- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Partners With OMNY Health To Advance EHR Data Access Through AWS

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) recently launched Nova Sonic, a new AI model designed to enhance voice application development, while also engaging in significant M&A discussions, notably a bid for TikTok, which was not taken seriously. These initiatives occurred amidst a broader market downturn, with the Nasdaq Composite declining 6% over a month marked by significant sell-offs and investor anxiety. Although these efforts could have added weight to the company's endeavors, they were not enough to deflect Amazon’s share price from aligning with the downward trend observed in the broader technology sector.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The recent launch of Amazon's Nova Sonic AI model and its M&A discussions coincide with a challenging market environment, dampening their short-term impact. Over a longer period, however, Amazon's total returns, including share price and dividends, have achieved a noteworthy increase of 65.62% over five years. This growth indicates resilience despite recent volatility, contrasting with its underperformance against the Multiline Retail industry, which saw a return of 5.1% over the past year.

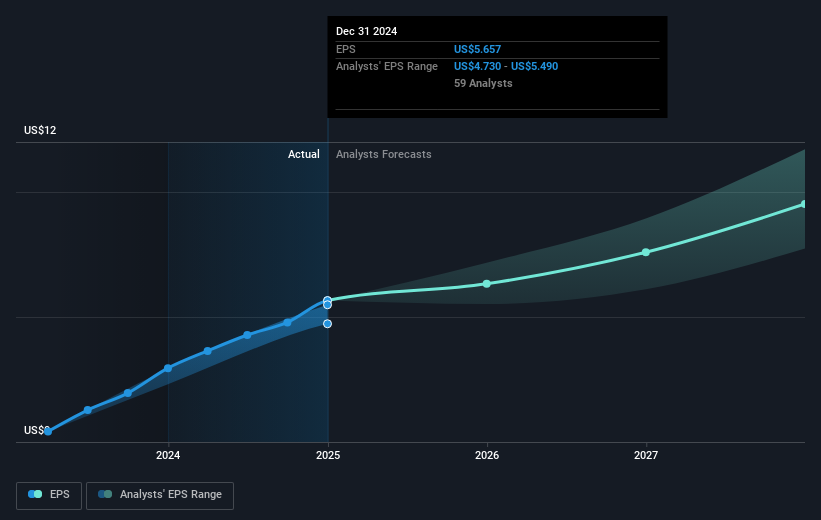

The introduction of AI technologies, along with Amazon's investments in fulfillment and advertising, is expected to enhance future revenue and earnings potential. Revenue growth through these advancements aligns with analysts' forecasts, predicting revenues to grow to $845.2 billion by 2028. Similarly, earnings forecasts of $103.9 billion point to substantial profitability improvements. Despite recent share price alignment with broader technology sector declines, the current share price of $170.66 represents a 34.8% discount to the consensus price target of $261.79, implying potential for future appreciation as forecasted growth materializes.

Evaluate Amazon.com's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives