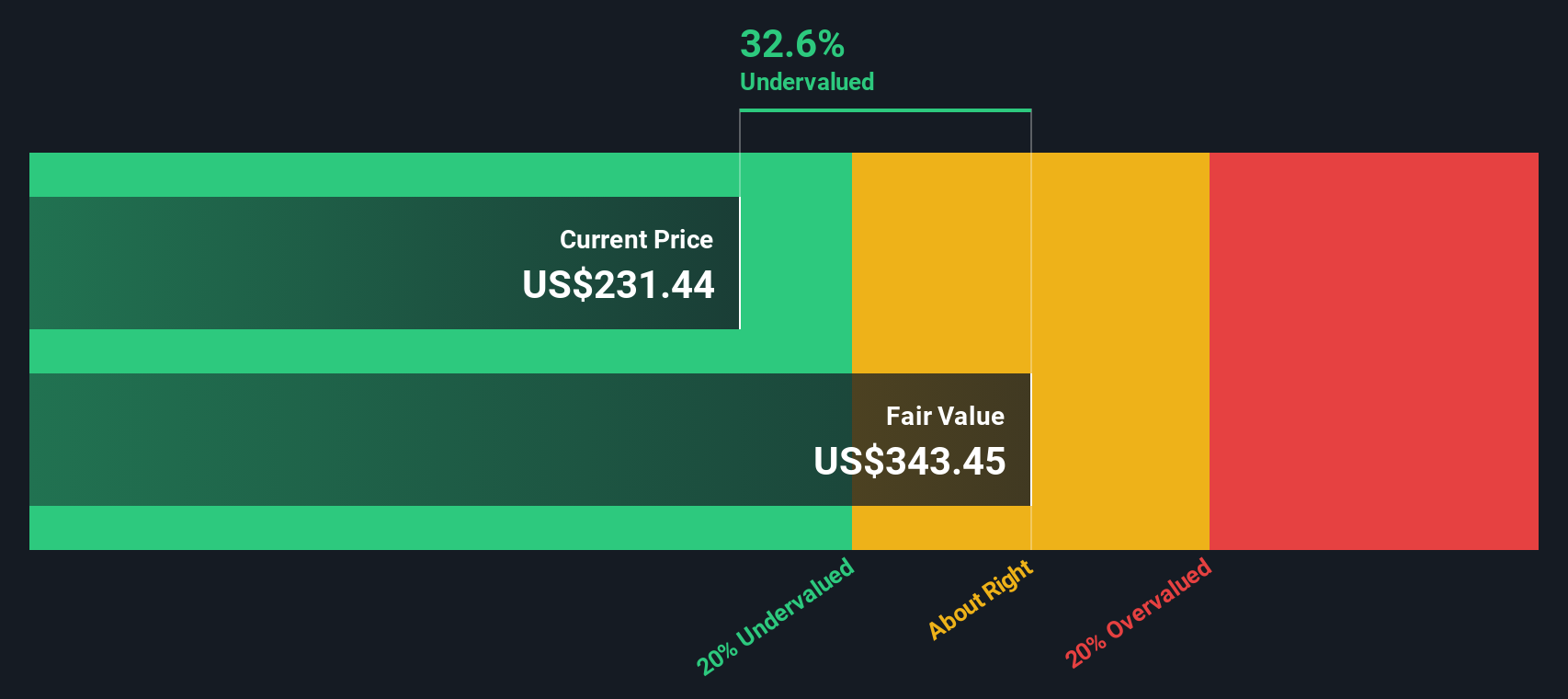

- When focusing on the fundamentals, Amazon.com receives a valuation score of 3 out of 6 on undervaluation checks. Different methods provide varying perspectives, so it is worthwhile to consider a more comprehensive approach to evaluating value that many investors may overlook.

Find out why Amazon.com's 23.4% return over the last year is lagging behind its peers.

Approach 1: Amazon.com Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its expected future cash flows and then discounting those figures to today’s dollars. This approach is especially useful for companies like Amazon.com that generate significant free cash flow and are expected to grow over time.

Currently, Amazon.com’s Free Cash Flow is $40.0 Billion. Analysts provide detailed estimates for up to five years. After this period, Simply Wall St extrapolates future values. By 2029, projected Free Cash Flow increases to $130.4 Billion, highlighting the company’s growth trajectory.

Using these cash flow projections and the 2 Stage Free Cash Flow to Equity model, the DCF valuation estimates Amazon’s intrinsic value at $272.24 per share. This suggests the stock is trading at a 10.3% discount to its estimated fair value and may be undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amazon.com is undervalued by 10.3%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

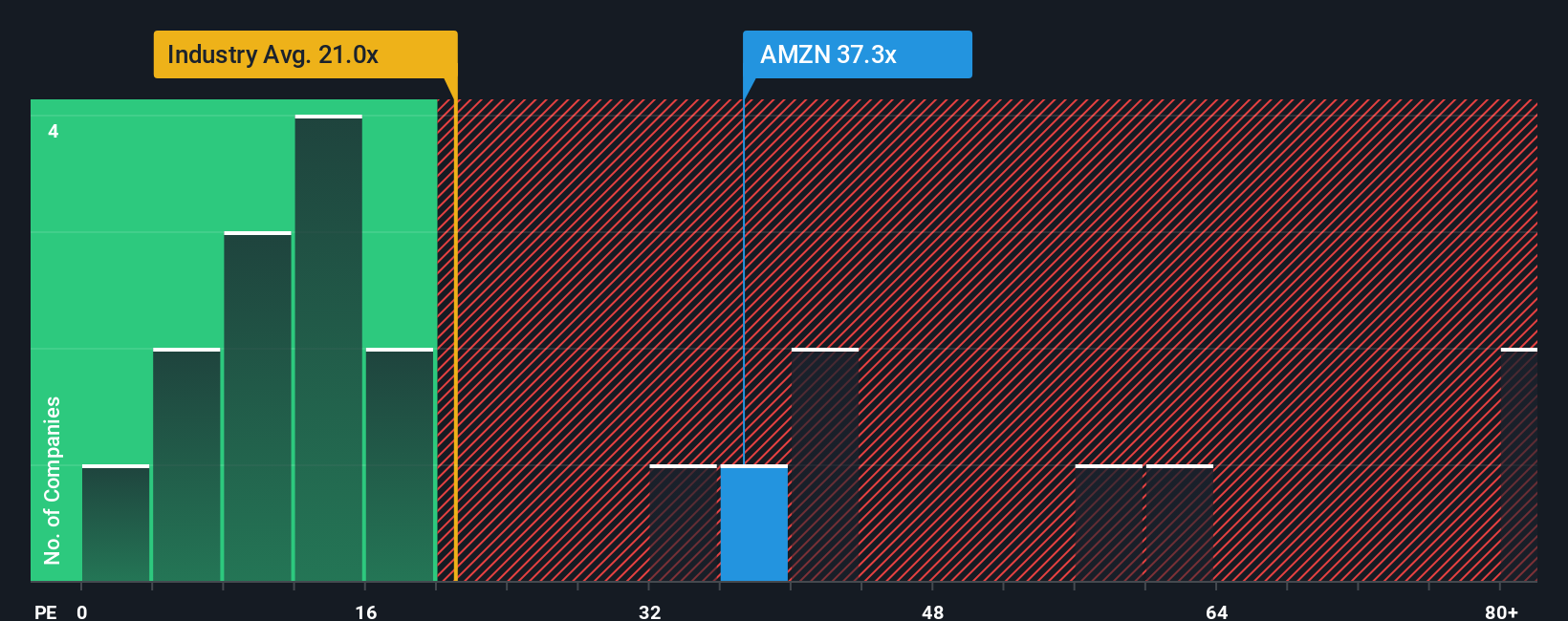

Approach 2: Amazon.com Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies like Amazon.com because it relates a company’s market value to its actual earnings. This makes it useful for gauging whether investors are paying a fair price for every dollar of profit a business generates.

Growth expectations and risk are key factors in determining what a “normal” or “fair” PE ratio should be. Companies with faster growth prospects or lower risk profiles usually command higher PE ratios. In contrast, those with slower growth or more uncertainty tend to trade at lower multiples.

Amazon.com currently trades at a PE ratio of 34.1x. This is higher than the Multiline Retail industry average of 19.8x but lower than the average of its peers at 41.6x.

Simply Wall St’s “Fair Ratio” estimates what Amazon’s PE multiple should be by weighing its earnings growth, profitability, size, industry, and overall risk. Unlike simply comparing Amazon to industry or peer averages, this proprietary metric provides a more tailored and accurate picture of fair value for the company’s unique profile. For Amazon, the Fair Ratio is 36.7x.

Since Amazon’s actual PE ratio of 34.1x is very close to its Fair Ratio, it suggests the stock is trading roughly in line with its fair value based on current earnings and company characteristics.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

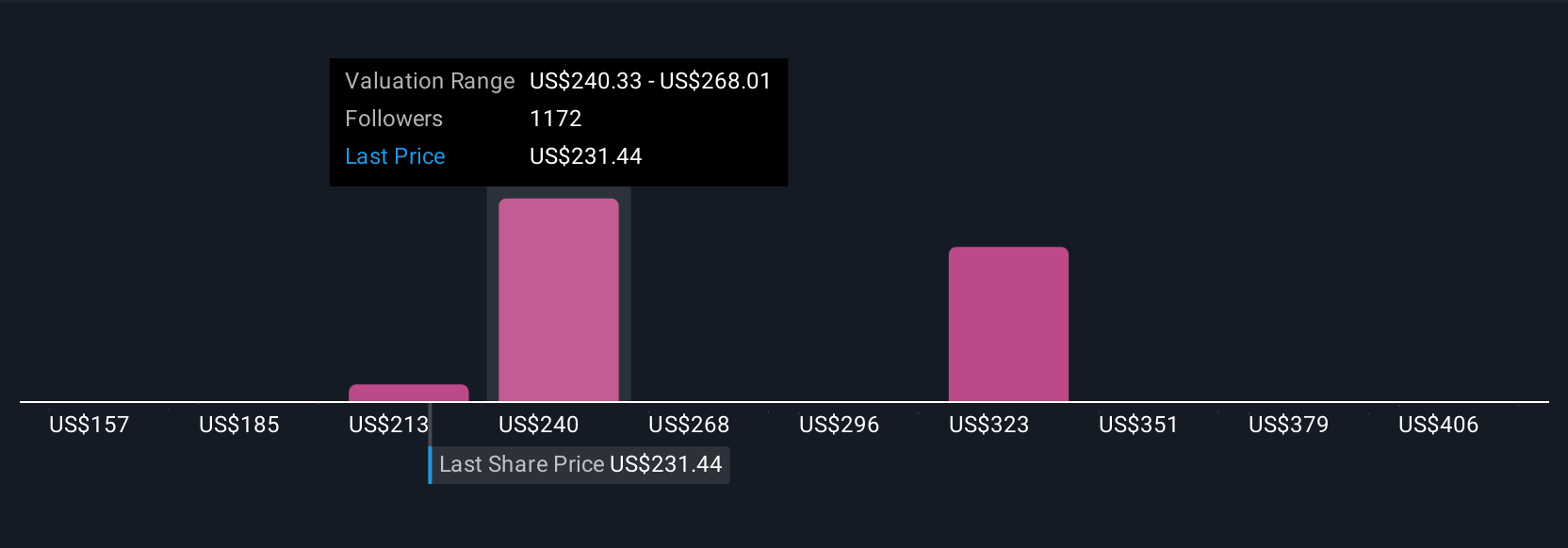

Upgrade Your Decision Making: Choose your Amazon.com Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story behind a company’s numbers. It connects your assumptions about Amazon.com’s future revenue, earnings, and margins to a fair value, making the investment case personal and actionable.

With Narratives on Simply Wall St’s Community page, anyone can easily create, view, and update these stories in real time, making them an accessible tool used by millions of investors. Narratives help you decide whether to buy or sell by comparing your Fair Value with the current share price. They automatically update whenever new information or news arrives, so your approach adapts as the business evolves.

For example, one investor’s Narrative might predict high margin growth from AWS and advertising, expecting Amazon to reach $1 trillion in annual revenue, $150 billion in earnings, and a fair value of $227 per share in five years. Another might see slower international expansion and competitive pressures, expecting only $809 billion in revenue and a fair value closer to $151 per share. Narratives make it clear why investors can reach different conclusions with the same data, encouraging you to sense check and build your own view.

For Amazon.com, we’ll make it really easy for you with previews of two leading Amazon.com Narratives:

- 🐂 Amazon.com Bull Case

Fair Value: $287.57

Currently 15.1% undervalued

Forecast Revenue Growth: 11.3%

- AWS leadership in cloud and AI, along with deep enterprise integration, is expected to drive high-margin growth and long-term expansion as cloud adoption accelerates globally.

- Logistics automation, international expansion, and the growing Prime ecosystem are improving structural cost efficiency and revenue growth. These factors are supporting higher margins.

- Main risks include regulatory and competitive pressures in both AWS and core retail. The analyst consensus price target is 9.5% above the current share price based on robust projected revenue and margin growth.

- 🐻 Amazon.com Bear Case

Fair Value: $222.55

Currently 9.7% overvalued

Forecast Revenue Growth: 15.2%

- Earnings power is seen as understated due to strong contributions from third-party sellers, AWS, and Advertising. However, heavy reinvestment continues to suppress short-to-medium term cash flows.

- Operational leverage and core business refocusing are likely to benefit long-term margins. Ongoing capex and cost expansion will limit free cash flow in the near future.

- Risks include regulatory headwinds in global markets, potential economic downturns affecting retail and AWS growth, and slower than expected expansion in key revenue streams.

Do you think there's more to the story for Amazon.com? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.