- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Teams Up With Fujifilm For Advanced Cloud Solutions In Healthcare Sector

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) recently partnered with FUJIFILM Healthcare Americas Corporation through its Amazon Web Services division, enhancing cloud capabilities for healthcare imaging. Despite this positive development, Amazon's stock fell 3.6% last week, a movement overshadowed by broader market trends. This decline aligns closely with the Nasdaq Composite's loss, as major indices were impacted by new U.S. tariffs against key trading partners, which have stirred investor anxiety. Notably, the Dow Jones and S&P 500 also dropped, with sectors such as technology, including companies like Tesla and Nvidia, facing significant pressures. Economic uncertainty stemming from tariffs and the resulting ripple effects contributed to broader market sell-offs, which inevitably affected tech giants like Amazon. This downturn occurs amidst a market that has seen a 2.5% drop over the past week. While the strategic collaboration with Fujifilm signals potential growth, Amazon's immediate share performance reflects wider economic challenges impacting investor sentiment.

Click here and access our complete analysis report to understand the dynamics of Amazon.com.

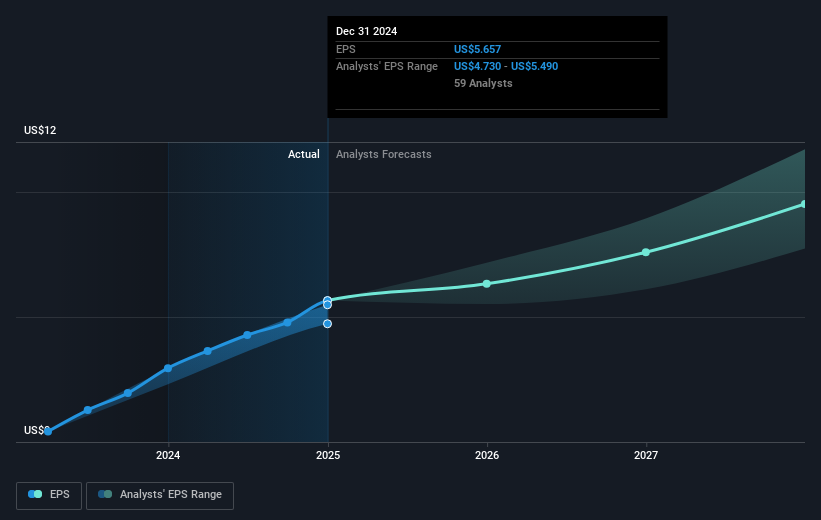

The past five years have witnessed Amazon's remarkable total return of 127.72%, including share price appreciation and dividends. This performance underscores Amazon's resilience and adaptability, even when faced with challenges. Significant profit growth has been pivotal, as earnings soared at an average of 22.6% annually, driven by strategic initiatives and improved efficiency. For instance, the net income in Q4 2024 reached US$20 billion, nearly doubling from the previous year, reflecting substantial operational advancements.

Amazon's share performance also reflects proactive measures like its massive share buyback program, where 31.15 million shares, valued at approximately US$3.88 billion, were repurchased, demonstrating robust capital management. Still, it hasn't been all smooth sailing—labor disruptions, including strikes and a class-action lawsuit over COVID-19 price-gouging, have presented hurdles. Although Amazon underperformed its industry over the last year, it still outpaced the broader US market's 13.1% return, showcasing its lasting strength amidst competitive pressures.

- See how Amazon.com measures up with our analysis of its intrinsic value versus market price.

- Gain insight into the risks facing Amazon.com and how they might influence its performance—click here to read more.

- Hold shares in Amazon.com? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Amazon.com, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives