- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Is Amazon a Bargain After Announcing Plans to Hire 250000 for the Holidays?

Reviewed by Bailey Pemberton

If you are trying to decide whether to hold, buy, or simply keep an eye on Amazon.com, you are definitely not alone. Few stocks generate as much buzz and debate, especially after the kind of price action we have seen lately. Amazon’s shares, most recently closing at $213.04, have pulled back about 8.0% in the past month and remain slightly down at -3.3% year-to-date. This comes despite a robust 12.7% gain over the past year and a remarkable 78.5% jump over three years. That roller-coaster might leave you wondering if the recent dip is a sign of trouble or just a pit stop on a longer journey upward.

Much of the short-term volatility can be traced to macro trends and news coming out about Amazon’s evolving business strategy. For example, Amazon has announced plans to hire a massive 250,000 workers for the holiday season. At the same time, the company is putting real muscle into its international footprint with an eye-catching EUR 1 billion investment in Belgium. Amazon Web Services is also adapting, reflecting a broader trend among tech giants to diversify manufacturing outside China.

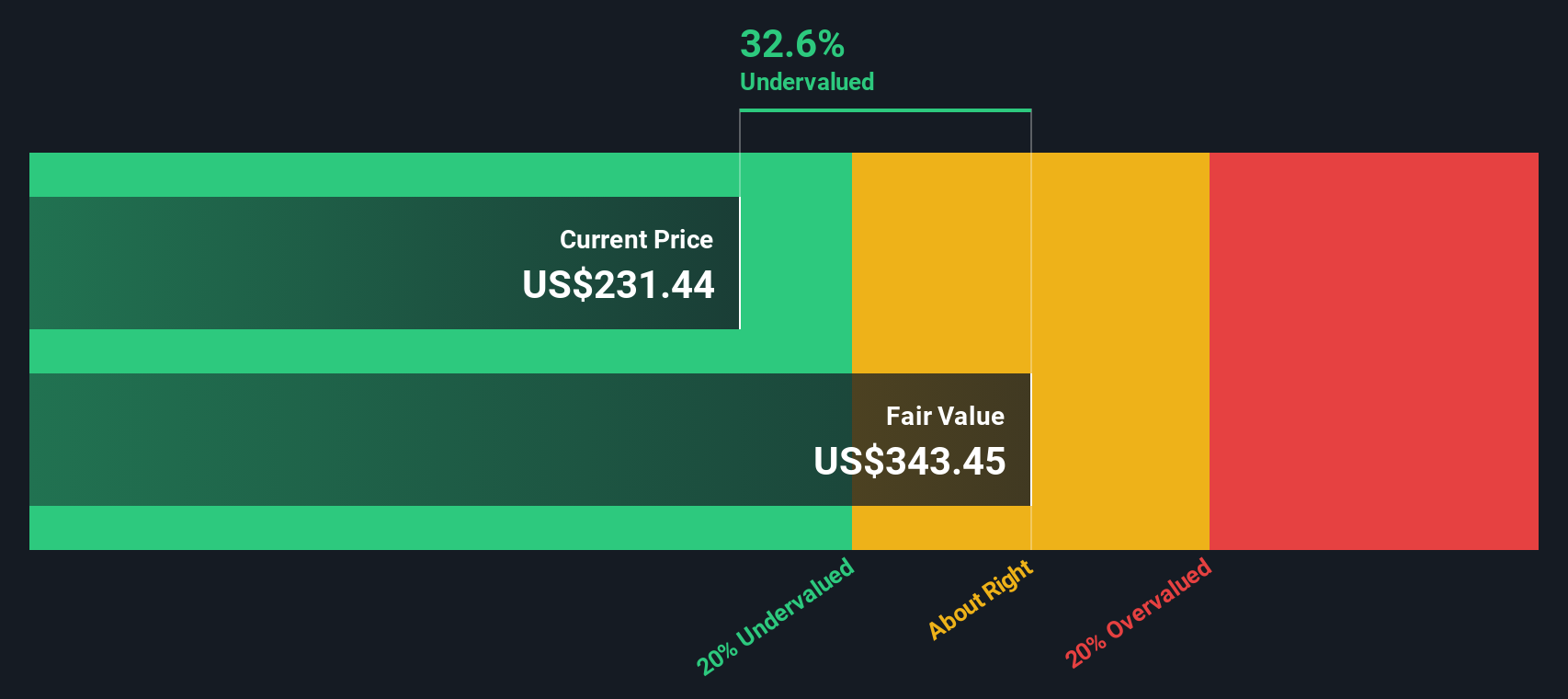

The market’s mixed reaction seems to reflect both excitement about Amazon’s growth potential and a recalibration of risks, especially as new faces come and go on leadership teams. But when you set aside the headlines for a moment and focus on value, the story gets interesting. According to our review, Amazon scores a 5 out of 6 on our valuation checks, putting it firmly in the “undervalued” camp based on most measures.

Next, let’s walk through those six valuation approaches, see how Amazon stacks up by the numbers, and, even more importantly, consider a smarter way to interpret valuation at the end.

Why Amazon.com is lagging behind its peers

Approach 1: Amazon.com Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model values companies by forecasting future cash flows and then discounting them back to today's value, giving us an estimate of what the company is really worth right now. Simply Wall St applies a two-stage Free Cash Flow to Equity model to Amazon.com, extrapolating the company’s future performance from both analyst consensus and extended projections.

Currently, Amazon generates free cash flow of $37.6 Billion, and analysts forecast aggressive growth over the coming years. For example, by the end of 2029, Amazon’s free cash flow is expected to reach $134.6 Billion. While analyst estimates are provided for the next several years, long-range forecasts are estimated based on industry trends. Looking further out always carries more uncertainty.

Using these projections, the DCF model calculates an intrinsic value of $272.55 per share. This is about 21.8% higher than today’s share price of $213.04, suggesting that Amazon's stock remains meaningfully undervalued according to this core valuation approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amazon.com is undervalued by 21.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Amazon.com Price vs Earnings (PE Ratio)

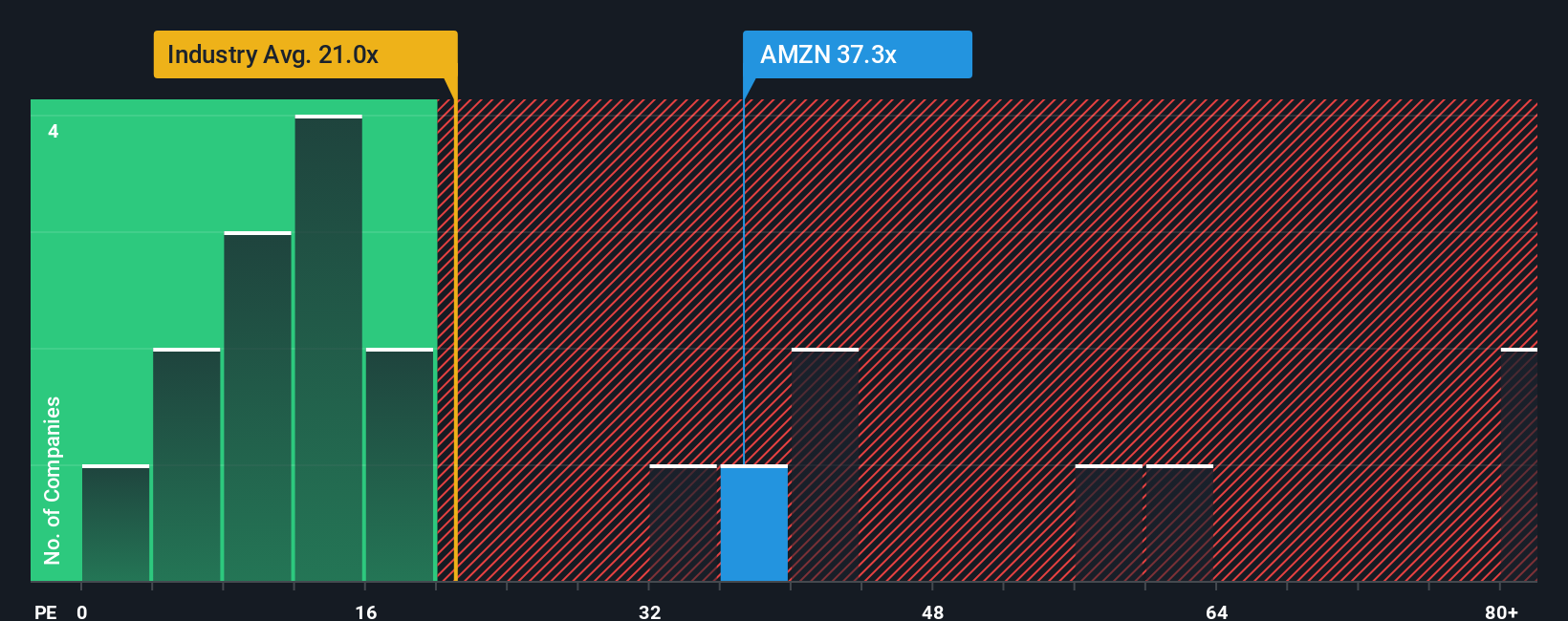

The Price-to-Earnings (PE) ratio is a popular metric for valuing profitable companies like Amazon.com, as it measures how much investors are willing to pay for each dollar of current earnings. For consistently profitable businesses, the PE ratio offers a straightforward way to gauge whether a stock is reasonably priced given its performance.

Growth expectations and risk play a critical role in what makes for a “normal” or “fair” PE. Companies with higher earnings growth and lower risk typically command higher PE ratios, since investors expect bigger profits in the future and are willing to pay more for those prospects.

Amazon currently trades at a PE ratio of 32.2x. This is significantly higher than the Multiline Retail industry average of 20.6x, but it is lower than its peer average at 40.1x. These benchmarks provide some context, but do not always reflect the unique qualities of a fast-growing global business like Amazon.

Simply Wall St’s “Fair Ratio” is designed to address this. The Fair Ratio is a tailored benchmark that blends key factors such as Amazon’s expected earnings growth, profit margins, industry, market cap, and risk profile. This provides a more nuanced and meaningful comparison than simply stacking the stock up against industry peers. For Amazon, this Fair Ratio is calculated at 38.8x, reflecting its standout financial profile and growth prospects.

Comparing the Fair Ratio (38.8x) with Amazon’s current PE ratio (32.2x), the stock appears undervalued using this approach, suggesting that the current market price does not fully reflect its strong fundamentals and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your Amazon.com Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Rather than just looking at numbers, a Narrative is your personalized investment story, connecting your view of Amazon's business (and its future growth, profitability, and risks) to the assumptions that drive fair value and forecasts.

Narratives work by linking the company's story to key financial estimates, such as future revenue, earnings, and margins, and then automatically calculating fair value based on these inputs. The benefit of this approach is that it makes complex valuation easy. By setting out your beliefs about Amazon’s future, Narratives turn them into actionable numbers that help you decide whether the stock may be suitable for buying, selling, or holding, especially when comparing fair value to the current price.

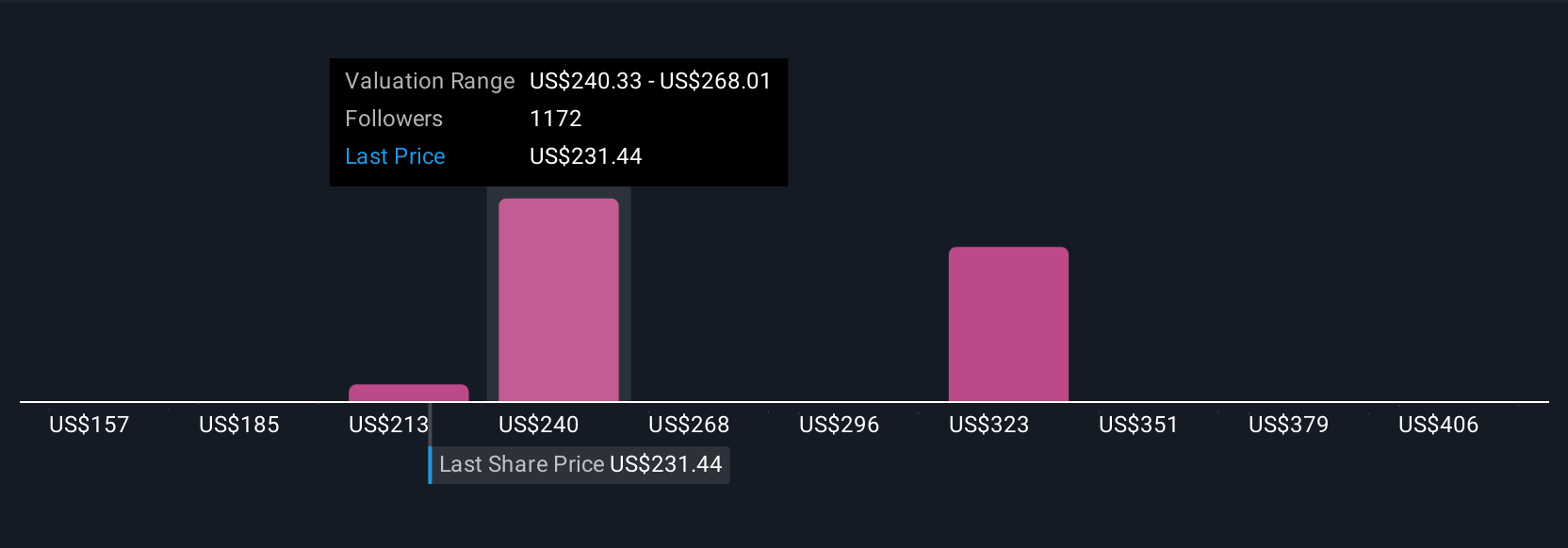

Best of all, Narratives on Simply Wall St’s Community page are updated in real time as new facts, news, or earnings come in, making this tool both accessible and dynamic for millions of investors. For example, when it comes to Amazon.com, you’ll find some investors see a fair value as low as $151, focusing on slower retail growth and competition, while others project upside toward $434 by 2034, banking on rapid cloud and AI expansion. This demonstrates how different perspectives and data can translate into different investment decisions.

For Amazon.com, however, we’ll make it really easy for you with previews of two leading Amazon.com Narratives:

Fair Value: $222.55

Currently trading at about 4.27% below this fair value

Revenue Growth Forecast: 15.19%

- Amazon's earnings power is much higher than reported, thanks to 3P sellers, Advertising, and AWS, with continued reinvestment to drive future growth.

- Operating leverage and a focus on core businesses position Amazon for increased margins and persistent international and cloud expansion.

- Key risks include regulatory challenges and potential downturns in global consumer spending, but long-term opportunities in retail and cloud remain strong.

Fair Value: $151.21

Currently trading at about 40.92% above this fair value

Revenue Growth Forecast: 7.2%

- Amazon’s core retail business faces limited expansion in the US, but ad and streaming segments could drive future profits and margin improvement.

- Increased capital intensity means Amazon must invest more to sustain growth, while strong competition in e-commerce and cloud could constrain market share gains.

- Risks include share dilution, rising costs, and macroeconomic or regulatory headwinds, suggesting the stock may be overvalued at current levels.

Do you think there's more to the story for Amazon.com? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives