- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Evaluating Amazon Stock as Prime Trial Approaches Amid Ongoing Valuation Debate

Reviewed by Simply Wall St

If you are on the fence about what to do with Amazon.com stock right now, you are definitely not alone. After all, Amazon is a magnet for strong opinions, and the recent price action has been just intriguing enough to keep investors glued to their screens. Over the past year, shares are up a healthy 19.4%, with a much more dramatic 101.0% jump over the last three years. That's a lot of long-term momentum, even if the past week and month have been fairly flat, with returns of 0.0% and 1.2% respectively. It reflects a company working through shifting currents such as regulatory headlines, high-profile trials about its Prime sign-up tactics, and even some drama over new visa fees that could impact its workforce.

These headlines naturally add a dose of uncertainty, but what's striking is how investors keep circling back to the same essential question: is Amazon reasonably priced for its growth, or are we all buying too much future at today's prices? Currently, Amazon clocks a valuation score of 3 out of 6, meaning it looks undervalued in about half of the metrics we track. That puts the spotlight on the approaches used to judge whether the stock is a bargain or a bet-on-the-hype.

Next, let's break down how different valuation checks stack up for Amazon. Plus, I'll share an even more insightful angle for sizing up what Amazon is really worth, so stay with me.

Why Amazon.com is lagging behind its peersApproach 1: Amazon.com Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future free cash flows and then discounting those cash flows back to today's value. This approach aims to capture what Amazon.com is fundamentally worth by considering both its current performance and potential future growth.

Amazon's latest twelve months of Free Cash Flow stand at $37.6 billion. Analysts expect strong growth, with projections indicating that free cash flow could climb as high as $223.9 billion by 2035. For the near-to-medium term, forecasts are relatively detailed. Analyst estimates provide guidance up to five years, with further projections extrapolated to cover the next decade.

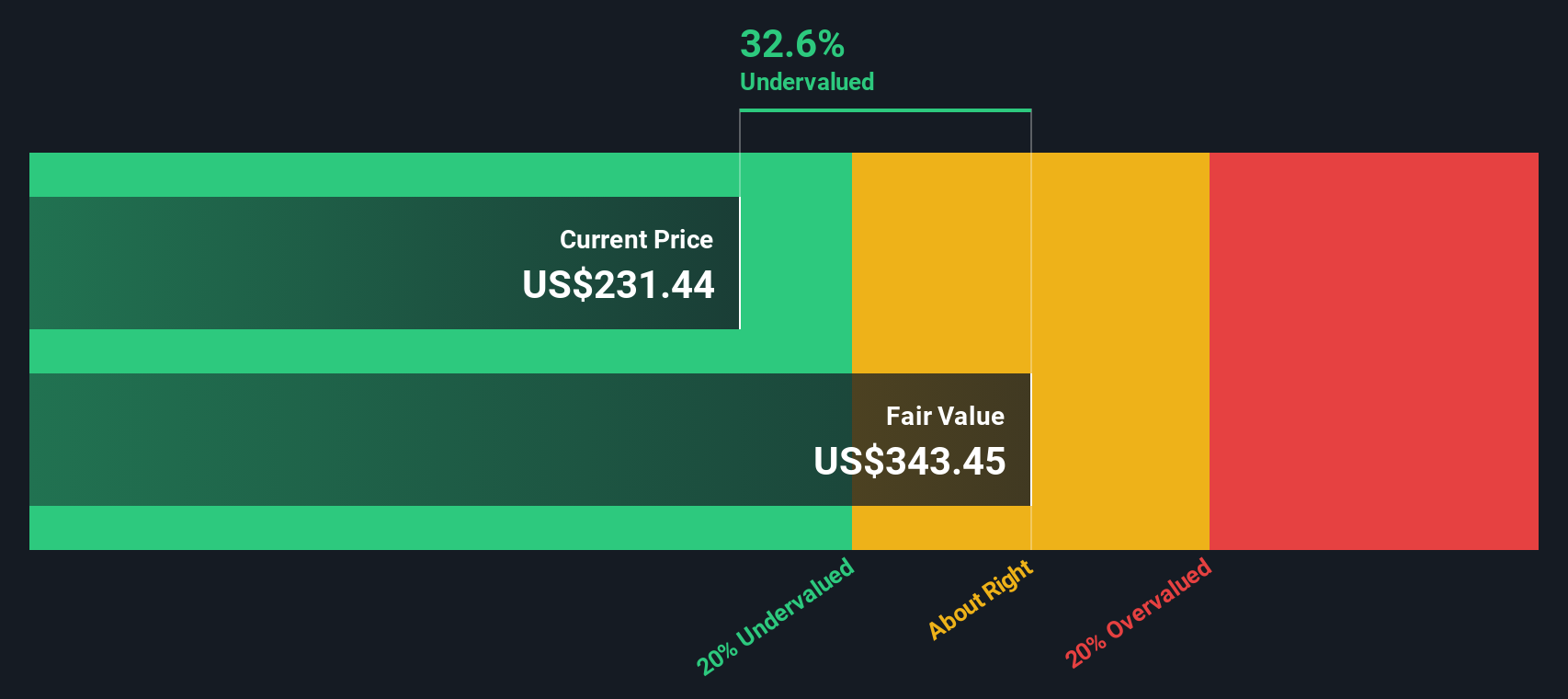

Based on these projections and using a 2 Stage Free Cash Flow to Equity model, the DCF approach arrives at an intrinsic value of $266.62 per share for Amazon.com. This represents a 13.2% discount compared to its current share price, suggesting that the stock is undervalued at present.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Amazon.com.

Approach 2: Amazon.com Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular and reliable valuation method for companies like Amazon.com that are consistently generating profits. This metric allows investors to gauge how much they are paying for each dollar of earnings and is especially useful for mature, profitable firms where earnings provide a stable foundation for valuation analysis.

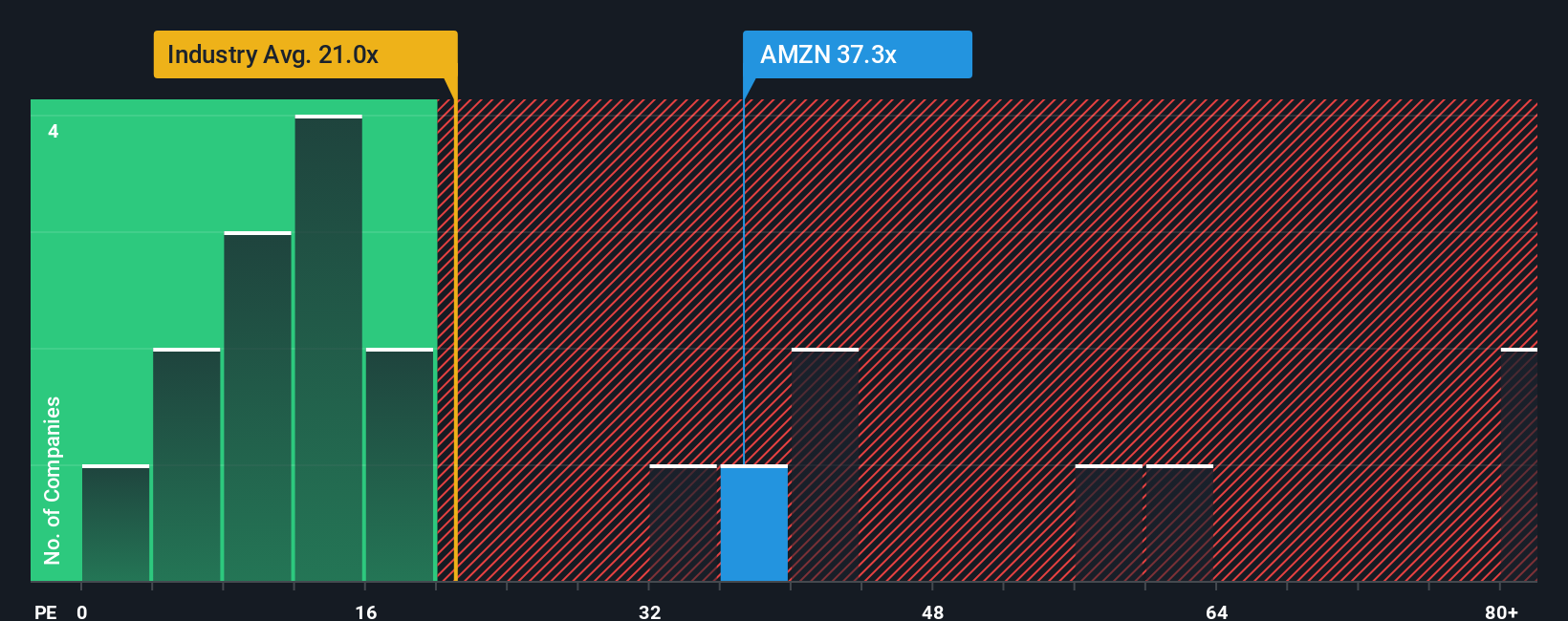

When interpreting a PE ratio, it is important to consider both growth expectations and business risks. Higher expected growth and lower risk can justify a higher PE, while lower growth or greater uncertainty warrant a lower multiple. Amazon.com's current PE stands at 35x, which is higher than the Multiline Retail industry average of 23x but below the peer average of 47x.

To move beyond simple industry or peer comparisons, Simply Wall St’s proprietary "Fair Ratio" provides a more nuanced assessment. This metric factors in Amazon’s earnings growth, industry, profit margins, company size, and risk profile to estimate a more tailored valuation multiple. For Amazon, the Fair Ratio is calculated at 41x. As a result, the company’s actual PE ratio of 35x is 6 points below its Fair Ratio. This suggests that, when considering all key factors, Amazon currently appears undervalued based on earnings.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Amazon.com Narrative

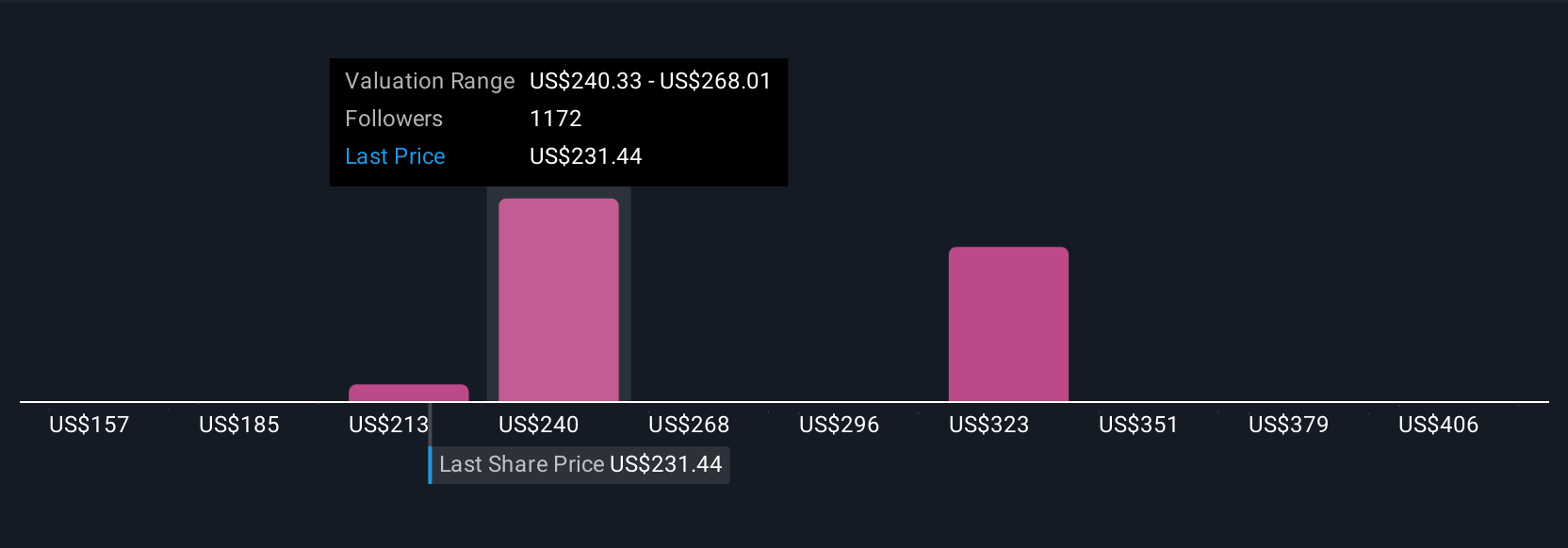

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simplified, story-driven investment approaches that allow you to express your beliefs about a company. Think of them as the story behind the numbers, combining your assumptions about future revenue, earnings, and margins with a financial forecast and estimated fair value.

On Simply Wall St's Community page, millions of investors use Narratives to link a company’s business story directly to financial outcomes, making it easy and accessible to judge when a stock is attractive or overpriced. You can compare Fair Value to today’s share price. Narratives help you decide when to buy or sell and are automatically updated as new information, such as company news or earnings results, becomes available.

For example, one Amazon.com Narrative for 2025 sees strong high-margin growth driving earnings towards $777 per share, while another, grounded in more cautious retail growth and higher capital costs, places the fair value closer to $151.21. This diversity of Narratives means you can see the full range of perspectives and data in one place, empowering you to make smarter, more informed investment decisions.

For Amazon.com, we'll make it really easy for you with previews of two leading Amazon.com Narratives:

- 🐂 Amazon.com Bull Case

Fair Value: $234.75

Current Price vs Fair Value: -1.39%

Revenue Growth Rate: 13.6%

- Sees Amazon as a long-term winner, highlighting strong e-commerce leadership, robust cloud (AWS) growth, and expanding advertising business.

- Recent earnings and ongoing investments in AI and infrastructure are viewed as positioning Amazon for conservative yet solid upside. Future pipeline projects are seen as catalysts for continued growth.

- Risk factors include slower-than-expected AWS growth and some vagueness around AI innovation in recent management commentary. However, the overall outlook remains highly optimistic, with sustainable growth projections over a decade.

- 🐻 Amazon.com Bear Case

Fair Value: $222.55

Current Price vs Fair Value: 4.03%

Revenue Growth Rate: 15.19%

- Argues Amazon is fairly valued given current share prices, with growth drivers in AWS, advertising, and third-party sellers balanced by heavy reinvestment suppressing near-term free cash flows.

- Notes Amazon continues to outperform in core business areas, but slower growth in advertising and 3P sales may temper returns. Maintains a conservative valuation approach despite recent strong operating cash flow performance.

- Main risks include increased regulatory scrutiny in key markets and potential macroeconomic headwinds, such as a global recession, that could impact growth across retail, advertising, and cloud segments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives